The Hershey Company Faces Challenges Amid a Changing Market

An Insight into Hershey’s Current Status

Currently holding a Zacks Rank #5 (Strong Sell), Hershey (HSY) is the largest chocolate manufacturer in North America and the leading global player in candy production, including both chocolate and non-chocolate confections. Besides its well-known chocolates, Hershey also produces baking ingredients, toppings, beverages, gum, and snack mixes. Despite its leadership in the chocolate industry, Hershey’s growth is currently declining, profit margins are tightening, and new political appointees pose potential risks for the business.

Political Changes and Their Implications

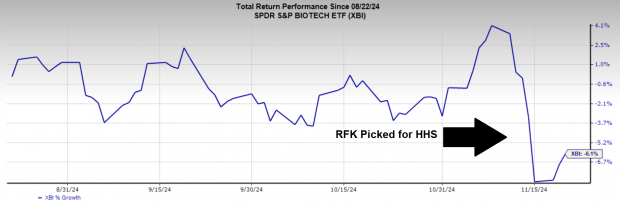

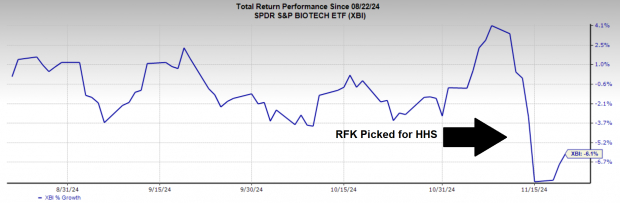

This year’s Republican electoral success suggests significant political shifts that could influence various sectors, including Hershey’s. One notable announcement came when President-elect Donald Trump selected former presidential candidate Robert F. Kennedy Jr. to lead the Department of Health and Human Services (HHS). Following this news, the SPDR S&P Biotech ETF (XBI) witnessed a sharp drop of nearly 12% within a week, reflecting investor concerns.

Image Source: Zacks Investment Research

Kennedy, with his controversial views on biotech and vaccine safety, raises eyebrows, particularly among biotech firms. However, his influence may extend further into the food sector, impacting major players like Hershey.

Concerns Over Processed Foods

Among Kennedy’s myriad views, one that resonates with growing public concern is his belief that processed foods are detrimental to American health. High obesity rates, often linked to junk food from chains like McDonald’s (MCD), reflect this issue. Recently, he criticized Kellanova (K), the maker of Fruit Loops, for using less healthy ingredients in their U.S. cereals compared to those sold abroad. Should Kennedy’s beliefs gain traction, Hershey and similar companies may face pressure to alter their recipes and use costlier ingredients, which could negatively affect their profits.

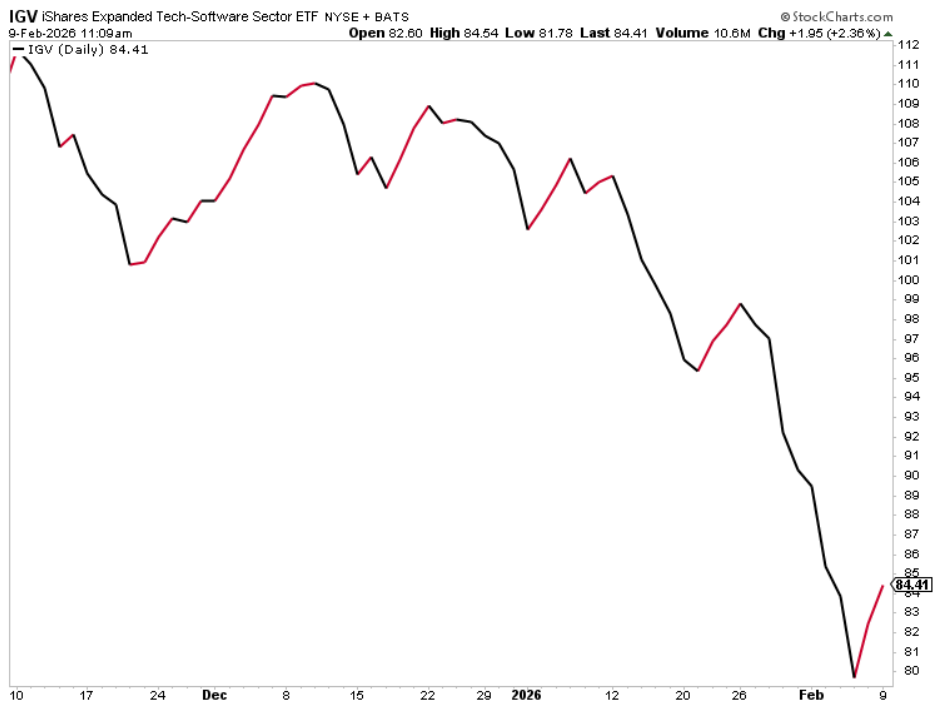

Current Market Trends Favor Riskier Assets

At present, investors are gravitating toward riskier market sectors, such as cryptocurrencies, with Bitcoin nearing $100,000 for the first time. This shift is evident in the underperformance of HSY shares, which have seen a decrease of nearly 10% even as the S&P 500 Index has risen by 26% year-to-date.

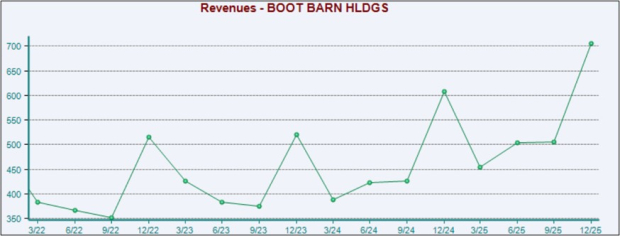

Image Source: Zacks Investment Research

Impact of Rising Cocoa Prices

Hershey’s primary ingredient, cocoa, has experienced significant price increases. This rise has intensified financial pressure on the company’s margins.

Image Source: FRED

Conclusion: A Cautious Outlook for Hershey

Given the current trend of investors moving away from safe-haven stocks, increasing cocoa prices, and potential regulatory changes under the new HHS leadership, Hershey stock should be approached with caution.

5 Stocks Set to Double

Each of these stocks has been handpicked by a Zacks expert, selected as the top choices expected to gain over 100% in 2024. While not every selection can be a guarantee, past recommendations have reported gains of +143.0%, +175.9%, +498.3%, and even +673.0%.

Most of these stocks are currently below the radar, offering a unique opportunity for early investors.

Today, See These 5 Potential Home Runs >>

McDonald’s Corporation (MCD) : Free Stock Analysis Report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Kellanova (K) : Free Stock Analysis Report

SPDR S&P Biotech ETF (XBI): ETF Research Reports

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.