Wall Street Prepares for Change: GOP’s Election Day Wins and Their Impact

For Wall Street, few events in 2024 were as anticipated as Election Day. The results of the elections affect fiscal policies, which can significantly influence corporate America and market performance.

In the evening of November 5, the Associated Press (AP) reported that Republicans had successfully flipped enough Senate seats to regain control, leading to a 53-to-47 majority in the upper house of Congress.

Shortly after the Senate was called for the GOP, the AP also declared former President Donald Trump as the president-elect. Trump garnered 312 electoral votes compared to Democratic nominee Kamala Harris, who received 226.

On November 13, eight days after the polls closed, the AP found that Republicans had also won enough seats in the House of Representatives to maintain their majority. Although three seats were still undecided as of November 21, the GOP holds a 219 to 213 majority in the House.

President Trump giving remarks to a crowd. Image source: Official White House Photo by Joyce. N. Boghosian.

GOP Control: Key Insights and Future Implications

While Wall Street has some clarity regarding the new administration, many questions linger about the U.S. economy and stock market’s future.

One of the primary concerns surrounding Trump’s return to power is foreign trade. He proposed imposing a 60% tariff on Chinese imports and a potential 20% tariff on goods from other countries.

Tariffs aim to boost domestic production and enhance the competitiveness of American products. However, trade wars could arise, provoking retaliatory tariffs from other nations, which may increase costs for businesses and consumers alike.

The unified Republican government will also need to address the growing national debt. Except for a few years from 1998 to 2001, the federal government has operated at a deficit since 1970, and recent years have seen increasing deficits. The GOP typically advocates for lower taxes, raising the question of whether substantial progress can be made on reducing the federal deficit.

One certainty is that discussions to raise the corporate income tax rate, which Harris suggested during her campaign, are no longer on the agenda.

Moreover, the individual tax cuts from Trump’s Tax Cuts and Jobs Act are set to expire on December 31, 2025. A Republican administration could facilitate extending these cuts or potentially making them permanent.

Image source: Getty Images.

Stock Market Trends Under Republican Leadership

The pressing question for investors is: How will a Republican-led government affect stock performance? Recent data suggests possible optimism.

A report from Retirement Researcher titled (“Are Republicans or Democrats Better for the Stock Market?”) analyzed the S&P 500’s performance over nearly a century (1926 to 2023).

Within the 98 years studied, Republican-controlled governments were the rarest scenario. Over the 13 years this situation occurred, the S&P 500 delivered an impressive average annual return of 14.52%. This rate of return can double an investor’s money every five years on a compound basis.

However, it’s important to note that all studied scenarios resulted in strong average returns for the S&P 500:

- Unified Republican: 14.52% average annual return over 13 years.

- Unified Democrat: 14.01% average annual return over 36 years.

- Divided with Republican president: 7.33% average annual return over 34 years.

- Divided with Democratic president: 16.63% average annual return over 15 years.

Regardless of the Election Day outcome, investors seem positioned for success.

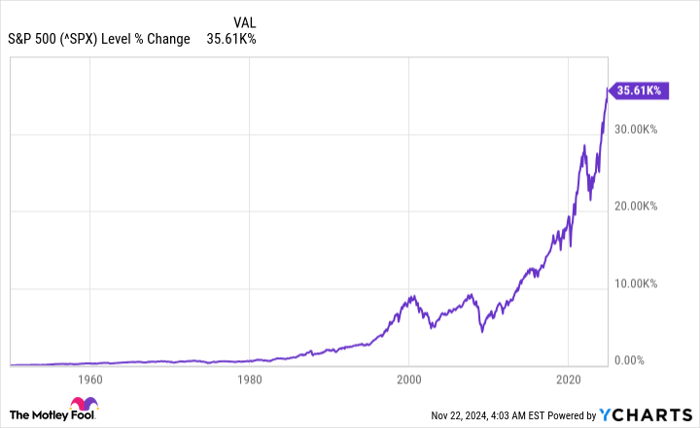

^SPX data by YCharts.

Taking the analysis further, the analysts at Crestmont Research have published data examining the 20-year total returns of the S&P 500 back to 1900. This research covers all 105 rolling 20-year periods from 1919 to 2023.

Crestmont found that every single one of these periods produced a positive annualized total return. In other words, had an investor purchased an S&P 500 index and held it for 20 years, they would have profited each time, regardless of economic downturns or other significant events.

Moreover, over 50 of these rolling 20-year spans yielded annualized returns of at least 9%, suggesting that patience—no matter which political party was in power—often led to substantial gains.

Even with uncertainties regarding the upcoming administration, long-term investors appear well set for future success.

A Second Chance: Capitalizing on Investment Opportunities

Have you ever felt like you missed out on investing in promising stocks? This might be your chance.

Occasionally, our team of analysts issues a “Double Down” stock recommendation for companies they believe are about to see significant growth. If you’re concerned about missing out, now is a pivotal time to consider investing. The numbers below illustrate remarkable past performances:

- Nvidia: A $1,000 investment when we made our “Double Down” in 2009 would be worth $380,291!*

- Apple: A $1,000 investment in 2008 would now be worth $43,278!*

- Netflix: A $1,000 investment in 2004 would have grown to $484,003!*

We’re currently recommending “Double Down” stocks for three exceptional companies, and opportunity like this may not arise again soon.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.