SoFi Technologies: Navigating Growth and Profitability

SoFi Technologies (NASDAQ: SOFI) has experienced a positive turn in recent months. The online bank and lending platform recently secured a new loan partner, reported strong third-quarter earnings, and is introducing robo-investing features for its customers.

The company continues to expand its product lineup, enhancing its overall value proposition. This growth in offerings is attracting more customers.

The stock has increased by 35% in the last month, nearing the all-time highs achieved during its 2020 merger with a special purpose acquisition company (SPAC). Now the question arises: is it time to invest after this surge? Let’s explore SoFi’s stock performance.

Rapid Expansion and Improving Profits

In the third quarter, SoFi’s top-line results showcased continued strong growth. The total customer base climbed 35% year over year, totaling 9.4 million, marking a new record. This robust customer growth contributed to a 30% increase in adjusted net revenue for the quarter.

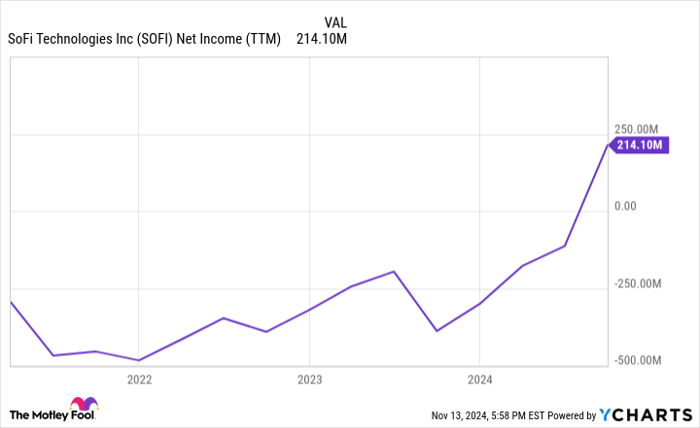

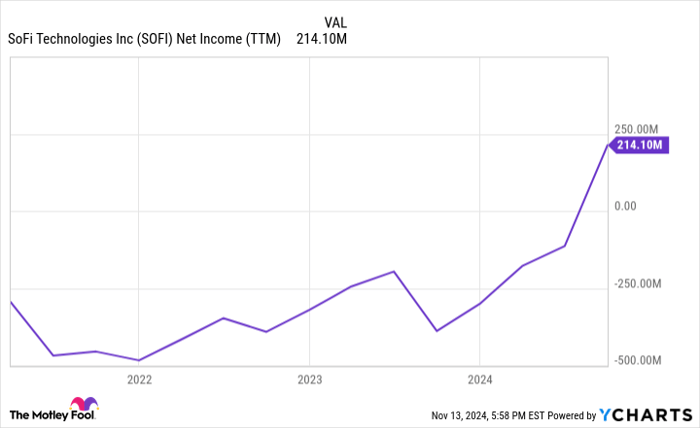

While SoFi has successfully fueled growth, profitability has been a challenge, hindering stock performance. However, management has worked to cut costs and enhance lending operations, leading to improved profit margins. Last quarter, SoFi reported a net income of $61 million and cumulative net income of $214 million over the past year, with expectations to exceed $200 million for fiscal year 2024.

It’s noteworthy that SoFi achieved positive net earnings despite significant reinvestment efforts, including over $200 million per month on marketing and $139 million on product development. As the company scales, these expenses are expected to decrease as a percentage of revenue, potentially boosting profits further.

Expanding Product Offerings

SoFi aims to be a comprehensive financial services provider, offering consumer banking, savings, credit cards, investing, and cryptocurrency trading. This diverse range of services is critical for distinguishing itself from traditional consumer banks. The company reported a total of 13.65 million products in use last quarter, an important metric for investors.

This month, SoFi announced the launch of a new robo-advisory platform, which will offer automated financial advice for a small fee based on quantitative portfolio allocations. This addition is popular in the investment field and is likely to attract more assets to SoFi’s services.

On the lending front, SoFi recently established a significant partnership with Fortress Investment Group to manage $2 billion in loans. While SoFi traditionally offers student, home, and personal loans, this deal aims to create a more asset-light model, whereby loans are sold to third parties, streamlining operations.

SOFI net income (TTM) data by YCharts; TTM = trailing 12 months.

Should You Buy SoFi Stock Now?

With a market capitalization of $14.6 billion, SoFi’s trailing price-to-earnings ratio (P/E) stands at 135. At first glance, this may appear overvalued. However, assessing a stock’s worth requires forward-looking evaluations, not solely past performance.

Since early 2021, SoFi’s revenue has soared by 262%. Customer growth shows no signs of slowing down, suggesting that revenue increases will continue in the upcoming years. The current net income reflects heavy investments in marketing and new product development.

Positive net income has only recently been achieved following previous losses. SoFi’s capacity for sustained growth in earnings should not be underestimated. If the company reaches $1 billion in net income, the stock’s P/E ratio would drop to about 14.6, significantly lower than the market average, potentially benefiting shareholders.

No investment is without risk, including SoFi. However, compared to other growth stocks currently priced at premium levels, SoFi appears to offer substantial value for those who purchased recently following last month’s rally.

Is Now the Time to Invest $1,000 in SoFi Technologies?

Before considering an investment in SoFi Technologies, take note:

The Motley Fool Stock Advisor analysts have highlighted what they believe are the 10 best stocks to invest in at this time… and SoFi Technologies is not among them. The identified stocks are expected to yield significant returns in the future.

Take Nvidia, for example; had you invested $1,000 when it was recommended on April 15, 2005, it could have grown to $870,068!*

The Stock Advisor service offers a straightforward strategy for investors including guidance on portfolio building, regular updates from analysts, and two new stock picks each month. Since its inception in 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024

Brett Schafer does not hold a position in any of the stocks mentioned. The Motley Fool does not have a position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.