Sociedad Quimica y Minera S.A. Posts Disappointing Q3 Earnings

Key Insights from SQM’s Third Quarter

- SQM earnings per share in Q3 was 46 cents, far below the Zacks estimate of 64 cents.

- SQM shares have lost 23.6% in the past year, compared to a 13.1% decline in the Fertilizers industry.

- Register now to see our 7 Best Stocks for the Next 30 Days report – free today!

Sociedad Quimica y Minera de Chile S.A. (SQM) reported a profit of $131.4 million, or 46 cents per share, in the third quarter of 2024. This marks a significant decrease from the $479.4 million, or $1.68 per share, posted in the same quarter last year. Additionally, this figure fell short of the Zacks Consensus Estimate of 64 cents per share.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

SQM generated revenues of $1,076.9 million for the quarter, down approximately 41% year over year and missing the Zacks Consensus Estimate of $1,090.2 million. Although SQM experienced growth in sales volumes across nearly all product lines, it struggled with declining prices compared to last year.

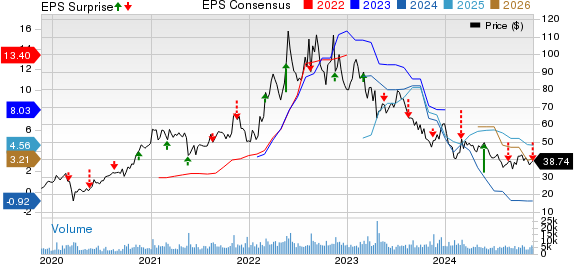

Price Trends and Market Performance

Sociedad Quimica y Minera S.A. price-consensus-eps-surprise-chart | Sociedad Quimica y Minera S.A. Quote

Segment Performance at SQM

In the Lithium and Derivatives segment, revenues fell around 61% year-over-year, totaling $497.2 million. This decline occurred despite an 18% increase in lithium sales volumes, attributed to a steep 67% drop in average sales prices.

Meanwhile, the Specialty Plant Nutrients (SPN) segment reported revenues of $249.1 million, an increase of 12% from last year, fueled by higher sales volumes but dampened by lower average prices.

The Iodine and Derivatives segment earned $233.5 million, which is a 10% improvement year over year, driven by increased sales volumes.

Revenues from the Potassium segment declined 9% to $68.2 million, as higher sales volumes were more than offset by falling prices.

Lastly, the Industrial Chemicals division saw a revenue decrease of about 57% to $18.6 million, primarily due to significantly lower sales volumes, despite a rise in average sales prices.

Financial Overview of SQM

At the quarter’s close, SQM’s cash and cash equivalents stood at $1,565.4 million, reflecting a 52% increase since the previous quarter. Long-term debt rose to $3,784.4 million, up approximately 28% from the last reported quarter.

Future Projections for SQM

The company reiterated its lithium volume forecast, anticipating the sale of 190,000-195,000 metric tons this year.

In terms of the SPN unit, SQM expects its sales volumes to exceed market growth projections of 17% for 2024, estimating around a 20% growth compared to last year.

In the Iodine and Derivatives segment, SQM predicts higher average realized sales prices in Q4, driven by robust demand in the iodine market, particularly for X-ray contrast media and industrial applications, projecting a 7% year-over-year growth in 2024.

Additionally, SQM expects its potassium sales volumes to reach 620,000 metric tons in 2024, considering a shipment delay that pushes some deliveries to 2025.

SQM Stock Performance

Over the past year, SQM’s stock has dropped 23.6%, contrasting with a 13.1% decline in the broader Fertilizers industry.

Image Source: Zacks Investment Research

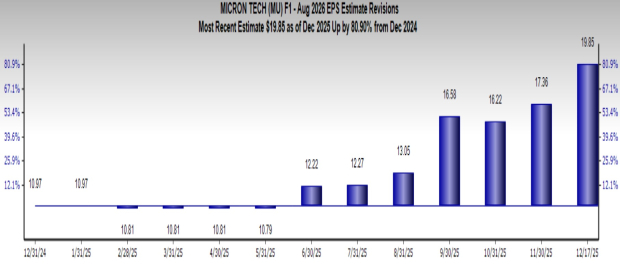

Image Source: Zacks Investment Research

Zacks Ranking for SQM and Industry Insights

Presently, SQM holds a Zacks Rank #3 (Hold). You can view the full list of Zacks #1 Rank (Strong Buy) stocks here.

DuPont de Nemours, Inc. (DD) reported adjusted earnings of $1.18 per share for the third quarter, exceeding the Zacks Consensus Estimate of $1.04. The company has revised its full-year 2024 projections higher for operating EBITDA and adjusted earnings.

The Chemours Company (CC) achieved adjusted earnings of 40 cents per share, beating expectations of 32 cents. However, CC forecasts that consolidated net sales might decline in the mid-to-high single digits in Q4.

PPG Industries, Inc. (PPG) posted third-quarter adjusted earnings of $2.13 per share, falling short of the Zacks Consensus Estimate of $2.15. PPG anticipates flat organic sales and adjusted earnings at the lower end of the $8.15 to $8.30 range for the year.

Research Chief Names “Single Best Pick to Double”

Among thousands of stocks, five Zacks experts have identified their top selections for potential doubling in value within months. From these, Director of Research Sheraz Mian has selected one with the most explosive upside.

This company targets the millennial and Gen Z demographic, boasting nearly $1 billion in revenue last quarter. A recent pullback makes it an attractive investment opportunity. While not all picks will succeed, this one has the potential to outperform previous top picks like Nano-X Imaging, which increased by +129.6% in just over nine months.

Sociedad Química y Minera Misses Expectations in Latest Quarter

Financial Performance Under Scrutiny

Sociedad Química y Minera S.A. (SQM) recently reported earnings that fell short of analysts’ estimates for the third quarter. This disappointing performance has raised questions about the company’s future outlook.

Analysis of Earnings and Revenues

The company struggled with its earnings and revenues, which did not meet market expectations. Investors are paying close attention to these results as they could affect SQM’s stock performance moving forward.

Comparative Industry Insights

In the context of the chemical industry, other companies like PPG Industries, Inc. (PPG), DuPont de Nemours, Inc. (DD), and The Chemours Company (CC) are also navigating challenging market conditions. Historical trends show that fluctuations in demand and prices can heavily influence the performance of companies in this sector. For instance, PPG and DuPont have both launched initiatives aimed at reducing costs and boosting efficiency to stay competitive.

Potential Actions for Investors

With the current financial landscape, investors may want to assess their positions in SQM and similar companies. Analysts suggest considering multiple factors, including market trends and company-specific news, before making investment decisions.

If you’re interested in a deeper analysis of companies like SQM, you can access free reports from Zacks Investment Research:

- PPG Industries, Inc. (PPG)

- DuPont de Nemours, Inc. (DD)

- Sociedad Quimica y Minera S.A. (SQM)

- The Chemours Company (CC)

Click here to read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.