PPG Industries Reaches Milestone with Marine Coating Innovation

50th Electrostatic Application Order Completed

PPG Industries Inc. has announced that it has received the 50th order for its electrostatic application of marine fouling control coatings. The order involves the application of the PPG NEXEON 810 antifouling coating on the VLCC SIDR, a 336-meter oil tanker operated by Bahri Ship Management. This project will take place at the Asyad Drydock Company shipyard in Oman.

New Technology in Coatings

With years of expertise in aerospace and automotive sectors, PPG introduced electrostatic coatings to the shipping industry just over a year ago. This method boasts a higher transfer efficiency compared to traditional airless spraying, leading to significant environmental improvements by minimizing overspray and waste. PPG has specially designed its hull coatings for this innovative application process.

Responding to Environmental Regulations

In light of stricter environmental regulations, ship owners and shipyards are keen to explore sustainable solutions. These include low-friction hull coatings that lower greenhouse gas emissions and eco-friendly application methods. Electrostatic applications are rapidly gaining popularity among major shipping firms and shipyards in Europe, Singapore, and China as they adapt to these new standards.

Advantages of Electrostatic Applications

Traditional fouling control coatings are often not compatible with electrostatic techniques. However, PPG’s formulation of NEXEON antifouling and PPG SIGMAGLIDE fouling release coatings allows for successful electrostatic spraying. This technique uses electrically charged paint particles that are directed towards the ship’s grounded surface, creating an even distribution and a durable, ultra-smooth coating.

Operational Benefits for Shipyards

Electrostatic application minimizes overspray, resulting in a cleaner working environment for applicators compared to airless spraying. This efficiency means shipyards spend less time masking vessels and cleaning docks, ultimately saving both time and money.

Performance Overview

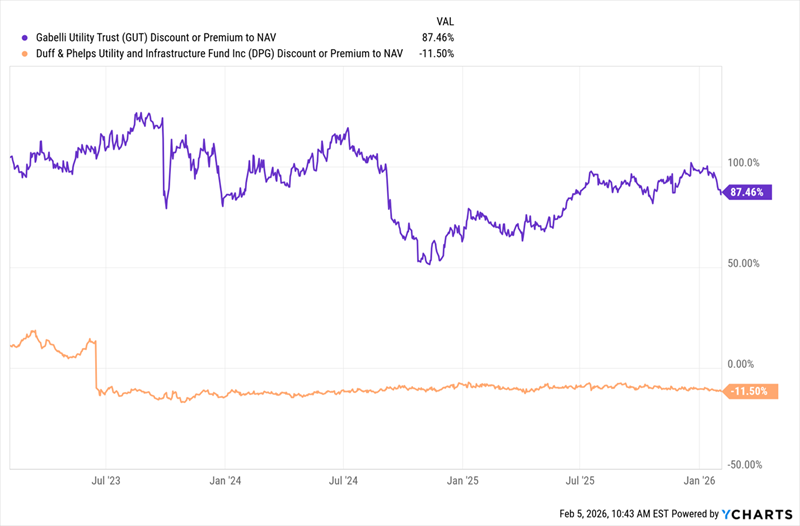

Despite these advancements, PPG Industries shares have experienced an 11.5% decline over the past year, while the industry overall dropped by 7.9% during the same timeframe.

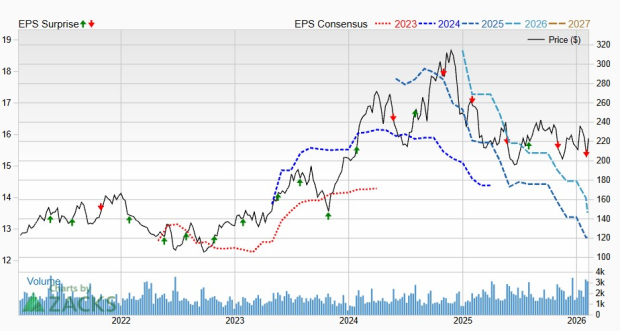

PPG Industries, Inc.: Price and Consensus Overview

PPG Industries, Inc. price-consensus-chart | PPG Industries, Inc. Quote

Stock Ranking and Recommendations

Currently, PPG holds a Zacks Rank #4 (Sell).

In the basic materials sector, stocks with better rankings include Carpenter Technology Corporation (CRS), DuPont de Nemours, Inc. (DD), and CF Industries Inc. (CF).

Carpenter Technology, which has a Zacks Rank #1 (Strong Buy), has exceeded the Zacks Consensus Estimate in each of the last four quarters, achieving an average earnings surprise of 14.1%. The company has seen its stock price soar by 160% over the past year.

The Zacks Consensus Estimate for DuPont’s current-year earnings is at $3.88 per share, reflecting a year-over-year increase of 11.5%. With a Zacks Rank #2 (Buy), DuPont has beaten consensus estimates consistently, boasting an average earnings surprise of 12.9% and a share price jump of approximately 16.9% in the past year.

CF Industries holds a Zacks Rank #1 as well, with the current-year earnings estimate at $6.32 per share. The company has achieved two earnings surprises in the last four quarters, averaging 10.3%. Over the past year, CF’s stock has risen around 18.3%.

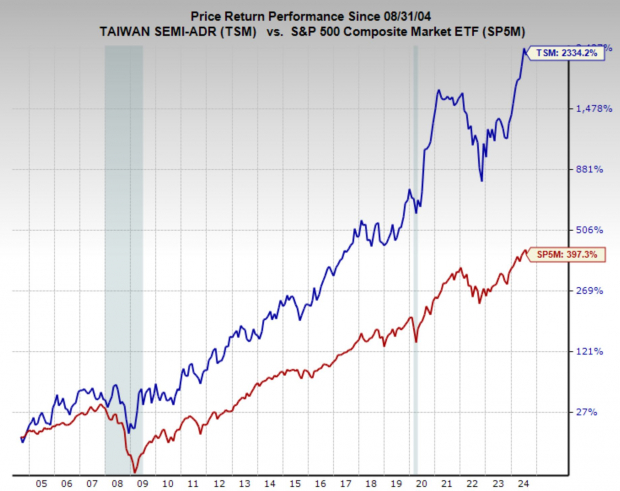

Discover: 5 Stocks to Buy Amid Infrastructure Investment Surge

With trillions of dollars allocated for America’s infrastructure repair and upgrades, investment will extend beyond roads and bridges to include AI data centers and renewable energy sources.

This report highlights 5 surprising stocks expected to benefit from this ongoing spending spree.

Download the guide on how to profit from the trillion-dollar infrastructure boom, completely free today.

Interested in the latest recommendations from Zacks Investment Research? You can also access “5 Stocks Set to Double” free of charge.

PPG Industries, Inc. (PPG): Free Stock Analysis Report

DuPont de Nemours, Inc. (DD): Free Stock Analysis Report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Carpenter Technology Corporation (CRS): Free Stock Analysis Report

For the full article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.