New Options for United Airlines: What Investors Need to Know

Today, investors in United Airlines Holdings Inc (Symbol: UAL) observed the start of trading for new options set to expire in January 2025. At Stock Options Channel, our YieldBoost formula has highlighted two contracts that stand out: one put and one call.

Put Option at a Discount

The put contract for the $86.00 strike price carries a current bid of $1.64. By selling to open this put, an investor agrees to buy UAL shares at $86.00 but collects the premium, lowering the effective cost basis to $84.36 (excluding broker fees). For those looking to buy UAL shares at today’s market price of $95.72, this option presents a compelling alternative.

This $86.00 strike price offers about a 10% discount relative to the stock’s current trading price. There’s a 79% chance that this put option could expire worthless, based on current analysis. If this occurs, the premium collected could yield a 1.91% return on the cash commitment, which annualizes to approximately 15.82%. At Stock Options Channel, we refer to this potential return as YieldBoost.

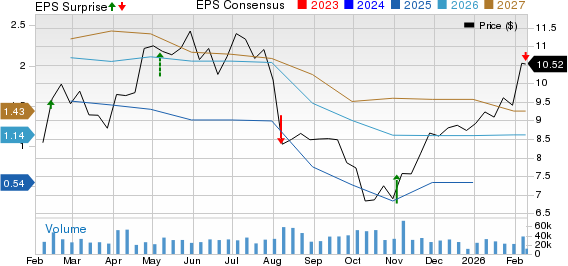

Below is a chart displaying the past twelve months of trading activity for United Airlines, marking the $86.00 strike location:

Call Option Insights

Looking at the call side, the option at the $97.00 strike price has a current bid of $5.20. Should an investor purchase UAL shares at $95.72 each and sell this call as a covered call, they will commit to sell the stock at $97.00. This strategy yields a total return (excluding dividends) of 6.77% if the shares are called away by the January 2025 expiration. However, if UAL’s stock prices rise significantly, potential gains could be left unrealized.

The $97.00 strike price reflects a 1% premium over the current trading price. There is a 49% chance that this call contract might also expire worthless, allowing the investor to retain both the shares and the premium they collected. In this case, the premium represents an additional return of 5.43%, which annualizes to 45.07%—another example of our YieldBoost.

Here’s a chart of UAL’s trading history over the last twelve months, with the $97.00 strike highlighted:

For the put option, the implied volatility is at 47%, while for the call option, it is at 45%. The calculated trailing twelve-month volatility, based on the last 252 closing values and today’s price of $95.72, stands at 44%. Interested in more options insights? Visit StockOptionsChannel.com for further ideas.

![]() Top YieldBoost Calls of Stocks Conducting Buybacks »

Top YieldBoost Calls of Stocks Conducting Buybacks »

Other Resources:

- Financial Stocks Hedge Funds Are Selling

- PSQ Options Chain

- WASH Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.