NVIDIA’s Rise: A New Player in the Dow Jones Industrial Average

NVIDIA Corporation’s NVDA graphic processing units (GPU), once prized by gamers, have now become essential in the artificial intelligence (AI) market. This shift has led to the inclusion of the company in the Dow Jones Industrial Average. But does this mean NVIDIA is a smart investment, or are there factors that need careful consideration? Let’s explore.

Intel Makes Way for NVIDIA in the Dow

Earlier this month, Intel Corporation INTC, a long-standing giant in the tech sector, was removed from the Dow after 25 years. Intel lost its competitive advantage to rival Taiwan Semiconductor Manufacturing Company Limited TSM and fell behind in the booming AI market. Recent reports from Intel’s management revealed the company may not reach its goal of $500 million in annual Gaudi AI revenues, which is relatively modest compared to its competitors.

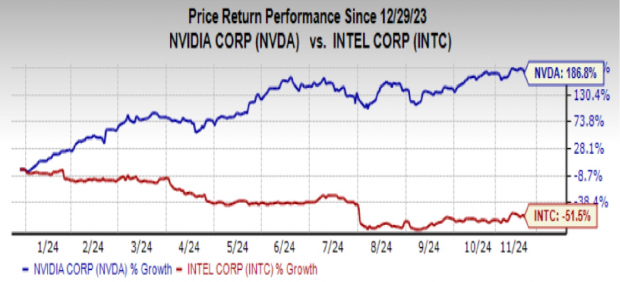

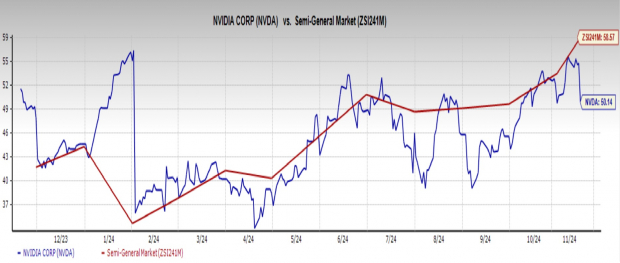

NVIDIA took Intel’s place in the Dow as it established itself as a cornerstone of the global semiconductor industry. Thanks to its chips driving generative AI technology, NVIDIA’s stock has surged by 186.8% this year, while Intel’s shares have seen a steep decline of 51.5%.

Image Source: Zacks Investment Research

The Rationale Behind NVIDIA’s Dow Inclusion

The Dow typically highlights major sectors of the economy, with a significant presence of energy and industrial stocks. However, the rise of technology companies has changed dynamics, leading to tech giants like Apple Inc. AAPL, Microsoft Corporation MSFT, and Amazon.com, Inc. AMZN being included in the index.

NVIDIA joined the Dow to better represent the rapidly growing semiconductor sector. With a market capitalization of $3.6 trillion, it stands as the largest company trading on U.S. exchanges, providing vital chips and technologies that enhance AI capabilities.

Furthermore, NVIDIA’s recent 10-for-1 stock split made it suitable for the index, as the Dow is a price-weighted index. Higher-priced stocks have a more significant impact on the index’s performance. Before the split, NVIDIA shares traded over $900 each, making them too expensive for the Dow. Post-split, shares are now trading just above $140, a more manageable price (read more: NVIDIA Stock Post 3-Month Split: Buy, Hold, or Sell?).

Potential Upside from Dow Membership

While typically, being added to an index following a strong performance doesn’t guarantee price increases, NVIDIA’s situation appears more promising. For example, Intel’s shares dropped roughly 36% after it was incorporated into the Dow in 1999. Similarly, Super Micro Computer, Inc. SMCI hasn’t seen a boost in stock price since joining the S&P 500 earlier this year.

NVIDIA’s listing means that various mutual funds and exchange-traded funds (ETFs) tracking the Dow will likely buy its shares, increasing demand and potentially driving up its stock price.

Reasons to Be Optimistic About NVIDIA

Excitement builds around the upcoming launch of NVIDIA’s highly anticipated Blackwell processors. CEO Jensen Huang clarified that demand for the new B200 chips is enormous, especially as we approach the fourth quarter, with expectations rising even higher for 2025. Major companies such as Amazon Web Services, Microsoft, Meta, and Tesla are poised to adopt these new chips.

These Blackwell processors offer greater AI processing capabilities compared to the existing Hopper H100 chips. The enhanced platform could significantly improve AI training performance while also reducing training costs.

NVIDIA’s leadership in the AI chip market is expected to reinforce its share price growth long-term. Its CUDA software platform currently outshines Advanced Micro Devices, Inc’s AMD ROCm platform, giving NVIDIA significant control over the GPU market.

NVIDIA Stock: A Strong Buy Opportunity

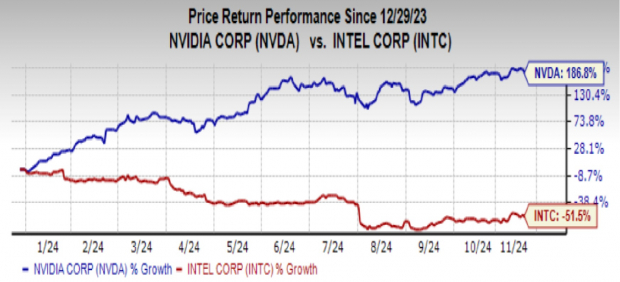

With NVIDIA’s entrance into the Dow, the release of new Blackwell chips, and its solid grip on the GPU market, the company appears well positioned for stock price growth. Analysts have raised the average short-term price target for NVDA stock by 5.9%, increasing it to $155.43 from a last closing price of $146.76. The most optimistic short-term price target sits at $200, indicating a 36.3% potential upside.

Image Source: Zacks Investment Research

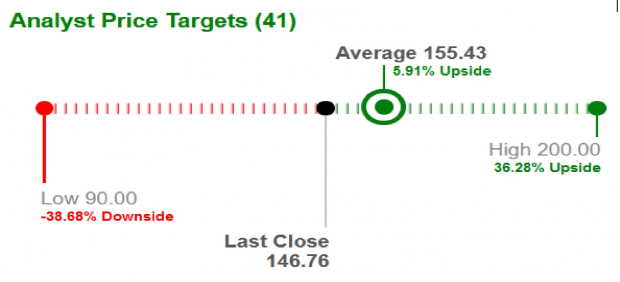

Currently, NVDA stock trades above both the short-term 50-day moving average (DMA) and the long-term 200-DMA, signaling a bullish trend and suggesting it may be a worthwhile investment.

Image Source: Zacks Investment Research

Moreover, NVDA stock is trading at 50.1 times forward earnings, which is lower than the 58.5 times average for the semiconductor industry. Thus, investing in NVIDIA could be more economical than similar stocks in the field.

Image Source: Zacks Investment Research

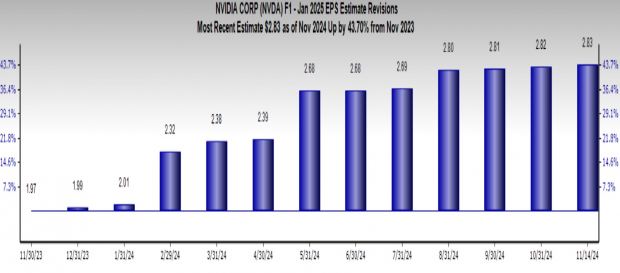

Overall, NVIDIA has earned a Zacks Rank #1 (Strong Buy) designation. The Zacks Consensus Estimate for NVIDIA’s earnings per share stands at $2.83, marking a 43.7% increase from one year ago. For a complete list of today’s Zacks Rank #1 stocks, click here.

Image Source: Zacks Investment Research

Only $1 to Access All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we surprised our members by offering 30-day access to all our picks for just $1, with no further obligation.

Thousands have seized this chance. Others hesitated, thinking there might be a catch. Indeed, we have a motive. We want you to become familiar with our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and more, which collectively closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.