Wall Street Climbs Higher Despite Trade Concerns

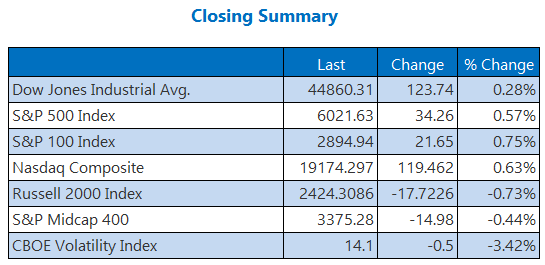

Even with new tariff threats from President-elect Donald Trump, Wall Street remains on its upward path. All three major indexes recorded impressive daily gains, with the Dow reaching a new record high and achieving its fifth consecutive increase. Meanwhile, the S&P 500 also set a fresh record and logged its seventh straight win. The Federal Reserve played a crucial role in calming fears related to Trump’s proposed high tariffs on goods from Mexico, Canada, and China. In recent meeting minutes, the central bank indicated it expects to continue raising interest rates, but will do so “gradually.”

Keep reading for more insights on today’s market trends, including:

Key Market Highlights

- A Senate report revealed that major U.S. airlines earned over $12 billion in seating fees between 2018 and 2023. (CNBC)

- Exchange-traded funds (ETFs) focusing on Canadian, Mexican, and Chinese stocks declined following Trump’s new tariff plans. (MarketWatch)

- An overview of how two retail companies fared after releasing their earnings reports.

- Kohl’s stock struggled, experiencing a notably bad day.

- Examining Semtech’s strong performance and future outlook.

Oil and Gold Prices Review amidst Global Tensions

On Tuesday, oil futures climbed higher following reports suggesting that Israel and Hezbollah may be nearing a ceasefire. The front-month January-dated West Texas Intermediate (WTI) crude saw an increase of 56 cents, or 0.8%, closing at $69.50 per barrel.

Meanwhile, ongoing geopolitical tensions have kept gold prices relatively stable. Gold for December delivery was last reported at approximately $2,621.30 per ounce, reflecting a slight uptick of 0.1%.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.