Dominion Energy’s Bold Move Towards a Sustainable Future

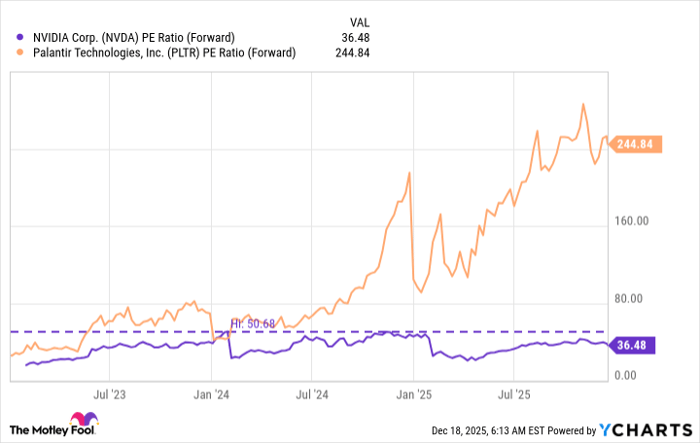

Dominion Energy’s D shares have surged 31.9% year-to-date, outperforming the Zacks Utility – Electric Power industry’s growth of 24.1%. In this timeframe, the company has also excelled compared to the broader Zacks Utilities sector and the Zacks S&P 500 Composite.

Stay updated with all quarterly releases: See Zacks Earnings Calendar.

Dominion Energy has announced a significant investment plan of $43 billion through 2029. This initiative aims to enhance its infrastructure and minimize service outages. Additionally, the company is committed to reducing emissions in electricity production, with a goal of achieving net-zero carbon and methane emissions from its electric generation and natural gas infrastructure by 2050.

Update on Dominion Energy’s Stock Performance

Image Source: Zacks Investment Research

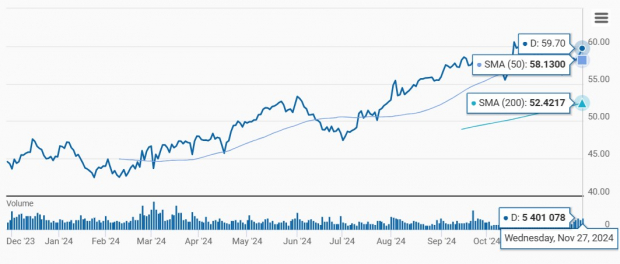

The chart below shows that D shares are currently trading above the 50-day and 200-day simple moving averages, indicating a positive trend.

Image Source: Zacks Investment Research

Positive Developments for Dominion Energy

Dominion Energy is strategically realigning its portfolio to focus on regulated assets, shown by its investments in regulated infrastructure that will strengthen its operations over time. To streamline its focus, the company has divested certain merchant generation facilities and exited the electric retail energy marketing business.

Recently, Dominion Energy entered a Memorandum of Understanding with Amazon AMZN. This collaboration aims to explore new development structures for enhancing Small Modular Reactor (“SMR”) nuclear developments in Virginia, which promise to deliver clean energy to customers sustainably.

With a well-defined long-term capital expenditure plan, the company aims to invest $43 billion to bolster its infrastructure. Its long-term goals include the addition of battery storage, solar, hydro, and wind projects by 2036, intending to increase renewable energy capacity by over 15% annually for the next 15 years.

Dominion Energy is witnessing growth in commercial load, driven mainly by increasing demand from data centers. The customer growth from its Virginia and South Carolina service areas further enhances the demand for its services. This year, the company connected 14 new data centers by September and plans to link an additional 16 in 2024.

To improve its electric infrastructure, Dominion Energy is installing smart meters and grid devices, as well as enhancing customer services through its information platform. The strategic undergrounding of 4,000 miles of distribution lines is also underway, aimed at increasing operational resilience and efficiency to meet a growing customer base. Additionally, the deployment of electricity storage devices will support its renewable initiatives.

Positive Earnings Forecast for Dominion Energy

Dominion Energy expects its 2024 EPS to be in a range of $2.68-$2.83, an increase from $1.99 in 2023. The Zacks Consensus Estimate for D’s earnings per share for 2024 and 2025 reflects expected year-over-year growth of 38.7% and 22.1%, respectively. This upward trend in earnings estimates suggests growing confidence among analysts regarding the stock’s performance.

Image Source: Zacks Investment Research

Dominion Energy’s Commitment to Shareholder Value

Dividends have been a long-standing component of Dominion Energy’s strategy, with a current annual dividend of $2.67. Its dividend yield stands at 4.52%, exceeding the industry average of 3.18%. For more details, check D’s dividend history here.

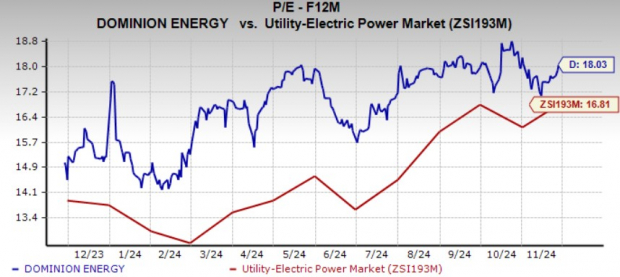

Current Market Valuation of Dominion Energy

Presently, Dominion Energy is valued at a premium compared to its peers on a forward 12-month P/E ratio. Given this high valuation, maintaining shares in the stock might be prudent until a more favorable entry point emerges.

Image Source: Zacks Investment Research

Comparative Analysis of D Stock Returns

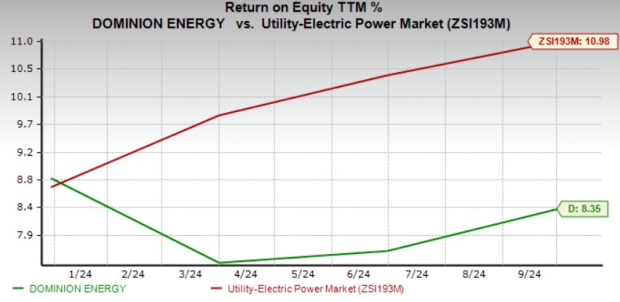

Dominion Energy’s trailing 12-month return on equity of 8.35% is below the industry average of 10.98%. This measure reflects how efficiently companies utilize their shareholders’ funds. Currently, D’s return on equity indicates a less effective use of funds compared to its competitors.

Image Source: Zacks Investment Research

Conclusion

Dominion Energy’s focused investments in clean energy production and infrastructure enhancements are set to provide dependable service to its customers. The increasing demand for clean energy is a significant advantage for the company.

However, its high valuation and lower return on equity relative to the industry warrant caution. Current shareholders of this Zacks Rank #3 (Hold) stock may wish to retain their holdings and benefit from dividends. New investors should consider waiting for a more appropriate entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds are dedicated to repairing and upgrading America’s infrastructure. This influx is not only aimed at roads and bridges but will also support AI data centers, renewable energy solutions, and more.

Discover 5 surprising stocks positioned to gain the most from this upcoming spending wave.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.

Interested in the latest recommendations from Zacks Investment Research? Download your free report on 5 Stocks Set to Double.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Dominion Energy Inc. (D): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.