The Mag 7 Dominates Q3 Earnings Once Again

The unofficial close of Q3 earnings season featured the last report from a Mag 7 company, Nvidia, which announced a staggering earnings increase of +100% compared to the same period last year. This trend echoes familiar patterns seen over the past two years.

Once again, large-cap earnings growth primarily stemmed from the Mag 7, while mid-cap and small-cap earnings continued to decline.

For Q3 (see the orange box), Mag 7 earnings climbed 20% year-over-year (represented by lighter blue bars), whereas the rest of the S&P 500 managed only a 3% increase (orange bars). Overall, combined earnings for the S&P 500 rose by 5.8%.

This performance overshadowed the S&P 400 mid caps (navy blue bars) and S&P 600 small caps (green bars), both of which experienced further earnings declines. Notably, mid-cap earnings have been negative for 7 of the last 8 quarters, while small caps have seen negative earnings for 9 consecutive quarters.

Mag 7 Achieves Higher Profit Margins

To grasp why the Mag 7 consistently outperforms other stock groups, examine their profit margins.

Since early 2023, Mag 7 margins have jumped from 17% to 24% (displayed as the lighter blue line in the chart below), effectively doubling the margins of the rest of the S&P 500 (orange line).

While the Mag 7 has enjoyed margin expansion, margins for the remaining S&P 500 companies and mid caps (navy blue line) have remained stable just below their highs from 2022.

In contrast, small caps have seen their margins shrink from 7.5% to 6% (green line). This decline is largely attributable to higher interest rates from the Federal Reserve, which adversely affect small caps due to their heavier reliance on floating-rate debt.

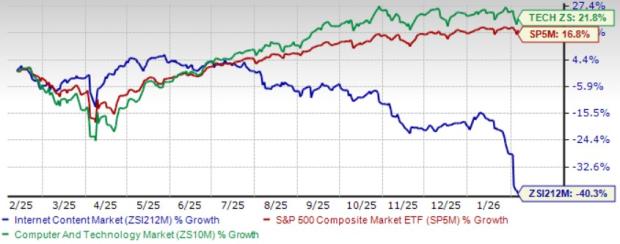

Year-to-Date Returns Highlight Earnings Power for Large Caps

The strong margin growth and earnings increase illuminate the significant price gains for the Mag 7 over the past two years.

In fact, three-quarters of the Mag 7’s 40% price increase this year (illustrated in the leftmost orange circle of the chart below) can be traced back to earnings growth (shown in the green portion of the bar). The remainder of the S&P 500 also credits much of their 16% year-to-date returns to earnings growth.

Interestingly, mid caps have outperformed with an 18% return despite their lower earnings growth. For mid and small caps, most (or all, in the case of small caps) of their gains this year stem from multiple expansions (represented by the blue portions of the bars), reflecting increased expectations rather than actual earnings growth.

The sustainability of these gains hinges on fulfilling these heightened expectations.

Looking ahead to Q4, mid caps might experience another earnings contraction (as shown in the first chart’s gray box). However, analysts project a potential rebound next year, with mid caps anticipated to see 13% year-over-year earnings growth and small caps expected to rise by 18%. If these forecasts hold true, there may soon be more stories than just the Mag 7 during earnings discussions.

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved.