Cava Group’s Rapid Rise: A Stock to Watch in 2023

Cava Group (NYSE: CAVA) has emerged as one of the top restaurant stocks this year. The Mediterranean-style, fast-casual restaurant chain has successfully attracted both customers and investors. Through strategic expansion and innovative menu options, Cava has consistently reported impressive financial results, pushing its share price upward.

Recently, the company shared its latest earnings, and one particular figure caught the eye. This metric underscores the business’s robust growth, indicating a positive trajectory for the future.

Impressive Same-Restaurant Sales Growth of 18.1%

For restaurant chains, achieving single-digit comparable sales growth is often considered a success, especially given today’s economic climate where consumers are more cautious with their spending.

However, Cava’s results tell a different story. For the most recent quarter ending October 6, the company reported comparable restaurant sales growth of an outstanding 18.1%. In contrast, Chipotle Mexican Grill achieved a comparable sales growth of 6% for its latest quarter, while global sales at McDonald’s saw a decline of 1.5% during the same period.

Comparable restaurant sales are a crucial indicator for restaurants, reflecting performance based solely on locations open for at least a year, thus excluding the benefits of new openings.

This statistic favors smaller, fast-growing companies like Cava, which typically focus on high-growth regions. As Cava expands, its growth rate may stabilize, but these numbers still show strong potential for continued success.

A Rapid Growth Strategy Makes Cava a Desirable Investment

Cava’s exceptional growth rate sets it apart from many competitors. The company has rapidly expanded its presence, ending the last quarter with 352 restaurants, up from 290 a year prior, and it aims for 1,000 locations by 2032.

This growth trajectory is impressive compared to other chains, suggesting that Cava’s ambitious plans will likely sustain this trend in the future.

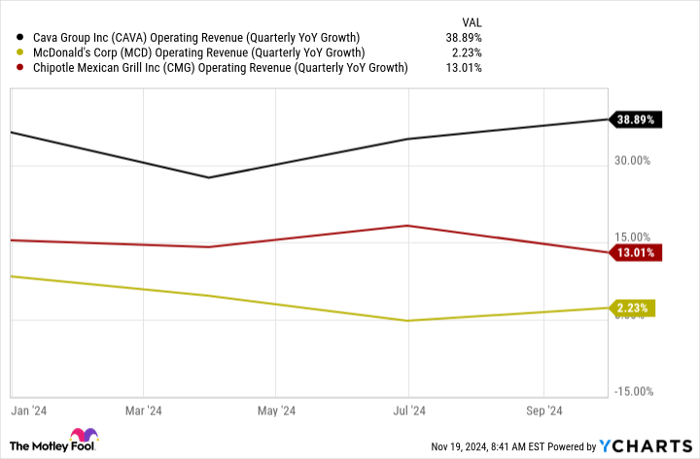

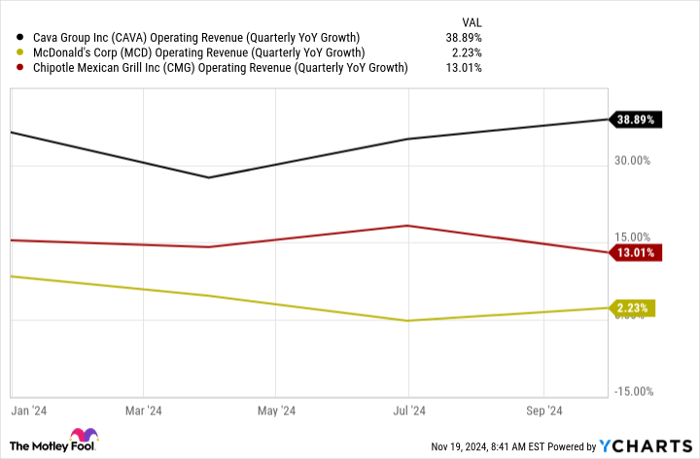

CAVA Operating Revenue (Quarterly YoY Growth) data by YCharts

Evaluating Cava’s High Valuation

Cava’s stock has skyrocketed by an impressive 219% as of Monday’s close, fueling considerable investor optimism. While this is good news for existing shareholders, potential buyers might worry they’re too late to the party.

In the last quarter, Cava’s sales surged by nearly 40% to $243.8 million. Its net income increased even more dramatically, climbing 163% to just under $18 million. Despite these impressive figures, the per-share profit stands at a modest $0.16. With Cava’s stock trading at $137.24 on Monday, its price-to-earnings ratio exceeds 330. Even with analyst forecasts, it trades at over 277 times next year’s earnings, raising concerns about its valuation. Potential investors may want to think carefully before entering at such high multiples, as much of this price comes from expected future growth.

Although Cava could be a solid long-term investment, new investors should manage their expectations due to the risks of high valuations. With such steep multiples, the stock lacks a margin of safety and could be susceptible to market corrections.

Is Investing $1,000 in Cava Group a Smart Move?

Before acquiring shares of Cava Group, consider this:

The Motley Fool Stock Advisor team recently pinpointed what they believe are the 10 best stocks to buy right now… and Cava Group did not make the list. The selected stocks have the potential for substantial returns in the near term.

For example, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, that investment would have grown to $898,809!

Stock Advisor offers a simple plan for investors, including portfolio-building tips, regular updates, and two new stock picks each month. The service has significantly outperformed the S&P 500 since its inception in 2002.

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024

David Jagielski has no financial interest in any of the stocks mentioned. The Motley Fool has positions in, and recommends, Chipotle Mexican Grill and Cava Group, while recommending the following options: short December 2024 $54 puts on Chipotle Mexican Grill.

The views and opinions expressed in this article are those of the author and do not reflect the views of Nasdaq, Inc.