Michael Saylor has had an impressive year. MicroStrategy (NASDAQ: MSTR), the company he co-founded about 35 years ago, has seen its stock price rise over 500% in 2024. Saylor’s net worth has also surged by roughly $1 billion, according to Fortune.

The surge in Bitcoin (CRYPTO: BTC), the world’s largest cryptocurrency, is largely responsible for Saylor’s fortunes, as MicroStrategy holds the most Bitcoin of any publicly traded company, and Saylor himself owns a significant amount. Saylor remains optimistic, believing one BlackRock index fund could skyrocket by over 13,760% in value over time.

Bitcoin’s Future: A Bold Prediction

As a prominent advocate for Bitcoin, Saylor has remained steadfast through its volatility and is optimistic about the future. Back in September, he asserted that Bitcoin could reach an astonishing $13 million by the year 2045.

Saylor supports his prediction with two main arguments. Firstly, he points out that Bitcoin currently represents only 0.1% of the global capital supply, which he anticipates will grow to 7% by 2045. Secondly, he notes that Bitcoin has achieved a remarkable average annual return of 46% over the past four years. His projections suggest that an annual return of 29% moving forward will enable Bitcoin to hit his ambitious target.

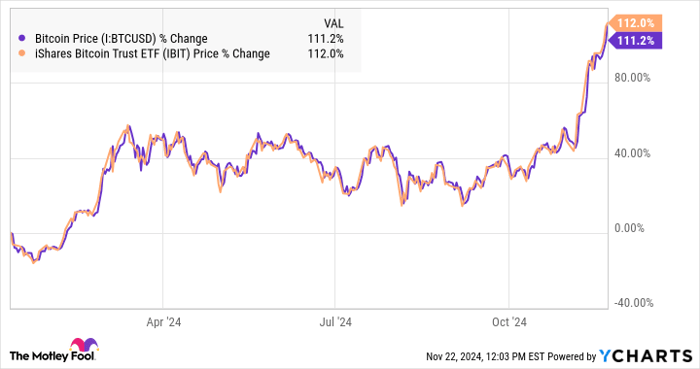

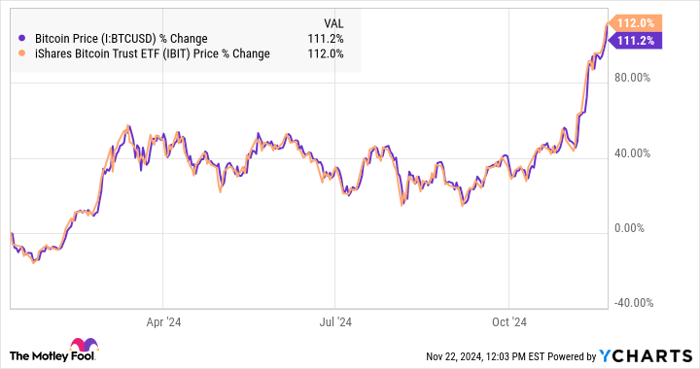

One way investors can gain exposure to Bitcoin is through the iShares Bitcoin Trust (NASDAQ: IBIT), an exchange-traded fund (ETF) that tracks actual Bitcoin prices. BlackRock, one of the largest asset managers globally, launched this fund earlier this year after the Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs.

The iShares Bitcoin Trust aims to reflect Bitcoin’s price movements by holding actual Bitcoin tokens in reserve. Each ETF share is directly supported by a portion of a Bitcoin, rigorously held in a custodial account. This structure has allowed iShares Bitcoin Trust to closely follow Bitcoin’s impressive returns throughout 2024.

Bitcoin Price data by YCharts

Investing in a Bitcoin ETF offers a way to bypass the complexities of buying and storing actual tokens, such as taxation and custody issues. While ETFs include small fees, necessary for managing the fund, the iShares Bitcoin Trust currently charges a fee of 0.12% on holdings until January 11, 2025, or until the fund reaches $5 billion in assets, after which the fee will increase to 0.25%.

Assessing Saylor’s Forecast

Nonetheless, Bitcoin is experiencing favorable conditions currently. Analysts believe the incoming Trump administration may adopt a supportive regulatory stance toward the crypto industry, which could significantly influence market dynamics. Removing the SEC’s staff accounting Bulletin-121, which complicates banks’ ability to protect crypto assets, is seen as crucial for this shift.

Furthermore, inflation concerns related to U.S. dollars could boost Bitcoin’s appeal as a hedge, as many investors increasingly view it as “digital gold.”

Saylor’s predictions regarding Bitcoin—and by extension, the iShares Bitcoin Trust—are ambitious. While a $13 million price point per Bitcoin is speculative, the cryptocurrency does appear to have potential for future growth. Investors may consider allocating a portion of their portfolios to Bitcoin as a long-term investment.

Should You Invest $1,000 in iShares Bitcoin Trust Now?

If you’re contemplating buying iShares Bitcoin Trust shares, take a moment to evaluate:

The Motley Fool Stock Advisor research team recently identified the 10 best stocks to buy right now—and iShares Bitcoin Trust was not included. The selected stocks are anticipated to yield strong returns in the coming years.

For example, when Nvidia made this list on April 15, 2005, an investment of $1,000 would have grown to approximately $869,885!*

Stock Advisor offers investors a straightforward roadmap for success, complete with portfolio building strategies, regular progress updates, and two new stock picks monthly. This service has more than quadrupled the returns of the S&P 500 since its inception in 2002.*

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024.

Bram Berkowitz has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.