The Rise of Spot Bitcoin ETFs: Transforming Institutional Investment

In 2021, the first Bitcoin (CRYPTO: BTC) exchange-traded funds (ETFs) launched in the U.S. market. Morningstar analyst Ben Johnson stated clearly, “These aren’t the Bitcoin ETFs you’re looking for.” The reason? These initial ETFs traded futures contracts rather than investing directly in Bitcoin itself.

This approach has significant drawbacks. Specifically, the price fluctuations in futures contracts do not always reflect real-time Bitcoin prices. To maintain continuous exposure, issuers must roll over Bitcoin futures contracts to the next month, incurring costs that ultimately affect shareholders.

This means the early Bitcoin ETFs offer only indirect exposure, failing to accurately follow Bitcoin’s price movements. For example, the ProShares Bitcoin ETF has dropped 37% since its October 2021 launch, whereas Bitcoin itself has appreciated by 60%. Essentially, the first U.S. Bitcoin ETF has underperformed the cryptocurrency by a staggering 97 percentage points since its introduction.

Ben Johnson’s words rang true: the initial ETFs were not what investors desired. However, the landscape shifted with the introduction of spot Bitcoin ETFs in January 2024. These new funds actually store Bitcoin, leading to an unprecedented adoption rate among institutional investors.

Spot Bitcoin ETFs Simplify Access for Institutions

The SEC greenlighted 11 spot Bitcoin ETFs in January 2024, streamlining the process for investors to add Bitcoin to their brokerage accounts. This innovation has eliminated the hassles and high fees linked to buying Bitcoin via exchanges.

“Not long ago, you had to invest in Bitcoin directly, which was complicated and risky in an unregulated market,” remarked John Eade, president of Argus Research. “But with the introduction of spot Bitcoin ETFs this complexity has been greatly reduced, allowing easy Bitcoin exposure without the need for ownership and management.”

Spot Bitcoin ETFs track Bitcoin prices closely since they hold the cryptocurrency rather than futures contracts. For instance, since launching in January 2024, the iShares Bitcoin Trust (NASDAQ: IBIT) has seen returns of 110%, closely parallel to Bitcoin’s 111% increase during the same period.

As a result, spot Bitcoin ETFs have sparked significant interest among both retail and institutional investors. Experts have labeled these launches as some of the most successful in ETF history. In particular, the iShares Bitcoin Trust achieved $10 billion in assets faster than any previous ETF, as reported by The Wall Street Journal.

Institutional involvement has surged as well. The number of institutions owning a spot Bitcoin ETF grew from 965 to 1,100 between the first and second quarters of 2024, leading to claims that these ETFs are being adopted at the fastest pace in history, according to Matt Hougan, chief investment officer at Bitwise.

This trend carries immense implications for Bitcoin’s future. With institutions managing approximately $120 trillion in assets, even minor allocations to Bitcoin could significantly elevate its price. Cathie Wood of Ark Invest suggests that institutions might eventually earmark “a little more than 5% of their portfolios to Bitcoin,” potentially catapulting the price of a single Bitcoin to $3.8 million.

Image source: Getty Images.

The Launch of Options Trading on the iShares Bitcoin Trust

In November 2024, the Nasdaq Stock Exchange initiated options trading for the iShares Bitcoin Trust, marking a key milestone that could further boost institutional adoption. Options contracts provide investors with the right, but not the obligation, to buy or sell securities at set prices on predetermined dates.

Options trading is particularly useful for hedging long positions. For example, institutional managers invested in the iShares Bitcoin Trust can protect their portfolios from downturns by acquiring put options, which allow selling a security at a specific price during a given timeframe.

Key Takeaways

Spot Bitcoin ETFs have significantly increased institutional demand for Bitcoin, reflected in a 111% price surge since their U.S. debut in January. As institutions continue to integrate options trading into their strategies, demand for these ETFs may escalate, potentially driving Bitcoin’s price even higher in the future.

Is Now the Right Time to Invest $1,000 in Bitcoin?

Before considering an investment in Bitcoin, reflect on this:

The Motley Fool Stock Advisor analyst team recently identified what they believe to be the 10 best stocks for current investment, and Bitcoin did not make the list. The selected stocks have the potential for remarkable returns in the coming years.

Take Nvidia, for example, which made this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, you would have $898,809!*

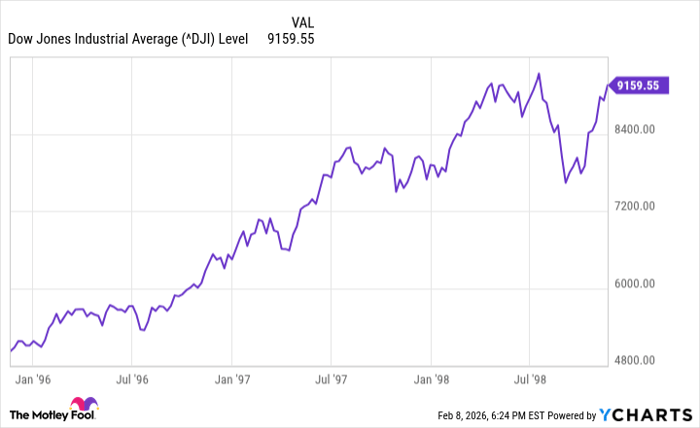

Stock Advisor presents a straightforward blueprint for successful investing, including guidance on portfolio building, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the S&P 500 returns since 2002*.

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024

Trevor Jennewine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

The views expressed in this article belong to the author and do not necessarily reflect those of Nasdaq, Inc.