Analysts Predict Upside for iShares Core S&P Mid-Cap ETF and Key Holdings

In our analysis of ETFs at ETF Channel, we evaluated the underlying holdings of the iShares Core S&P Mid-Cap ETF (Symbol: IJH). By comparing each holding’s trading price to the average 12-month analyst target price, we calculated an implied target price of $70.89 per unit for IJH.

Current Trading Insights

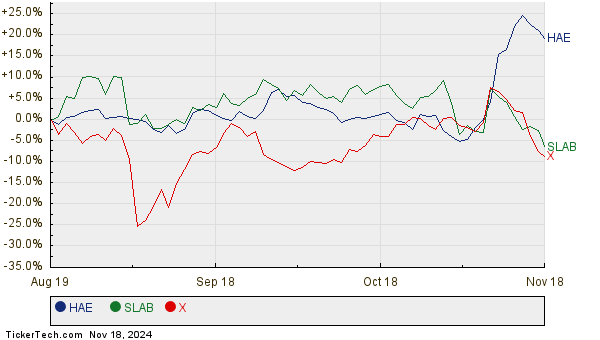

Currently priced at approximately $64.17 per unit, IJH is projected to have a potential upside of 10.47% based on analysts’ expectations for its underlying stocks. Notably, three specific holdings show strong upside potential relative to their target prices: Haemonetics Corp. (Symbol: HAE), Silicon Laboratories Inc (Symbol: SLAB), and United States Steel Corp. (Symbol: X).

Highlighted Holdings

While HAE trades at $89.22 per share, analysts target it at $109.78, signaling a potential increase of 23.04%. SLAB, currently at $100.60, has an analyst target of $121.86, suggesting an upside of 21.13%. United States Steel Corp. (X) shows similarly promising potential, with a current price of $35.83 and an analyst target of $42.94, reflecting a possible 19.84% gain. Below is a twelve-month price history chart for these stocks:

Summary of Analyst Targets

Below is a summary of the current analyst targets for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core S&P Mid-Cap ETF | IJH | $64.17 | $70.89 | 10.47% |

| Haemonetics Corp. | HAE | $89.22 | $109.78 | 23.04% |

| Silicon Laboratories Inc | SLAB | $100.60 | $121.86 | 21.13% |

| United States Steel Corp. | X | $35.83 | $42.94 | 19.84% |

Analysts’ Outlook: A Critical Assessment

Are analysts optimistic or realistic with their price targets? Investors should consider whether these targets are justified based on recent company and industry trends. A high target price can indicate positive expectations but may also prompt downgrades if analysts fail to account for new developments. Investors are encouraged to conduct further research in this dynamic market environment.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Large Caps By Top Market Capitalization

• FIHD Videos

• XGN Historical Earnings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.