Analysts Project Gains for SPDR SPTM ETF and Key Holdings

By analyzing the underlying holdings of the ETFs we cover at ETF Channel, we compared each holding’s trading price to the average 12-month target price predicted by analysts. For the SPDR Portfolio S&P 1500 Composite Stock Market ETF (Symbol: SPTM), the weighted average implied target price based on these holdings stands at $79.03 per unit.

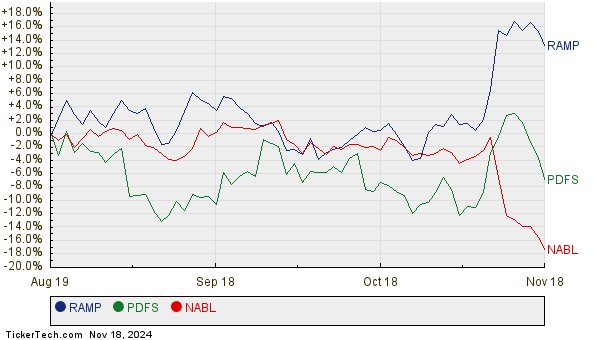

Currently, SPTM is trading around $71.59 per unit. This indicates that analysts expect a 10.40% increase for this ETF, based on the average targets of its holdings. Notably, three holdings within SPTM show substantial potential for growth: LiveRamp Holdings Inc (Symbol: RAMP), PDF Solutions Inc. (Symbol: PDFS), and N-able Inc (Symbol: NABL). RAMP, which recently traded at $27.89 per share, has a target price 41.88% higher at $39.57. Similarly, PDFS offers a potential upside of 40.83%, expected to rise from its recent price of $30.00 to an average target of $42.25. Finally, analysts predict NABL’s share price will climb to $14.75, which reflects a 39.94% increase from its recent price of $10.54. Below is a 12-month price history chart that illustrates the stock performance of RAMP, PDFS, and NABL:

Here’s a summary table of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Portfolio S&P 1500 Composite Stock Market ETF | SPTM | $71.59 | $79.03 | 10.40% |

| LiveRamp Holdings Inc | RAMP | $27.89 | $39.57 | 41.88% |

| PDF Solutions Inc. | PDFS | $30.00 | $42.25 | 40.83% |

| N-able Inc | NABL | $10.54 | $14.75 | 39.94% |

Are these analysts being realistic with their targets, or are they overly optimistic about future stock prices? It’s important to consider whether their predictions are grounded in recent company and industry developments. A high target price can suggest positivity about a stock’s future, but it may also lead to downward adjustments if those targets do not align with market realities. Investors should conduct further research to explore these questions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Ten Hedge Funds Holding EVGO

• ETFs Holding MDC

• QSY Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.