Analysts Predict Strong Gains for SPDR Portfolio S&P 500 Growth ETF

In our analysis of exchange-traded funds (ETFs) at ETF Channel, we examined the trading prices of ETF holdings and compared them to average analyst 12-month target prices. For the SPDR Portfolio S&P 500 Growth ETF (Symbol: SPYG), the calculated implied analyst target price is $96.66 per unit.

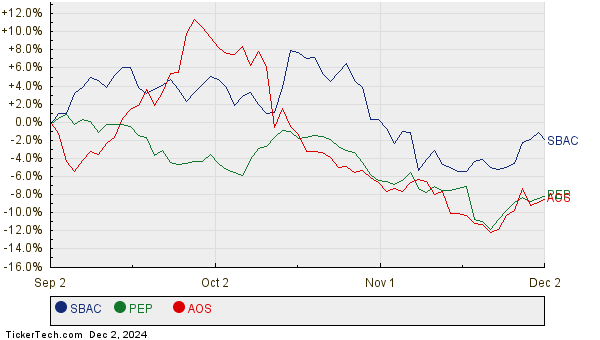

Currently, SPYG shares trade around $87.36 each, suggesting that analysts anticipate a potential Upside of 10.65%. Among SPYG’s top holdings with impressive upside to target prices are SBA Communications Corp (Symbol: SBAC), PepsiCo Inc (Symbol: PEP), and Smith (A O) Corp (Symbol: AOS). SBAC, recently priced at $226.25 per share, has a target price of $258.18, indicating a 14.11% potential increase. For PEP, with a recent price of $163.45, the target is $183.28, representing a 12.13% upside. Analysts also project AOS’s price to rise to $82.88, which is 11.26% above its current price of $74.49. Below is a chart depicting the twelve-month price movements of these stocks:

Here’s a summary of the current analyst target prices for these selected companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Portfolio S&P 500 Growth ETF | SPYG | $87.36 | $96.66 | 10.65% |

| SBA COMMUNICATIONS CORP | SBAC | $226.25 | $258.18 | 14.11% |

| PepsiCo Inc | PEP | $163.45 | $183.28 | 12.13% |

| Smith (A O) Corp | AOS | $74.49 | $82.88 | 11.26% |

Are analysts being overly optimistic in their targets, or do they have valid reasons backed by current company data and industry trends? Price targets exceeding the current stock price can reflect positive expectations but may also lead to downward revisions if they no longer align with market realities. Investors may want to conduct further research to determine the reliability of these forecasts.

![]() Discover 10 ETFs With Most Upside To Analyst Targets »

Discover 10 ETFs With Most Upside To Analyst Targets »

Additional Resources:

• Dividend Stock Screener

• AWF Historical Stock Prices

• NRGX Insider Buying

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.