“`html

Identifying the “best stock to buy” is a challenge, but Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) stands out as a top choice. Despite being the fourth-largest company in the world by market capitalization, Alphabet still shows significant potential for growth. Investing in this stock now could benefit shareholders in 2025, as the company is poised to excel next year.

Alphabet’s Well-Rounded Growth Strategy

Commonly recognized as Google’s parent company, Alphabet also owns the Android operating system and YouTube. A significant portion of its revenue comes from advertising, which accounted for 75% of total earnings in the third quarter. This steady revenue stream supports the company’s investments in other growth sectors.

Although its advertising division grew only 10% this past quarter—a relatively steady, not explosive, increase—this stability allows Alphabet to channel resources into faster-growing sectors.

One of these growth areas is cloud computing, closely linked to Alphabet’s ambitions in artificial intelligence (AI). Google Cloud has seen remarkable success, with revenue climbing 35% year over year. This expansion is partly due to its access to the advanced generative AI model, Gemini.

The usage of the Gemini model in APIs (application program interfaces) surged 14-fold year over year. The integration of generative AI into various applications is growing in popularity and is expected to enhance Google Cloud’s revenue further over the coming years.

In summary, while Alphabet’s advertising business remains robust, it is channeling its cash flows into high-growth sectors, making it a compelling investment opportunity.

Additionally, Alphabet’s impressive financial results provide a solid basis for investment.

Alphabet’s Stock Trades at a Discount

In the third quarter, Alphabet reported a revenue increase of 15% across the company. With improved operational efficiencies, earnings per share (EPS) rose from $1.55 last year to $2.12, marking a 37% increase.

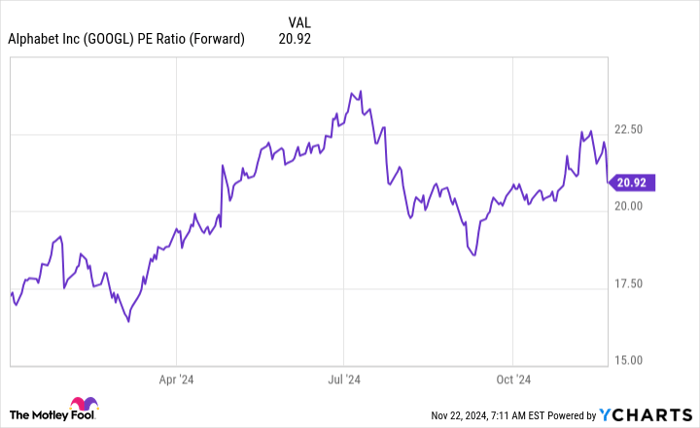

This impressive growth comes from a well-established company, but surprisingly, its stock is undervalued. Currently, it trades at 20.9 times forward earnings, significantly lower than the S&P 500, which trades at 24.6 times forward earnings.

GOOGL PE ratio (forward); data by YCharts. PE = price to earnings.

This disparity indicates strong value, especially when compared to major competitors with similar financial profiles, such as Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), and Meta Platforms (NASDAQ: META). Alphabet trades at the lowest valuation among these tech giants.

| Company | Q3 Revenue Growth | Q3 EPS Growth | Forward P/E |

|---|---|---|---|

| Alphabet | 15.1% | 37.2% | 20.9 |

| Apple | 6.1% | (34%) | 30.9 |

| Microsoft | 16% | 10.7% | 31.9 |

| Meta Platforms |

18.6% | 37.8% | 24.8 |

Data source: YCharts. Note: Q3 encompasses the calendar quarter for Q3; Apple and Microsoft results are in the same time frame but are on a different fiscal-year calendar.

While Alphabet performs better than both Apple and Microsoft, it currently trades at a much lower valuation. Investors may want to reconsider their positions in those companies in favor of Alphabet and potentially also look into Meta.

However, concerns regarding the Department of Justice’s attempt to break up Alphabet, including a possible sale of Google Chrome, may contribute to this undervaluation. Although this situation raises valid concerns, any resolution is likely years away. Historically, similar lawsuits can be protracted. For instance, the government’s case against Microsoft began in mid-1998, but final rulings were not resolved until 2002.

Given this timeline, investors are advised to take advantage of this temporary dip in stock value. Alphabet remains strong, and its current stock price does not reflect its true market position. With uncertainty surrounding the DOJ outcomes already factored into the share price, now could be a strategic time to invest.

Seize This Opportunity for Future Gains

Have you ever felt like you missed out on investing in successful companies? Now is your chance to re-enter the market.

On certain occasions, our analyst team rates stocks as “Double Down” recommendations for companies they predict will see substantial growth soon. If you feel you’ve missed your opportunity, it’s timely to invest now before prices rise. Here are some historical successes:

- Nvidia: If you had invested $1,000 when we recommended it in 2009, that investment would have grown to $380,291!

- Apple: An initial $1,000 investment in 2008 would now be worth $43,278!

- Netflix: Those who invested $1,000 in 2004 saw their investment explode to $484,003!

Currently, we are offering “Double Down” alerts for three promising companies, which may not come along again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Randi Zuckerberg, former director of market development at Facebook, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, also serves on the board. Keithen Drury owns shares in Alphabet and Meta Platforms. The Motley Fool recommends Alphabet, Apple, Meta Platforms, and Microsoft stocks as well as short positions related to Microsoft. The Motley Fool follows a strict disclosure policy.

The views and opinions expressed herein are those of the author and do not reflect the views of Nasdaq, Inc.

“`