SentinelOne Eyes Promising Q3 Results Amid Strong Market Trends

SentinelOne S is preparing to announce its results for the third quarter of fiscal 2025 on December 4, 2024.

The company anticipates total revenues of $209.5 million, reflecting a 28% increase year-over-year. The Zacks Consensus Estimate for revenue stands at $209.56 million, implying a 27.65% growth compared to last year’s quarter.

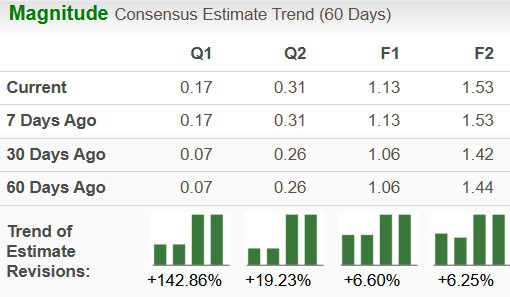

Over the last 30 days, the consensus mark for earnings has stayed steady at 1 cent per share, which is an improvement from a loss of 3 cents in the same quarter last year.

Analyzing SentinelOne’s Historical Earnings Performance

SentinelOne, Inc. price-eps-surprise | SentinelOne, Inc. Quote

Over the past four quarters, SentinelOne has consistently beaten the Zacks Consensus Estimate, achieving an average earnings surprise of 103.13%.

Factors Influencing Third-Quarter Results

The upcoming quarterly results are likely bolstered by the growing adoption of the Singularity platform, which features solutions for endpoint security, cloud security, and data lakes.

The company’s efforts to expand into new markets, such as Singularity Cloud and Singularity Data Lake, might have also positively impacted performance for this quarter.

Continued investments in security measures, data management, and artificial intelligence are anticipated to support growth during this fiscal third quarter.

New advancements, including Purple AI — designed to improve the Singularity platform’s speed and effectiveness — are likely to contribute to revenue growth and user expansion this quarter.

SentinelOne is expected to maintain its momentum with large enterprise clients. The number of customers with over $100,000 in Annual Recurring Revenue (ARR) grew by 24% year over year, rising to 1,233 in the second quarter. Growth in ARR per customer also expanded, primarily driven by strong platform adoption among larger enterprises.

The company foresees continued benefits from its advanced AI-powered security solutions, particularly through its cloud and data platforms. Notably, growth in its CNAPP (Cloud-Native Application Protection Platform) and SIEM solutions is significant.

International revenues, which climbed 36% in the second quarter, are expected to remain a vital growth factor in the upcoming report as well.

Expanding Client Base Drives Growth

SentinelOne’s collaboration with major partners like Alphabet GOOGL’s Google Cloud, Amazon AMZN’s AWS, and Lenovo LNVGY is likely to have fueled growth in the third fiscal quarter.

In the second quarter, SentinelOne and Google Cloud strengthened their partnership by integrating AI-driven endpoint protection with Google’s threat intelligence, enhancing enterprise cyber defense capabilities. This collaboration likely contributed to quarterly performance.

In October, SentinelOne expanded its partnership with Amazon Web Services, integrating generative AI into its Purple AI cybersecurity platform, pushing broader engagement of its Singularity Platform on the AWS Marketplace.

A multi-year partnership with Lenovo was also announced in September, aiming to embed SentinelOne’s AI-powered Singularity Platform into Lenovo hardware, improving endpoint security and launching a new Managed Detection and Response service.

Despite these promising factors, ongoing macroeconomic uncertainties and geopolitical tensions could temper some of SentinelOne’s revenue growth this quarter.

Currently, SentinelOne carries a Zacks Rank of #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the Spotlight: Solar Stocks on the Rise

The solar sector is poised for a rebound as technology firms and economies pivot away from fossil fuels amidst the growing demand for AI.

Analysts project that trillions of dollars will flow into clean energy in the upcoming years, with solar energy expected to make up 80% of this renewable expansion. This trend represents a significant opportunity to invest wisely for immediate and long-term gains.

Check out Zacks’ top recommendations for solar stocks at no cost.

Stay updated with Zacks Investment Research’s latest recommendations; you can download 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

SentinelOne, Inc. (S): Free Stock Analysis Report

Lenovo Group Ltd. (LNVGY): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.