Piper Sandler Lowers Sunrun Rating Amid Shift in Institutional Ownership

Fintel reports that on November 22, 2024, Piper Sandler downgraded their outlook for Sunrun (WBAG:RUN) from Overweight to Neutral.

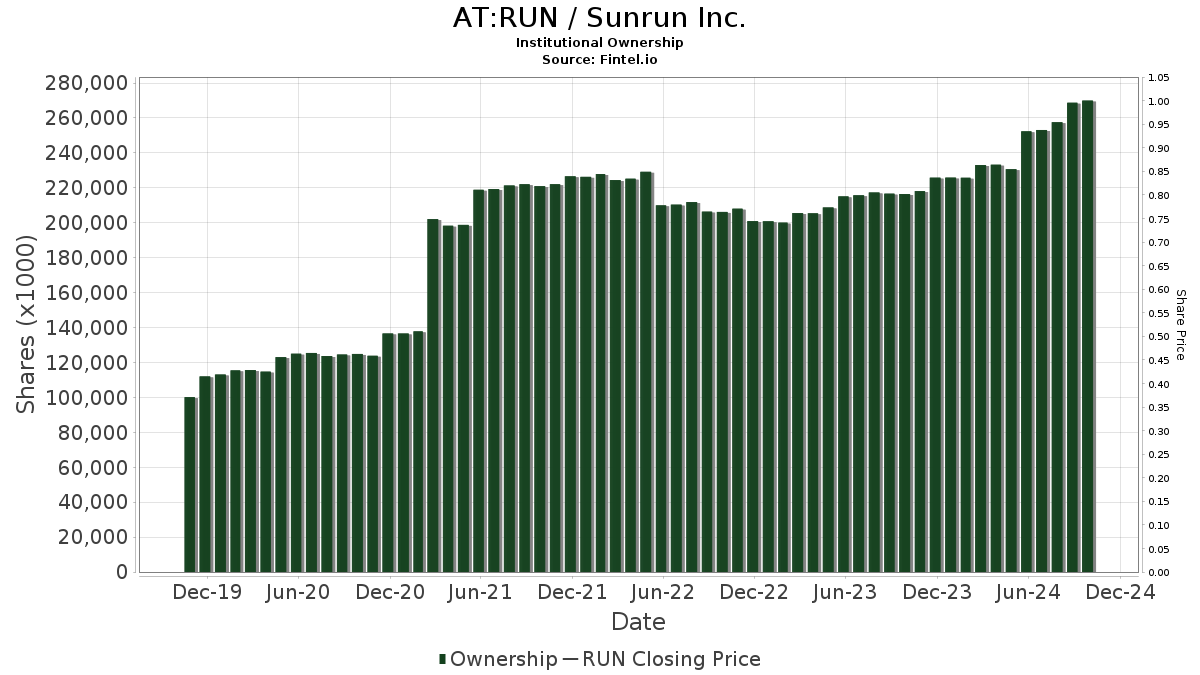

Current Institutional Sentiment

There are now 784 funds or institutions with stakes in Sunrun, marking an increase of 20 owners, or 2.62%, in the last quarter. The average portfolio weight for all funds invested in RUN is 0.22%, which reflects a 12.72% uptick. Over the past three months, the total shares held by institutions rose by 3.85%, amounting to 288,702K shares.

Actions from Major Shareholders

BlackRock has increased its holdings to 42,261K shares, representing 18.84% ownership. This is an increase from their previous 41,400K shares, which translates to a rise of 2.04%. Over the last quarter, BlackRock boosted its portfolio allocation in RUN by 44.17%.

Meanwhile, IJR – iShares Core S&P Small-Cap ETF now holds 14,335K shares, representing 6.39% ownership, a significant increase from having no shares reported previously, indicating a 100.00% rise.

In contrast, Orbis Allan Gray reduced its stake to 11,247K shares, or 5.01% ownership, down from 13,896K shares, marking a decrease of 23.55%. This represents a 31.44% reduction in their portfolio allocation in RUN over the last quarter.

Grantham, Mayo, Van Otterloo & Co. also pulled back, decreasing its holdings to 11,119K shares, or 4.96% ownership, down from 16,311K shares, a 46.70% decrease in shares owned. Their portfolio allocation in RUN was trimmed by 3.67% in the last quarter.

Conversely, Greenvale Capital LLP’s holdings decreased from 11,750K shares to 8,983K shares, representing a drop of 30.80%. However, they still increased their portfolio allocation in RUN by 5.85% during the last quarter.

Fintel is a leading research platform utilized by individual investors, traders, financial advisors, and small hedge funds.

Our global data encompasses fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, and unusual options trades. Exclusive stock picks are powered by advanced, backtested quantitative models to enhance potential profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.