SMCI Faces Major Challenges But Holds Long-Term Promise

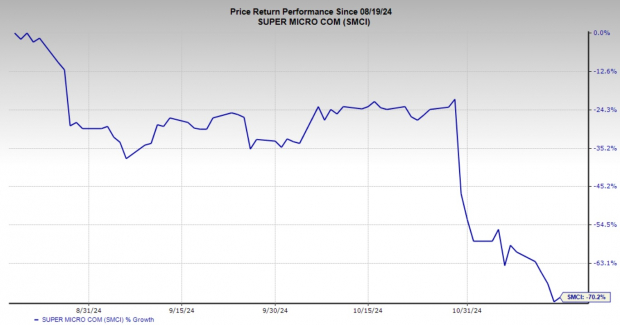

Super Micro Computer, Inc. SMCI has had a rough three months, with its stock price dropping 70%. This steep decline stems from several issues that have unsettled investors and raised flags about the company’s short-term future.

Image Source: Zacks Investment Research

What Led to SMCI Stock’s Slump?

The company’s troubles began in late August with a critical report from Hindenburg Research. The report accused Super Micro of accounting irregularities, engaging in self-dealing with family members of executives, and possibly breaching U.S. sanctions. These serious allegations caused a major sell-off, leading to doubts about the firm’s financial integrity.

Compounding the issue, Super Micro’s auditor, Ernst & Young, resigned in October. This unusual decision raised serious concerns among investors. The company also missed deadlines for filing its annual 10-K report and faced delays with its quarterly 10-Q report, putting it at risk of being delisted from Nasdaq.

Additionally, competition intensified as reports suggested that NVIDIA Corporation NVDA, a vital collaborator, might be diverting orders to rivals like Cisco Systems, Inc. CSCO. This shift added to worries about Super Micro’s revenue and business position. Meanwhile, Dell Technologies Inc. DELL, with its strong AI server offerings, also looked set to benefit from SMCI’s challenges.

SMCI’s Plan to Regain Stability

Despite these hurdles, Super Micro is working to restore stability. To avoid delisting, the company has announced plans to submit a filing strategy to Nasdaq. This move could help curb immediate delisting risks and possibly rebuild some investor confidence.

Furthermore, Super Micro aims to appoint a new auditor, replacing Ernst & Young, to get back to its regulatory filing responsibilities. Addressing these governance and compliance issues is crucial for winning back the trust of investors and creating a clearer operational structure.

In a sign of potential recovery, Susquehanna International Group recently acquired a 5.3% stake in Super Micro through its affiliates. This passive investment indicates that some institutional investors still see value in the company, even during these challenging times.

Long-Term Potential Remains Strong for SMCI

Even with its current problems, Super Micro’s long-term growth potential looks promising. The company is recognized for offering high-performance server solutions, especially for data centers that handle AI and other leading technologies. As global demand for AI solutions grows, Super Micro is well-positioned to benefit from this trend.

The company’s established reputation for creating energy-efficient and high-performance server systems has not been completely dimmed by recent events. Its expertise in integrating advanced graphic processing units from tech giants like Nvidia gives it a competitive edge as businesses upgrade their data centers for future computing needs. This strong foundation indicates that Super Micro could rebound as it resolves its present issues.

Current projections from Zacks suggest that fiscal 2025 and 2026 revenues and earnings will reflect continued growth.

Image Source: Zacks Investment Research

Valuation Indicates an Investment Opportunity

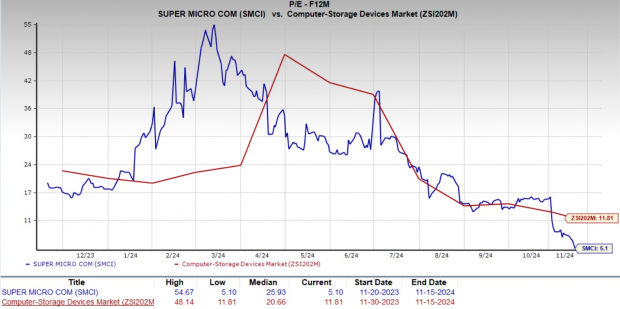

From a valuation perspective, Super Micro Computer appears attractive at its current price. The stock has a 12-month price-to-earnings (P/E) ratio of 5.1X, compared to a higher 11.81X for the Zacks Computer – Storage Devices industry. This lower valuation presents a possible entry point for investors eager to benefit from the company’s future growth as it stabilizes operations.

Image Source: Zacks Investment Research

Although risks linger, the market’s reaction may have been too harsh, undervaluing Super Micro’s significant assets and technology. As it navigates through its regulatory and governance challenges, the core strengths of its business should help support a turnaround.

Final Thoughts: Consider Buying SMCI Stock

Despite substantial obstacles, Super Micro Computer’s proactive measures and solid long-term growth prospects make it a worthwhile investment consideration. The company’s efforts to file necessary documents and replace its auditor reflect valuable steps forward. Together with its favorable valuation and leadership in AI-focused server solutions, this may be a good time for risk-tolerant investors to consider adding SMCI stock to their portfolios. As a Zacks Rank #2 (Buy) company, the potential for recovery and lasting gains positions it as a strong choice for forward-looking investors.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we surprised our members by offering them 30-day access to all our picks for just $1. No obligation for further spending.

Thousands took advantage of this offer, while many hesitated, thinking there had to be a catch. We want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which closed 228 positions with double- and triple-digit gains in 2023 alone. See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Dell Technologies Inc. (DELL): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.