HSBC Boosts Outlook for Moderna, Signaling Strong Growth Potential

HSBC has changed its rating for Moderna (XTRA:0QF) from Hold to Buy as of November 18, 2024.

Analysts Forecast Significant Price Increase

The average one-year price target for Moderna is currently set at 91.02 €/share, as of October 21, 2024. These projections range from a low of 42.76 € to a high of 230.01 €. Notably, the average price target indicates a potential increase of 158.13% from the latest closing price of 35.26 € per share.

Moderna’s Projected Revenue and Earnings

Moderna is expected to generate annual revenue of 6,692 million Euros, reflecting a robust increase of 31.71%. However, the projected annual non-GAAP EPS stands at -3.39.

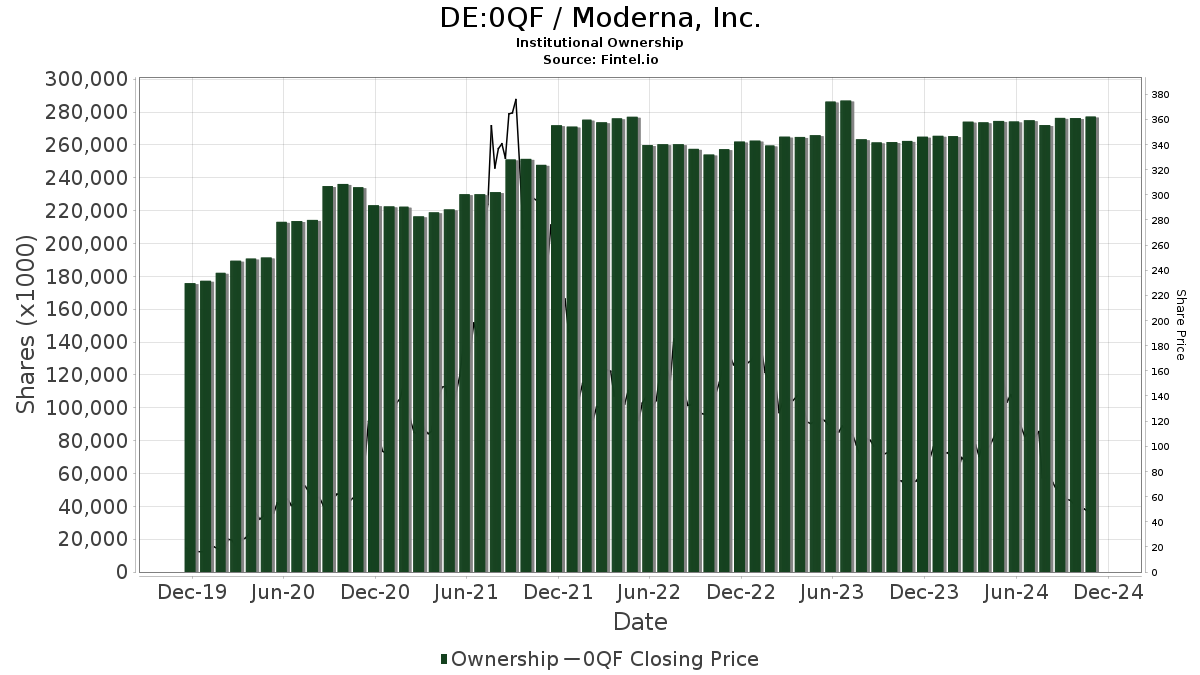

Trends in Fund Ownership

There are currently 1,503 funds or institutions holding positions in Moderna, which marks a decline of 146 owners, or 8.85%, from the previous quarter. Funds dedicated to 0QF have seen an increase in average portfolio weight of 28.12%, now at 0.21%. Institutional ownership dropped slightly over the last three months, with total shares owned decreasing by 1.63% to 280,798K shares.

Institutional Shareholder Actions

Baillie Gifford holds 42,458K shares, accounting for 11.03% of the company. This reflects a reduction from 43,449K shares previously, marking a drop of 2.33%. The firm’s portfolio allocation in 0QF has decreased by 47.17% over the last quarter.

BlackRock has 25,032K shares, representing 6.50% ownership, down from 25,562K shares with a decrease of 2.12%. Their portfolio allocation in 0QF was cut by 48.89% this past quarter.

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) increased its holdings to 10,907K shares, now representing 2.83% ownership, up from 10,801K shares, which is a 0.98% increase. Their portfolio allocation for 0QF rose by 9.44% over the last quarter.

Vanguard 500 Index Fund Investor Shares (VFINX) holds 8,558K shares, equating to 2.22% ownership, an increase from 8,359K shares, which is a 2.31% rise. Their portfolio allocation in 0QF also increased by 7.99% this last quarter.

Conversely, Vanguard International Growth Fund Investor Shares (VWIGX) holds 8,556K shares, maintaining 2.22% ownership, but this is down from 9,029K shares, representing a decline of 5.53%. Their allocation in 0QF decreased by 48.72% quarter-over-quarter.

Fintel provides an extensive range of investing research tools for individual investors, financial advisors, and small hedge funds, encompassing data on company fundamentals, analyst reports, ownership statistics, fund sentiment, and various trading strategies.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.