Ron Baron Predicts Tesla’s Market Value Could Soar to $5 Trillion by 2033

Billionaire investor Ron Baron, known for his strong support of Tesla Inc. (TSLA), forecasts that the company’s market cap may reach an astounding $5 trillion in the next ten years.

Ambitious Goals for Tesla

During a recent appearance on CNBC, Baron stated, “Tesla, I think, is going to be worth $5 trillion in 10 years, based upon the business plan that I am aware of.” He believes that CEO Elon Musk’s aspirations could lead to a company valued at $30 trillion, even more than his own prediction.

This outlook stands out given that Tesla has only just achieved a market capitalization of $1 trillion. Currently, the largest publicly traded company is Nvidia (NVDA), with a valuation of $3.65 trillion.

Baron’s Investment Journey

Ron Baron, who heads Baron Capital, an investment firm based in New York that manages $45 billion in assets, has long been a significant investor in Tesla. Between 2014 and 2016, he invested $400 million in the company. Today, he claims he has made $6 billion from that initial investment, attributing success to Tesla’s growth over the years. Currently, Tesla constitutes 10% of Baron’s overall investment portfolio, which he insists is diversified.

Tesla has been positioned as a key player under the new U.S. administration led by president-elect Donald Trump. Musk has become an influential supporter and contributor to Trump and has been tasked with leading a new government efficiency initiative.

Following Trump’s election victory, TSLA stock has gained approximately 25% in November. Baron expressed his intent to hold onto his Tesla shares for the long term. “No way I’m going to sell,” he affirmed during the CNBC interview.

Current Analysis of TSLA Stock

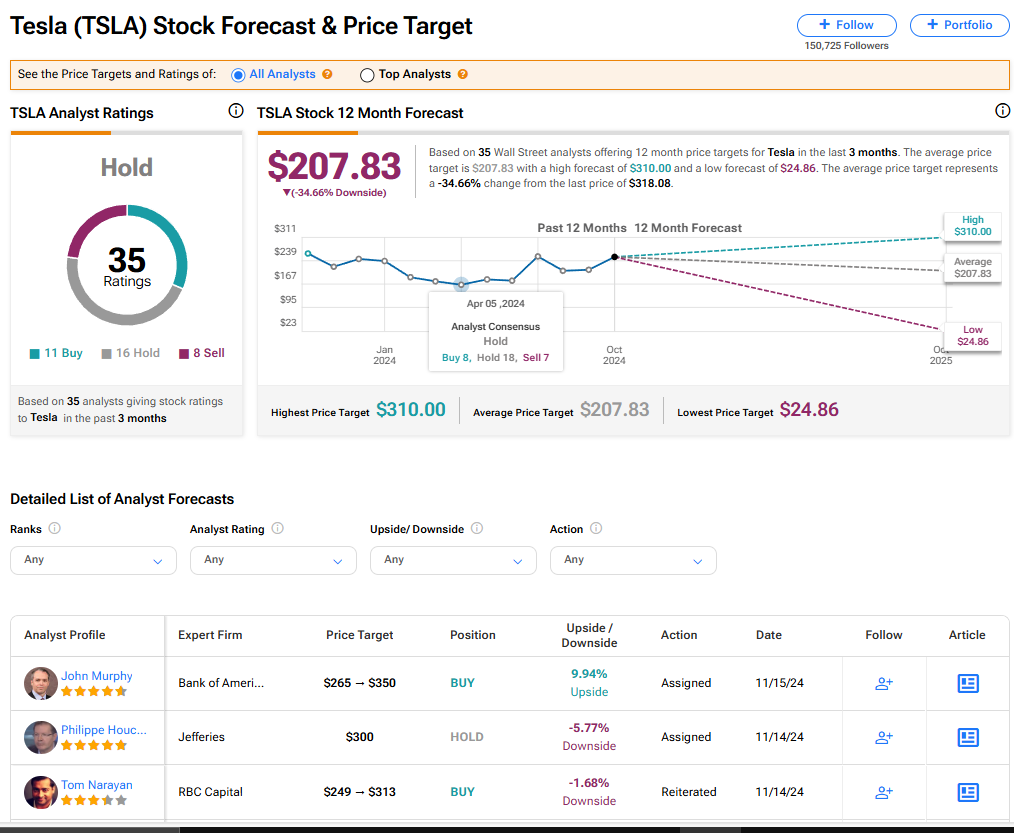

The consensus among 35 Wall Street analysts rates Tesla stock as a Hold. This rating reflects 11 Buy, 16 Hold, and eight Sell recommendations issued in the last three months. The average price target for TSLA is currently $207.83, suggesting a potential downside of 34.66% from its existing levels.

Read more analyst ratings on TSLA stock

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.