Stock Market Surges After Trump’s Election: What’s Next?

Editor’s Note: InvestorPlace Quant Specialist Louis Navellier has a well-known stock system that has successfully identified stocks like Google, Apple, Nvidia, and Intel when they were priced inexpensively.

With Donald Trump being elected last week, stock prices climbed rapidly. However, Louis emphasizes that it’s essential to remain vigilant and plan for cash needs for new cars, college tuitions, vacations, and other monthly expenses.

Therefore, Louis is updating his renowned system to focus on the market’s fastest moving stocks. He recorded a special broadcast detailing this system, which you can check out here.

Now, let’s hear more from Louis.

Following Trump’s presidential win last week, stocks experienced a significant boost. The small-cap Russell 2000 led the charge, increasing by 8.6%. The S&P 500 and Dow Jones Industrial Average both rose by 4.6%, while the tech-heavy Nasdaq Composite saw a jump of 5.7%.

Three main factors drove these changes.

The first was the presidential election. With Republicans maintaining control of both the Senate and the House, Trump’s large margin in the Electoral College and popular vote signals a solid mandate, likely resulting in pro-business reforms and initiatives aimed at economic growth, which excites both Wall Street and Main Street.

InvestorPlace CEO Brian Hunt recently argued that stocks are likely to perform well under a new Trump administration. Whether people support Trump or not, he suggests that it’s time to brace for potential gains. (Read Brian’s complete argument here.)

The second factor is the Federal Reserve. On November 7, the Fed agreed to cut key interest rates by 0.25%. Although they hinted that cuts might slow down, Chair Jerome Powell mentioned that the Fed’s policy remains “restrictive.” This suggests that at least one more rate cut may occur, depending on future inflation and job reports.

Lastly, an early “January effect” contributed to the market rally.

Let’s focus on this early January effect. This phenomenon occurs when investors increase their market contributions as they wrap up their financial activities for the year, whether by adding money to retirement accounts, employers contributing to employee savings, or giving financial gifts. As the year ends, many seek to kick off the New Year positively.

This surge in contributions typically benefits small- and mid-cap stocks.

Stocks usually need to stabilize after gaining momentum. Recently, we’ve seen some pullback: on Tuesday, the Russell 2000 fell 1.8%, the S&P slipped 0.3%, the Dow decreased 0.9%, and the Nasdaq dipped by about 0.09%. Wednesday’s trading was quieter.

Encouragingly, I expect stocks to rebound. Historically, the market rallies as Thanksgiving approaches; Bespoke Investment Group noted that the S&P 500 has averaged a rise of 3.81% in November over the past decade. This upswing often occurs as consumer sentiment brightens during the holiday season, positively influencing investor outlook.

Anticipating Continued Gains

The stock market is poised to keep climbing in the upcoming weeks and months, fueled by the early January effect and the other catalysts mentioned. I anticipate that fundamentally strong stocks, like those recommended in my elite Accelerated Profits service, will spearhead this upward trend.

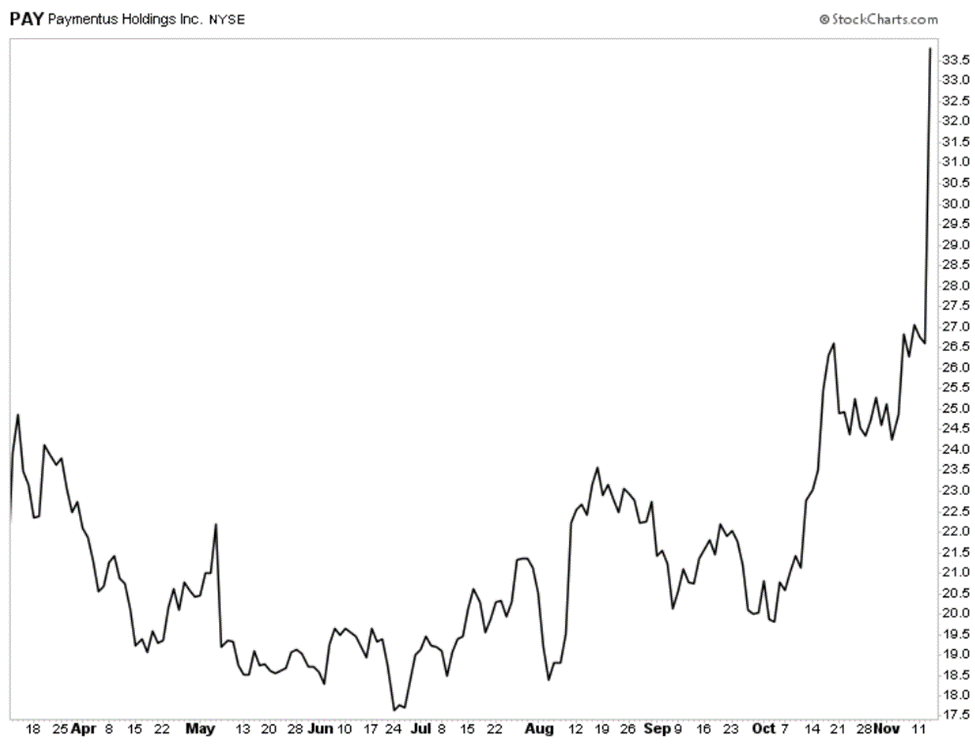

For instance, consider Paymentus Holdings, Inc. (PAY). I suggested this stock to my Accelerated members in March. The company recently reported quarterly results that exceeded analysts’ expectations for earnings and revenue.

In the third quarter, Paymentus recorded earnings of $19.6 million, or $0.15 per share, along with record revenues of $231.6 million. This marked a significant 79.5% growth in earnings and 51.9% in revenue year-over-year.

Analysts had predicted $0.09 per share in earnings on $190.63 million in revenue, meaning Paymentus surpassed earnings estimates by 66.7% and revenue projections by 21.5%.

The company ended a solid third quarter with strong bookings and a promising backlog. It expects fourth-quarter revenues between $215.0 million and $220.0 million, well above the previous year’s $164.8 million for this period and higher than current analyst projections of $203.62 million.

Due to this impressive performance, PAY soared by 27% on Wednesday. The chart below illustrates the impact of this boost.

Remarkable Stock Gains: A Look at Recent Successes

This is not an isolated event.

Last week, one of my top Accelerated Profits stocks rose dramatically after exceeding analysts’ earnings estimates by 228% and boosting its forecast for fiscal year 2024. Consequently, the stock jumped 102% in a single week.

This impressive performance has led to an overall return of approximately 200% in just nine weeks!

Discover More Winning Stock Picks

While Wall Street was caught off guard by these earnings results, I anticipated them due to my Quantum Cash system.

The Quantum Cash system employs advanced algorithms to analyze large sets of data in search of patterns. Many patterns are nonlinear, which means they’re not easily identifiable without assistance. Feeding the system more information allows it to recognize even deeper trends.

Thanks to the insights generated by my Quantum Cash system, subscribers to my Accelerated Profits service have achieved several successful trades in 2024, including:

- YPF Sociedad Anonima (YPF) with a 187% gain

- CECO Environmental Corp. (CECO) with a 135% gain

- Builders FirstSource Inc. (BLDR) with a 95% gain

- Axcelis Technologies Inc. (ACLS) with a 74% gain

- e.l.f. Beauty Inc. (ELF) with nearly a 61% gain

- Dorian LPG Ltd. (LPG) with about a 49% gain

- DHT Holdings Inc. (DHT) with a 48% gain

- PBF Energy Inc. (PBF) with roughly a 48% gain

- And more…

To understand more about my Quantum Cash system, be sure to view my special presentation. There, you’ll find out how I’ve been able to offer readers three income opportunities a month, even in stagnant markets or during downturns. Additionally, you will see how this system is ideal for those with smaller investment portfolios.

Most importantly, you’ll gain insight into the innovative algorithmic technology that powers my Quantum Cash system.

Click here to watch my special Quantum Cash presentation now.

Sincerely,

Louis Navellier

Editor, Market360