IonQ (NYSE: IONQ) experienced significant gains in Tuesday’s trading. The quantum-computing firm’s share price ended the day up 10.5%, even peaking at 12.2% during earlier trading hours.

On the same day, IonQ announced that it successfully demonstrated its quantum-computing hardware using Nvidia‘s CUDA-Q software platform. With Nvidia set to release its third-quarter earnings and hold a conference call tomorrow, investors are optimistic that updates on a potential partnership with IonQ may be provided.

Investors Show Confidence in IonQ’s Use of Nvidia’s Software

Nvidia’s CUDA platform serves as the key software tool that maximizes the efficiency of its graphics processing units (GPUs) for AI applications. In contrast, CUDA-Q is a hybrid platform designed to harness the capabilities of GPUs, central processing units (CPUs), and quantum processing units within one quantum program.

Technological advancements in quantum computing have been recognized as crucial for driving significant progress in AI technologies, which has boosted IonQ’s value considerably. In the past year, news of Nvidia’s partnerships or investments in various companies has led to remarkable gains, making investors eager for Nvidia’s Q3 report, anticipating possible details about a collaboration with IonQ.

Looking Ahead: The Future of IonQ

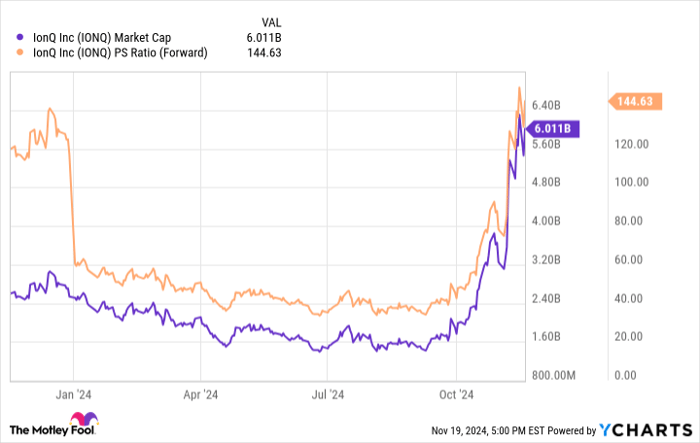

IonQ’s stock has surged approximately 119% in 2024’s trading. The company currently boasts a market capitalization of roughly $6 billion, representing about 145 times this year’s expected sales.

IONQ Market Cap data by YCharts.

While IonQ has demonstrated promising technological advancements and collaborations this year, investors should remain cautious. Quantum computing remains a speculative area, and the reality of substantial commercial applications might still be years away even under the best circumstances.

Moreover, IonQ isn’t the only contender in this field. However, if the company is able to achieve its ambitious goals in computing innovation, its share price may well rise dramatically. Investors face a high-risk, high-reward situation, and volatility in stock prices is likely to persist.

A Rare Opportunity Awaits

Have you ever felt like you missed out on the most successful investments? If so, this may be your chance.

Sometimes, our team of analysts identifies a “Double Down” stock—a company they believe is poised for significant growth. If you think you’ve missed your window to invest, now may be the time to act before it’s too late. The numbers show the potential:

- Nvidia: if you invested $1,000 back in 2009, you’d have $363,386!*

- Apple: if you invested $1,000 in 2008, you’d have $43,183!*

- Netflix: if you invested $1,000 in 2004, you’d have $456,807!*

Currently, we are issuing “Double Down” alerts for three impressive companies, and this opportunity may not come again.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.