Kohl’s Shares Slide Amid Leadership Changes and Earnings Miss

Investors React to Bearish News

On Tuesday, shares of Kohl’s Corporation KSS fell significantly, suggesting a potential new downtrend is forming.

Our technical analysts have designated Kohl’s as the Stock of the Day due to recent developments.

The reasons are clear: the company reported disappointing earnings and announced that CEO Tom Kingsbury will resign in January.

Read Also: Cathie Wood-Led Ark Invest’s Latest Portfolio Maneuver: Dumps Tesla And Palantir Shares, Buys Amazon And AMD Stock

Kohl’s reported a Q3 earnings of 20 cents per share, falling short of the anticipated 28 cents.

Revenue also missed expectations, with sales down 8.8% compared to last year. The $3.507 billion reported was below the estimates of $3.638 billion.

The drop in operating margin is another concern; it shrank by 120 basis points to 2.7%.

Understanding operating margin is crucial. This metric measures how much profit a company earns on its sales after all expenses are considered. Expanding margins signal increased profitability, while contracting margins, like Kohl’s experience, indicate decreased efficiency.

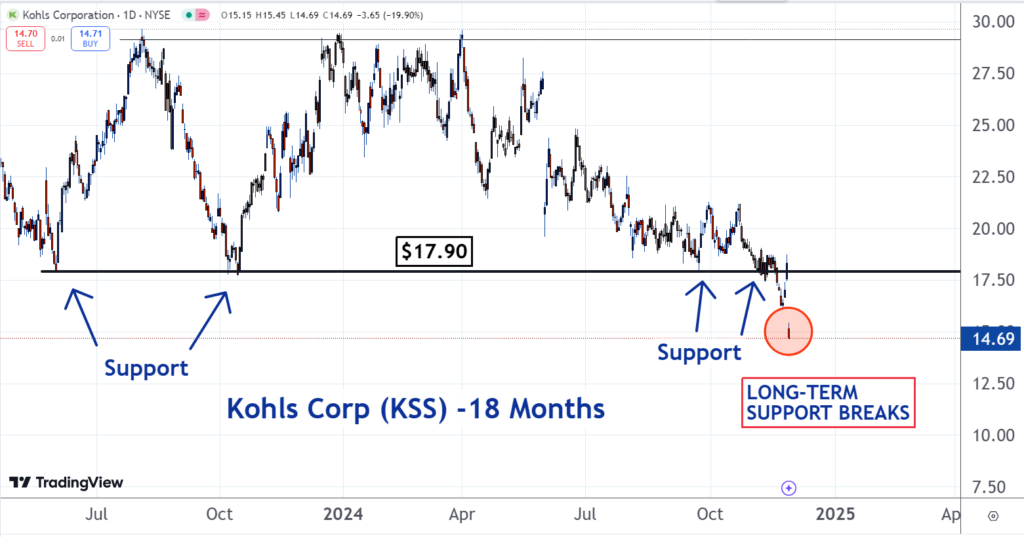

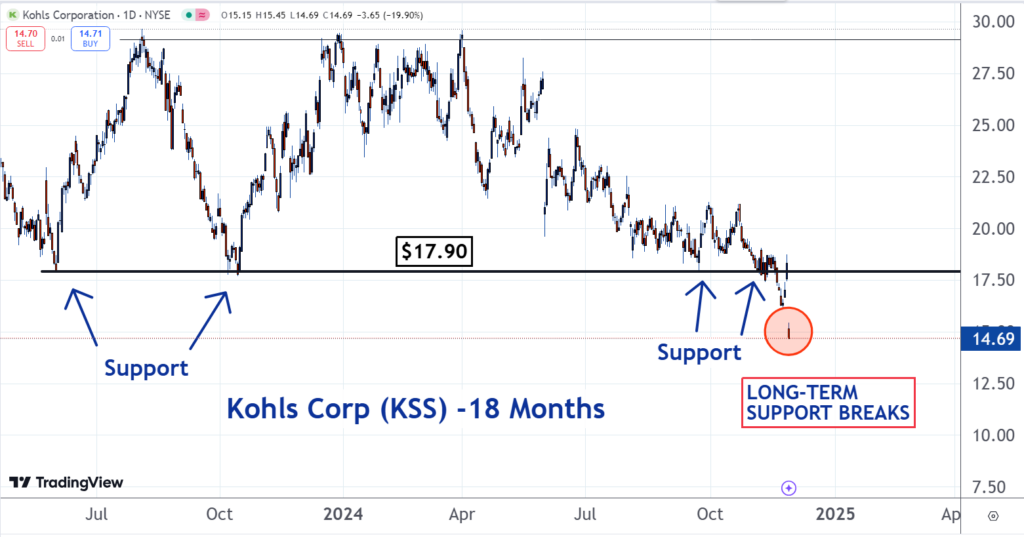

Based on technical analysis, the outlook for Kohl’s appears negative. The stock has broken below a long-term support level of $17.90.

A support level can remain significant for long periods, a phenomenon sometimes referred to as “market memory.” For Kohl’s, this support took shape in May 2023.

Support represents a group of investors willing to purchase shares around the same price, which often halts selloffs due to sufficient demand.

However, when support is breached—as seen with Kohl’s—it indicates that the buyers who once propped up the stock have exited the market. This can lead to a situation where sellers must reduce prices to attract new buyers, potentially initiating a downtrend.

Kohl’s may be facing this very scenario.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs