EV Stocks Surge as Regulatory Hopes Rise

Shares of electric vehicle companies began the week on a positive note following reports that President Trump’s administration may reduce regulatory barriers for autonomous vehicles. Although the implications remain unclear, this speculation sent the market upward, at least temporarily.

Lucid (NASDAQ: LCID) experienced a notable rise, climbing as much as 9.5% in early trading. Additionally, Rivian‘s (NASDAQ: RIVN) shares increased by 6.6%, while EVgo (NASDAQ: EVGO) surged 15.8% just after the market opened. Although these stocks surrendered some of their gains, they remained up 5.7%, 0.4%, and 7.5%, respectively, by 3:30 p.m. ET.

The Current Landscape for EV Stocks

Since President Trump’s election, the electric vehicle (EV) market has faced volatility. Initially, investors anticipated an economic boost that would favor EV sales. However, this optimism waned as it became evident that Trump would reduce EV subsidies, notably the $7,500 tax credit that makes purchasing these vehicles more affordable.

Currently, the focus has shifted back to autonomous driving, a technology that is gradually evolving. Tesla (NASDAQ: TSLA) aims to advance its Full Self-Driving (FSD) software amidst this backdrop.

For Tesla, navigating state-by-state regulations presents significant challenges, particularly if it wants to launch a universal autonomous driving service. Speculation suggests that Trump’s potential policy shifts could streamline this process.

However, with few specifics available, regulations will still be a requirement for autonomous vehicles, and it remains uncertain whether Tesla, Rivian, or Lucid are prepared to take autonomous driving to the broader market.

Potential Challenges Ahead

While today brought gains for EV stocks, the outlook may not be as promising.

Concerns surrounding the future of the $7,500 EV tax credit persist, alongside other critical subsidies for battery and EV manufacturing that could be retracted.

Moreover, the financial performance of these companies raises alarms. As the competition intensifies and subsidies decrease, losses for Lucid and Rivian may exacerbate.

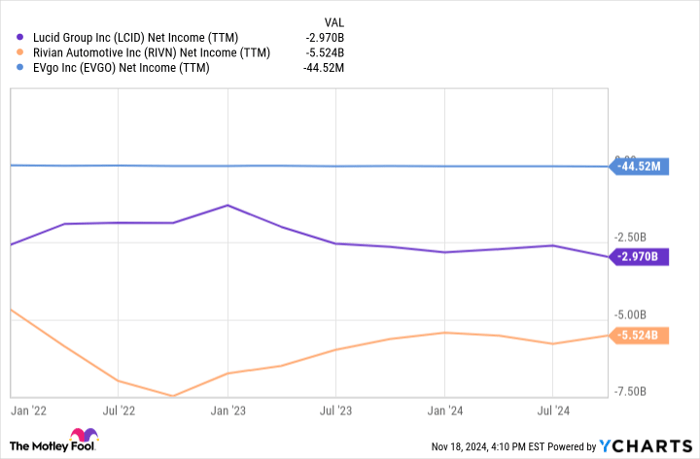

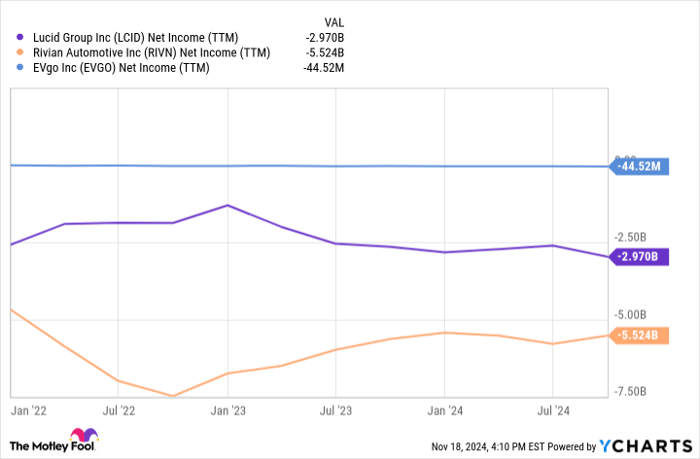

LCID Net Income (TTM) data by YCharts

Lucid and Rivian, specifically, are struggling to achieve even a gross profit from their production. The path to profitability remains uncertain, even with the potential of autonomous vehicles coming into play.

The Divergence Between Speculation and Fundamentals

The market appears driven by speculation across various sectors, including electric vehicles. Factors such as President Trump’s statements and speculation about future winners and losers significantly influence investor sentiment.

Nonetheless, the fundamental realities differ greatly. As competition in the EV market escalates, companies are depleting billions in resources attempting to scale their operations, which could lower prices even further. For companies like Lucid and Rivian, the road to profitability is unclear.

In light of these developments, it may be wise for investors to reconsider their positions and seek more promising opportunities elsewhere. With the incoming administration unlikely to be more favorable to EVs than the previous one, profitability within this sector appears elusive.

Seize New Investment Opportunities

Do you ever feel you missed important stock purchases? If so, you might want to explore this further.

Occasionally, our analysis team identifies stocks they believe are on the verge of significant growth, referred to as a “Double Down” stock recommendation. If you’re concerned about missing the opportunity to invest, now might be the optimal time to consider these potential winners.

- Nvidia: If you had invested $1,000 in 2009, it would now be worth $368,131!*

- Apple: A $1,000 investment in 2008 would have grown to $42,611!*

- Netflix: An investment of $1,000 made in 2004 would be worth $444,355!*

We are currently issuing “Double Down” alerts for three compelling companies, and this may be an exceptional chance that won’t last long.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.