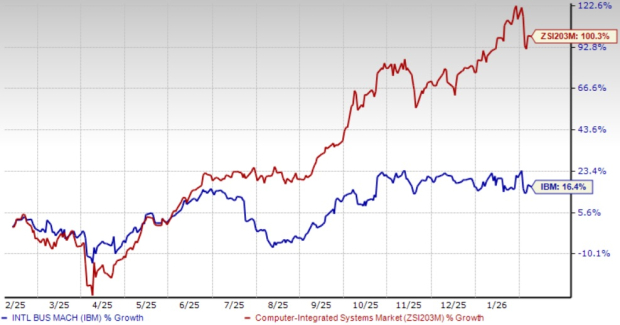

Maximizing Returns: Exploring Covered Call Strategies with Wesco International

For Wesco International, Inc. (Symbol: WCC) shareholders seeking higher income, an option exists: selling an August 2025 covered call at the $240 strike price could yield significant returns.

Investors can earn a premium based on the current $16.80 bid, which translates to an annualized return of 11.3% based on the current stock price. When combined with the stock’s existing 0.8% annualized dividend yield, the total possible return could reach 12.1% if the stock remains below the strike price. It’s important to note that any rise above $240 would mean giving up that upside potential. However, for WCC shares to be called away, they would need to increase by 15.4%, making the overall return 23.5% when factoring in dividends prior to the call.

Understanding dividend predictability is crucial since they often fluctuate with a company’s earnings. Analyzing Wesco’s dividend history can provide insight into whether the latest yield of 0.8% will be stable. The following chart illustrates WCC’s dividend performance:

The accompanying chart tracks WCC’s trading history over the past year, showcasing the $240 strike in red:

These charts, along with knowledge of historical volatility, can help in assessing whether it’s advantageous to sell a covered call at the $240 strike. Notably, Wesco International has a trailing twelve month volatility of 52%, calculated from the last 252 closing prices and the current price of $208.44. For additional call options across various expiration dates, the WCC Stock Options page at StockOptionsChannel.com is worth exploring.

In mid-afternoon trading on Wednesday, S&P 500 component put volume stood at 1.06 million contracts while call volume reached 1.82 million, resulting in a put:call ratio of 0.58 for the day. This indicates a preference for calls, as the long-term median put:call ratio is 0.65. Traders appear more inclined toward call options during this session.

![]() Top YieldBoost Calls of Stocks Conducting Buybacks »

Top YieldBoost Calls of Stocks Conducting Buybacks »

Additional Resources:

- PAMT Videos

- Funds Holding SHCR

- FUD Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.