Why XRP Could Skyrocket by 2025

The price of XRP (CRYPTO: XRP) has surged more than 122% since election night on November 19, significantly outperforming Bitcoin (CRYPTO: BTC), the largest cryptocurrency. This positive shift in the sector coincides with President-elect Donald Trump’s support for the crypto industry, promising regulatory changes that could rejuvenate interest in crypto within the U.S.

With a more favorable regulatory climate and declining interest rates, XRP may continue to excel. Here are four reasons why XRP is positioned for substantial gains by 2025.

1. Robinhood’s New Offering

Online brokerage Robinhood has recently begun trading XRP, opening it to over 24 million funded customers who manage $152 billion in assets. The company has been cautious in adding new tokens due to fears of regulatory action from the U.S. Securities and Exchange Commission (SEC) concerning unregistered securities.

However, with Trump’s anticipated changes to the SEC, fewer regulatory hurdles may exist for Robinhood to expand its token offerings. This listing will likely enhance retail investors’ access to XRP, leveraging Robinhood’s user-friendly platform.

2. Spot XRP ETFs on the Horizon

The successes of Bitcoin and Ethereum spot exchange-traded funds (ETFs) have led to significant price gains for those cryptocurrencies. Spot ETFs offer greater exposure and liquidity for crypto assets. Unlike direct crypto purchases that involve handling digital wallets and complex passphrases, ETFs can be bought and traded like stocks, making them more accessible.

Companies such as Bitwise are preparing to introduce spot XRP ETFs, although pending approval remains. Ripple Labs CEO Brad Garlinghouse has stated that a spot XRP ETF is “inevitable.”

3. Resolution of the SEC Case

The SEC’s lawsuit against XRP, Ripple, and its founders, Garlinghouse and Chris Larsen, has highlighted the debate over crypto regulation in the United States. The SEC asserts that it should oversee cryptocurrencies, which many view as speculative investments, thereby needing to comply with securities regulations.

On the other hand, proponents argue that cryptocurrencies should be regulated as currencies by the Commodity Futures Trading Commission. The SEC filed its case against Ripple in 2020, claiming that XRP was sold as an unregistered security starting in 2013. While a judge had initially ruled in favor of Ripple, the SEC has since appealed. The case is expected to conclude in 2025, and many analysts believe a favorable outcome for Ripple is possible, which would alleviate the pressure on XRP’s price.

4. XRP’s Relative Underperformance

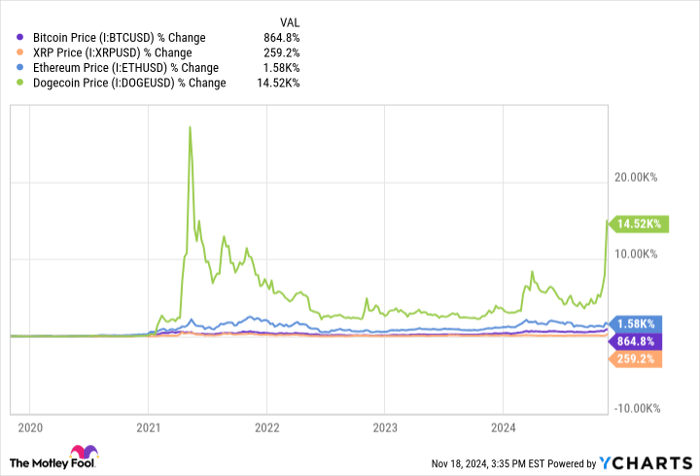

Despite its recent rally, XRP continues to lag behind other major cryptocurrencies like Bitcoin, Ethereum, and even meme tokens like Dogecoin. This underperformance can largely be attributed to the ongoing SEC lawsuit. Nonetheless, as one of the earlier cryptocurrencies, XRP provides an essential use case for companies needing faster cross-border payments.

XRP also has a fixed supply, distinguishing it from many other cryptocurrencies, which could serve as an inflation hedge if Trump’s policies lead to inflation. Given its historical underperformance, XRP may have significant potential for future growth, especially in a favorable market environment.

Should You Invest in $1,000 of XRP Now?

Before making any investments in XRP, it’s essential to consider all factors:

The Motley Fool Stock Advisor analyst team has recently identified what they believe are the 10 best stocks available today, and XRP is not among them. The stocks they recommend could see tremendous returns in the coming years.

For instance, consider when Nvidia was recommended on April 15, 2005… if you had invested $1,000 at that time, it would now be worth $869,885!*

The Stock Advisor service offers a straightforward approach to investment success, including portfolio building strategies, regular updates, and two new stock picks every month. Since 2002, the performance of Stock Advisor has more than quadrupled that of the S&P 500 Index.

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024

Bram Berkowitz has positions in Bitcoin, Ethereum, and XRP. The Motley Fool has positions in and recommends Bitcoin, Ethereum, and XRP. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.