Analysts See Potential Upside for Invesco S&P 500 QVM Multi-factor ETF

Recent evaluations of the Invesco S&P 500 QVM Multi-factor ETF (Symbol: QVML) indicate promising growth opportunities. Analysts have calculated a weighted average implied target price of $38.35 per unit for this ETF based on its underlying investments.

Currently trading around $34.58 per unit, QVML suggests a potential upside of 10.91% according to analysts’ forecasts. This positive outlook is supported by three significant underlying holdings: Xylem Inc (Symbol: XYL), Avery Dennison Corp (Symbol: AVY), and LyondellBasell Industries NV (Symbol: LYB). Notably, XYL has a recent trading price of $122.82 per share, but analysts project its target price to be 23.43% higher at $151.60 per share. Similarly, AVY shows a potential increase of 21.92%, moving from a recent share price of $197.64 up towards an average analyst target of $240.96. LyondellBasell, trading at $82.48, is expected to reach a target price of $99.56, which is a 20.70% upside.

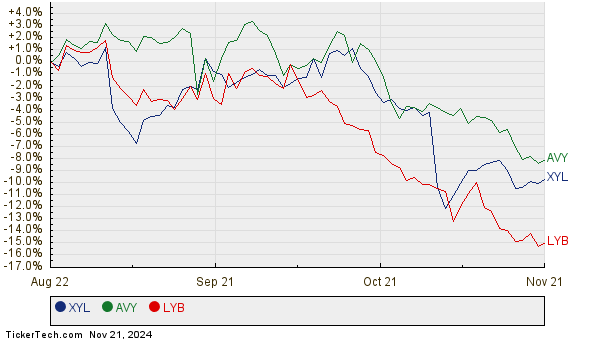

Below is a twelve-month price history chart illustrating stock performance for XYL, AVY, and LYB:

Here’s a concise summary of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P 500 QVM Multi-factor ETF | QVML | $34.58 | $38.35 | 10.91% |

| Xylem Inc | XYL | $122.82 | $151.60 | 23.43% |

| Avery Dennison Corp | AVY | $197.64 | $240.96 | 21.92% |

| LyondellBasell Industries NV | LYB | $82.48 | $99.56 | 20.70% |

As investors consider these targets, it’s important to ask whether analysts are justified in their projections. There’s always a chance that these target prices reflect past performance rather than future potential. Understanding the basis of these estimates can help investors make informed decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Top Ten Hedge Funds Holding PSDO

SHI Price Target

Institutional Holders of HEXO

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.