CyberArk Software Shines in Tech Sector with Stellar Q3 Performance

IT security solutions provider CyberArk Software CYBR has emerged as a strong player in the technology field after surpassing third-quarter expectations on Wednesday.

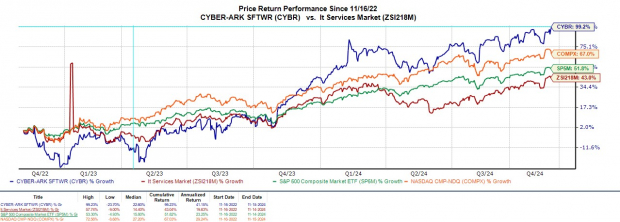

With shares reaching an all-time high of $318 this week, CyberArk’s stock has surged nearly 40% year to date and is currently rated Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

CyberArk Reports Impressive Q3 Results

In its Q3 earnings report, CyberArk CEO Matt Cohen attributed the company’s success in identity security to significant growth in net new annual recurring revenue (ARR), record sales, increased profits, and strong cash flow.

Record Sales Figures

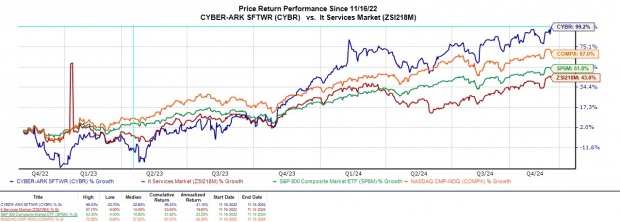

CyberArk achieved record quarterly sales of $240.1 million, exceeding Zacks’ estimate of $233.9 million. This figure represents a 25% increase from last year’s $191.24 million.

The company saw its Total ARR rise 31% year over year to $926 million. Impressively, CyberArk has beaten sales estimates for six straight quarters, with an average surprise of 3.84% over the last four reports.

Image Source: Zacks Investment Research

Profitability Gains

Notably, CyberArk set a record for adjusted earnings per share (EPS), achieving Q3 EPS of $0.94, a remarkable 124% increase from $0.42 a share in the same quarter last year. This result easily surpassed the Zacks EPS consensus of $0.45 by 109%.

The company has met or exceeded earnings expectations for 13 consecutive quarters, boasting an impressive average EPS surprise of 97.68% in its last four quarters.

Image Source: Zacks Investment Research

Strengthened Cash Flow

Free cash flow improved dramatically to $51.56 million, up from $13.62 million in Q3 2023. Additionally, CyberArk’s cash and equivalents grew to $1.23 billion, compared to $355.93 million at the start of the year.

CyberArk’s Revenue Forecast

Looking ahead to Q4, CyberArk anticipates revenue between $297 million and $303 million, which reflects a growth of 33%-36%. For the full fiscal year 2024, revenue is expected to rise by 31%-32% to between $983 million and $989 million.

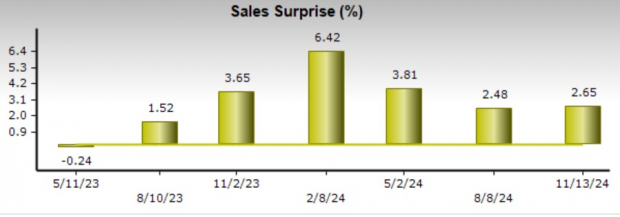

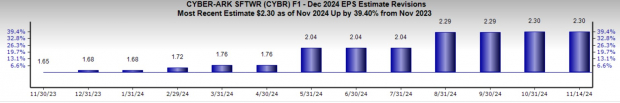

Forecast for EPS Growth

According to Zacks estimates, CyberArk’s annual EPS is projected to grow 105% in FY24 to $2.30, compared to $1.12 in 2023. Additionally, FY25 EPS is expected to increase another 45% to $3.35 per share. This outlook, coupled with CyberArk’s strong buy rating, emerges from a positive trend in earnings estimate revisions for FY24.

Image Source: Zacks Investment Research

Final Thoughts

CyberArk stands out as a tech stock worth monitoring, and the upward trajectory in earnings estimates suggests that CYBR may continue its ascent.

Important Update: Solar Stocks Set for Growth

The solar sector is expected to thrive as industries shift away from fossil fuels, particularly to support the rise of artificial intelligence.

Trillions of dollars are projected to flow into clean energy over the next several years, with analysts anticipating solar will account for 80% of the renewable energy expansion. This presents a substantial investment opportunity in the near and distant future, but it’s crucial to select the right stocks for potential gains.

Explore Zacks’ top solar stock recommendations for free.

Looking for the latest updates from Zacks Investment Research? Download “5 Stocks Set to Double” at no cost. Click here for your free report.

CyberArk Software Ltd. (CYBR): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.