Archer Aviation’s Earnings Surge Sparks Stock Rally, but Caution is Advised

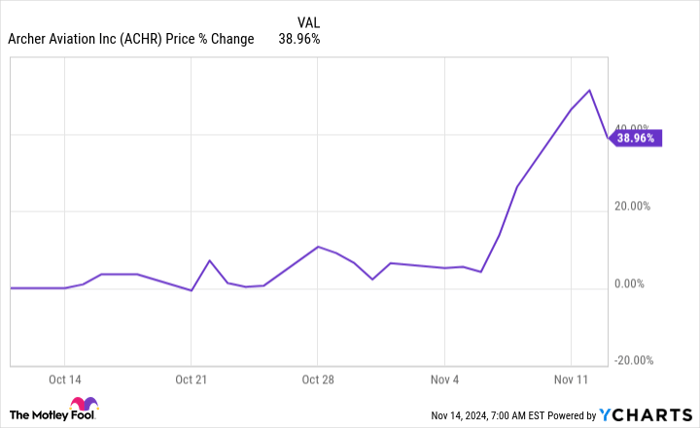

Shares of Archer Aviation (NYSE: ACHR) have increased nearly 40% over the past month, primarily following the company’s third-quarter 2024 earnings announcement. While the report included encouraging news, investors should remain aware of the potential risks that accompany this new technology venture.

Highlights from Archer’s Positive Earnings Report

Archer Aviation has set ambitious targets, aiming to create an electric vertical takeoff and landing (eVTOL) aircraft designed for short-haul flights and develop an innovative air taxi service. They are not the only company in this space, but they are making significant progress toward these goals, as revealed in their recent earnings report.

Image source: Getty Images.

Key points from Archer’s earnings announcement portray a company on the verge of new breakthroughs:

- The completion of its manufacturing facility is scheduled for the coming weeks, aiming to produce piloted aircraft for testing and initial commercial use as early as 2025.

- Archer is nearing the end of phase 3 of the Federal Aviation Administration (FAA) certification process and is rapidly moving through phase 4, the final step for certification.

- They have established a consortium led by the Abu Dhabi Investment Office to launch commercial air taxi services in the United Arab Emirates by late 2025.

- A new partnership with Soracle, a joint venture of Japan Airlines and Sumitomo, includes a planned order worth up to $500 million, boosting total customer interest to $6 billion.

While companies often emphasize their successes while downplaying challenges, Archer’s progress suggests they are closer to achieving their ambitious targets, which has contributed to the recent surge in stock values following their earnings update.

ACHR data by YCharts.

Path to Profitability is Steep

Despite the positive developments, Archer is still in the early stages of turning its vision into reality. The factory nearing completion means further investment is necessary before operations can begin. Initially, the facility will produce aircraft for testing, not for commercial sale, indicating that profitability is still a considerable distance away.

Regarding FAA approval, while progress has been made, the company must continue to invest time and resources before receiving final sign-off. There remains an inherent risk that approval may not be granted, despite optimistic projections from Archer Aviation.

The partnerships and potential market for Archer’s services reflect a promising future, with a backlog of orders valued at $6 billion. However, the success of their air taxis depends on public acceptance of a service that is still largely theoretical at this stage, which raises questions about the scalability and sustainability of the business model.

An Investment with High Stakes

Archer Aviation could potentially yield substantial returns for growth-focused investors, provided that everything unfolds as planned. Nevertheless, conservative investors may wish to wait until the company meets additional milestones before considering an investment.

A Second Chance for Investors?

Do you worry about missing out on successful investments? Opportunities arise on occasion that investors can’t overlook.

Our expert analysts occasionally issue a “Double Down” stock recommendation for companies poised for significant growth. If you think you’ve missed your chance to invest, now may be the ideal time.

- Amazon: A $1,000 investment from 2010 would be worth $22,819 today!*

- Apple: $1,000 invested in 2008 would have grown to $42,611!*

- Netflix: If you had put in $1,000 back in 2004, you would now have $444,355!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, offering a unique investment opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.