Seagate Technology: A Look at Recent Performance and Future Prospects

With a market cap of $21.1 billion, Seagate Technology Holdings plc (STX) stands out as a global leader in data storage solutions, focusing on hard disk drives (HDDs), solid state drives (SSDs), and hybrid systems. Based in Singapore, the company provides innovative products to various markets, including enterprise, cloud, consumer, and gaming sectors.

Stock Performance Compared to Major Indices

The performance of Seagate’s stock has been slightly less impressive compared to the overall market over the past year. STX shares have risen 30.1% during this period, while the S&P 500 Index ($SPX) has seen a 31% increase. So far in 2024, STX is up 16.7%, trailing SPX’s gain of 25.2% year-to-date.

Seagate vs. Sector Peers

Despite its recent underperformance relative to the broader market, Seagate has exceeded the returns of the Technology Select Sector SPDR Fund’s (XLK) 26.4% return over the last year. However, it fell short of XLK’s 21.4% gain YTD.

Mixed Reactions to Quarterly Results

On October 22, Seagate announced a better-than-expected Q1 adjusted EPS of $1.58 and revenue of $2.2 billion. Despite these strong results, STX shares fell 8.1% the following day as Q2 guidance did not meet analysts’ expectations, predicting an EPS of $1.85 and revenue of $2.3 billion. Investor concerns centered around potential demand challenges in cloud and enterprise markets, along with profit-taking after recent gains and a cautious outlook for the tech sector.

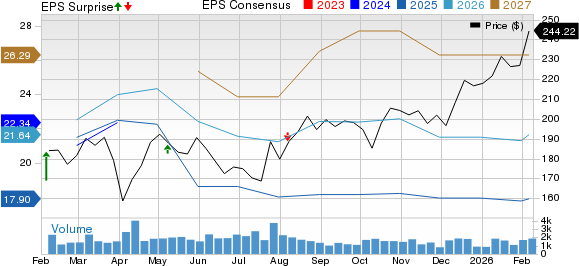

Future Earnings Expectations

For the fiscal year ending in June 2025, analysts project that STX’s EPS will grow to $7.18, indicating significant year-over-year growth. Encouragingly, Seagate has consistently exceeded consensus estimates in the past four quarters.

Analyst Recommendations

The consensus among the 20 analysts following Seagate is a “Moderate Buy.” This assessment is based on ten “Strong Buy” ratings, one “Moderate Buy,” seven “Holds,” and two “Strong Sells.”

Price Target Insights

On October 23, Wedbush analyst Matt Bryson reiterated a “Buy” rating for Seagate Technology, establishing a price target of $150. This forecast suggests a potential upside of 50.6%. At the time of this report, STX shares were trading below the average price target of $122.17.

On the date of publication, Sohini Mondal did not hold either directly or indirectly positions in any of the securities mentioned in this article. All information and data featured here are intended solely for informational purposes. For more details, please refer to the Barchart Disclosure Policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.