With the holiday shopping season on the horizon, consumers are gearing up for their purchases. Companies like Amazon AMZN and Walmart WMT are poised to gain significantly from this year’s shopping frenzy, largely due to their strong digital platforms.

Let’s delve deeper into each company’s performance.

Amazon Optimistic About Holiday Sales

Amazon’s recent quarterly report showed impressive results, surpassing predictions for both earnings per share (EPS) and sales. EPS soared by 70% compared to last year, while sales reached $60 billion, marking an 11% increase from the previous year.

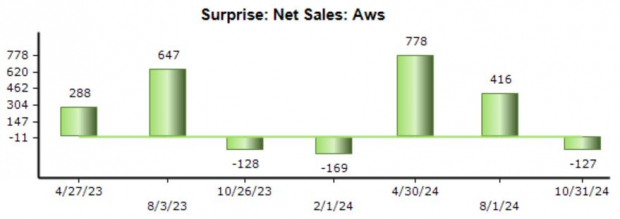

A notable aspect of these results was Amazon Web Services (AWS), which saw a 19% year-over-year rise in sales, totaling $27.5 billion. This growth mirrored the previous quarter’s results but slightly missed analysts’ expectations.

Image Source: Zacks Investment Research

Looking ahead, Amazon is optimistic about the upcoming holiday season, promoting its largest-ever Prime Big Deal Days alongside a newly launched Kindle lineup that has exceeded early projections.

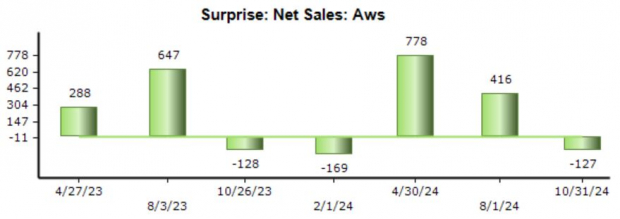

Online sales also exceeded expectations, hitting $61.4 billion, a 3.3% increase, breaking a streak of disappointing results in this area.

Image Source: Zacks Investment Research

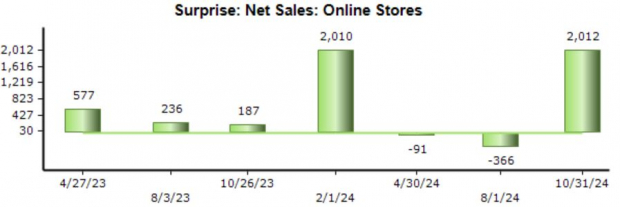

The company’s earnings outlook is promising, reflected in its favorable Zacks Rank #2 (Buy), supported by recent positive earnings estimate changes.

Image Source: Zacks Investment Research

Walmart’s Strong Digital Performance

Walmart’s recent quarterly results delighted investors, highlighting the effectiveness of its digital strategies. Adjusted EPS rose by 14%, and sales increased by 5.5%, continuing the company’s growth pattern.

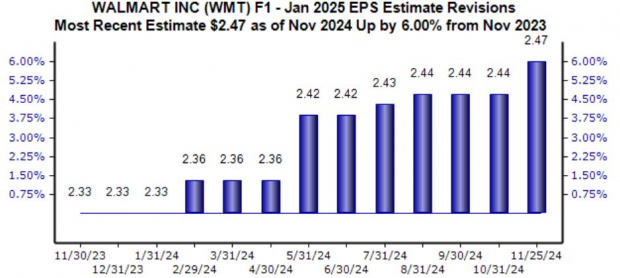

Analysts are now optimistic about Walmart’s future, with the $2.47 Zacks Consensus EPS estimate rising by 6% year-over-year, indicating a potential 12% growth for the current year.

Image Source: Zacks Investment Research

Importantly, global eCommerce sales surged by 27%, with all segments showing higher penetration, reinforcing Walmart’s growing digital momentum. Innovations like store-fulfilled pickup and delivery have attracted more consumers to the service.

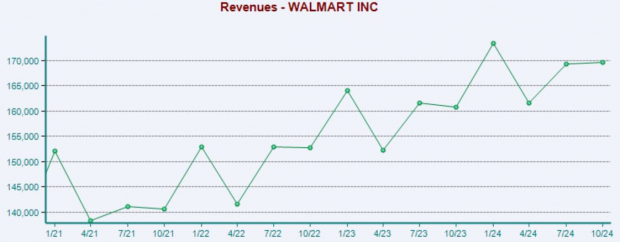

Below is a chart detailing the company’s quarterly sales performance.

Image Source: Zacks Investment Research

Following the report, Walmart raised its fiscal 2025 net sales and operating income projections, contributing to a positive reaction in its stock price.

Conclusion

The holiday shopping season is fast approaching, and companies are ready to leverage their digital and in-store strategies to attract consumers. Amazon AMZN and Walmart WMT are well-positioned to benefit from this surge in holiday spending.

Throughout the years, Amazon has solidified its presence as a leader in e-commerce, thriving during holidays. Meanwhile, Walmart has rapidly enhanced its digital capabilities, also seeing growth as shoppers shift towards more cost-effective options.

5 Stocks with Huge Potential

These stocks were selected by a Zacks expert as the top candidates to potentially gain +100% or more in 2024. While not every choice can be a success, past recommendations have seen increases of +143.0%, +175.9%, +498.3%, and +673.0%.

The majority of stocks featured in this report remain under the radar of Wall Street, creating a prime opportunity to invest early.

Today, Discover These 5 Promising Stocks >>

Want to stay updated on the latest insights from Zacks Investment Research? Download the report on 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.