Comparing Financial Titans: Coca-Cola vs. Kraft Heinz

When considering the world of consumer goods, Coca-Cola (NYSE: KO) and Kraft Heinz (NASDAQ: KHC) stand out as two of the most recognizable names. These companies not only represent stable, dividend-paying investments but are also significant holdings within Warren Buffett’s Berkshire Hathaway, which claims 9.3% and 26.9% stakes in each, respectively.

Despite falling behind the market benchmark, the S&P 500, in recent years, both Coca-Cola and Kraft Heinz have provided a sense of stability for investors. Let’s delve into the financials of these two industry leaders to determine which stock presents a better buying opportunity today.

Examining Financial Performance

To start, it’s essential to highlight that Coca-Cola dwarfs Kraft Heinz in size, boasting a market capitalization of $278 billion compared to Kraft Heinz’s $39 billion.

In its latest quarterly report, Coca-Cola posted revenues of $11.9 billion, marking a 0.8% decline compared to the same quarter last year. CEO James Quincey identified weak performance in China as a contributing factor. Yet, he remains optimistic, stating during a recent earnings call, “We see light at the end of the tunnel and long-term investment opportunities for the China business.”

Meanwhile, Kraft Heinz reported $6.4 billion in sales for Q3 2024, down 2.8% year-over-year. Management attributed this decline primarily to shifts in consumer behavior amidst economic uncertainty, particularly affecting its Lunchables brand.

Looking at profitability, Coca-Cola generated nearly $2.9 billion in net income for the quarter, a drop of 7.6% from a year ago. However, the company’s free cash flow registered a loss of $1.7 billion due to an ongoing tax dispute with the IRS dating back to 2007, leading to a $6 billion escrow deposit in the quarter.

On the other hand, Kraft Heinz experienced a net loss of $290 million compared to a net income of $262 million the previous year, largely attributed to a $1.4 billion impairment charge related to its Lunchables brand. However, excluding this charge, the company’s free cash flow stood at $849 million, reflecting a 24.3% year-over-year decline.

Dividend Strategies of Both Companies

Coca-Cola and Kraft Heinz, being established companies, prioritize profit distribution through dividends and share repurchases. Currently, Coca-Cola features a quarterly dividend of $0.485 per share, providing a 3% yield. As a respected member of the Dividend Kings club, it has maintained a streak of 62 years of increasing dividends.

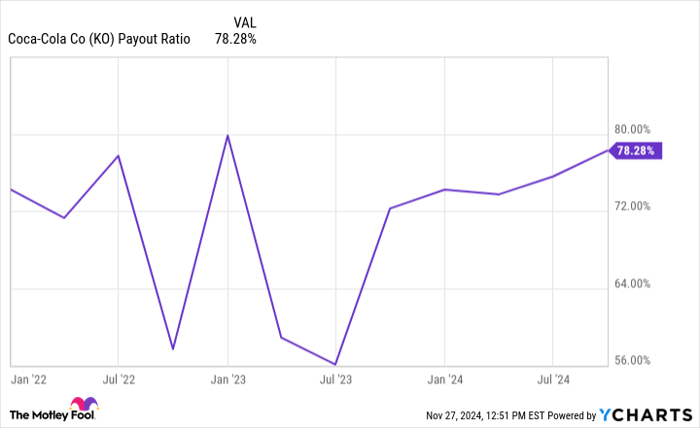

In assessing dividend investments, it’s important to analyze the payout ratio, indicating what portion of earnings is distributed. Coca-Cola’s payout ratio is 78%, though it has kept this under 75% in recent years, suggesting that its dividends are likely stable.

KO Payout Ratio data by YCharts

On the contrary, Kraft Heinz’s quarterly payout stands at $0.40 per share, equating to a higher yield of 5%. The company has regularly dispensed dividends since 2013 but has not increased its payout in the past five years.

The current payout ratio of Kraft Heinz is concerning at 142%. This figure, however, is skewed by a $2.3 billion write-off in 2024 tied to goodwill and intangible assets, especially impacting its Lunchables brand. When factoring this out, the adjusted payout ratio based on projected earnings is a more acceptable 52% to 53%.

Both companies engage in share repurchase programs to bolster shareholder value. Over the past three years, Coca-Cola has repurchased only 0.4% of its outstanding shares, while Kraft Heinz has cut its share count by 1.3%.

KO Shares Outstanding data by YCharts

Which Stock Is the Best Buy Today?

Assessing a stock’s valuation is crucial before making any purchase. A useful metric is the forward price-to-earnings (P/E) ratio, which evaluates a stock’s price relative to expected earnings in the next year, facilitating comparisons to historical averages.

Currently, Coca-Cola has a forward P/E ratio of 22.7, while Kraft Heinz is significantly lower at 10.7. Both stocks are presently trading beneath their five-year median forward P/E, which indicates a potentially fair to undervalued status.

KO PE Ratio (Forward) data by YCharts

In summary, Coca-Cola and Kraft Heinz exhibit similarities despite their considerable market cap differences and ongoing sales challenges linked to evolving consumer preferences. Neither company is expected to surpass the overall market in the near future, although both can appeal to income-seeking investors through attractive dividends.

If you’re deciding between these two stocks, Coca-Cola may be the more favorable choice due to its relatively better sales performance and a proven history of annual dividend increases.

Explore a Unique Investment Opportunity

Have you ever feared missing out on top-performing stocks? If so, stay tuned.

Occasionally, our analysts issue a “Double Down” stock recommendation for companies they believe are set for significant growth. If you’re feeling that you missed your chance to invest, the present might be your best shot before we see drastic changes. Here are some notable examples:

- Nvidia: An investment of $1,000 made when we doubled down in 2009 would yield $358,460!*

- Apple: A $1,000 investment when we doubled down in 2008 would be worth $44,946!*

- Netflix: If you had invested $1,000 when we doubled down in 2004, it would amount to $478,249!*

We are currently presenting “Double Down” opportunities for three remarkable companies, and this chance may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

Collin Brantmeyer has positions in Berkshire Hathaway. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Kraft Heinz. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.