Will BigBear.ai Follow in Palantir’s Successful Footsteps?

Palantir Technologies is enjoying a remarkable year, with a stock increase of 285% so far, driven by strong growth and growing profits. Investors are optimistic about this artificial intelligence (AI) company’s global expansion potential.

While Palantir shines, investors might also explore other companies innovating in AI. BigBear.ai (NYSE: BBAI) is a smaller tech company developing various AI applications with significant promise.

Could BigBear.ai emerge as the next Palantir? Here’s a deeper look.

Image source: Getty Images.

Comparing the Titans: BigBear.ai vs. Palantir

BigBear.ai has a market cap of $550 million, dwarfed by Palantir’s $150 billion valuation. Despite their size difference, both focus on AI and machine learning software that helps organizations analyze data. They also maintain a strategic partnership to boost each other’s offerings.

Generative AI and workflow automation are vital for productivity, making them popular among businesses. While Palantir has excelled with comprehensive solutions, BigBear.ai is only beginning to gain traction in specific markets.

Historically, Palantir has shifted focus from government and defense to commercial markets. In its most recent third quarter, which ended on September 30, Palantir’s revenue rose 30% year-over-year, thanks to enterprise customers embracing its Artificial Intelligence Platform (AIP). This revenue growth has led to substantial increases in earnings, a trend expected to persist into 2025 and beyond.

BigBear.ai, however, has not yet had a breakout moment. Most of its revenue still stems from a few key Department of Defense contracts. Although its revenue in the last third quarter increased by 22% year-over-year, this follows a series of disappointing results in previous periods, demonstrating inconsistency.

Unlike Palantir, BigBear.ai is operating at a loss, which has put pressure on its stock price. For BigBear.ai to become the next Palantir, it must show significantly stronger growth.

| Metric | BigBear.ai 2024 Estimate | Palantir Technologies 2024 Estimate |

|---|---|---|

| Revenue | $169 million | $2.8 billion |

| Revenue change (YOY) | 8.6% | 25.5% |

| Earnings per share (EPS) | -$0.28 | $0.38 |

| Annual EPS change (YOY) | N/A | 52% |

Data source: Yahoo Finance. YOY = year over year.

BigBear.ai’s Edge in Computer Vision

BigBear.ai shines through early leadership in AI-powered computer vision. Its Pangiam digital identity brand uses biometrics, images, and videos to spot anomalies and prevent threats. Major airports worldwide are already customers, utilizing systems like “TrueFace” and “veriScan” for security checks.

Investors are particularly attracted to BigBear.ai’s innovative AI technology, which could transform various sectors beyond just transport and logistics, including healthcare, agriculture, retail, and manufacturing.

Those who believe in the company’s ability to expand into new markets may find it an attractive investment opportunity.

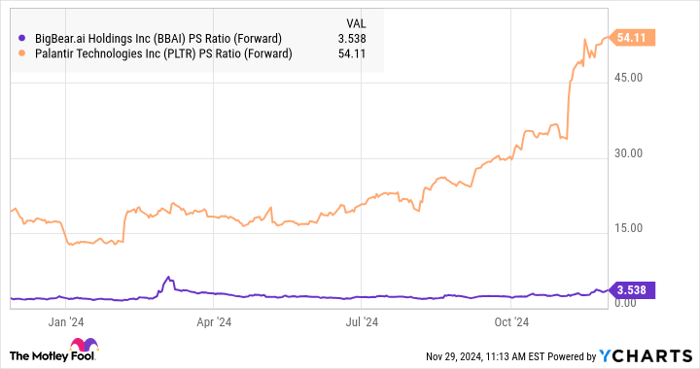

Interestingly, shares of BigBear.ai are currently trading at around four times its estimated revenue for the year, significantly lower than Palantir’s remarkable forward sales multiple of 54. This suggests that while Palantir appears costly, BigBear.ai’s stock could be more appealing, especially if it surpasses growth expectations.

BBAI PS Ratio (Forward) data by YCharts

Final Thoughts

The central question for investors isn’t whether BigBear.ai can someday surpass Palantir but whether it can deliver similar high returns. There seems to be potential for significant growth, particularly in 2025, a crucial year for proving its AI solutions can attract commercial interest.

That said, BigBear.ai’s current challenges and financial instability may lead to volatile stock performance. For investors focused on the long term, BigBear.ai stock could still play a valuable role in a diversified portfolio.

Should You Invest $1,000 in BigBear.ai Now?

Before investing in BigBear.ai, keep this in mind:

The Motley Fool Stock Advisor team recently selected their top 10 stock picks for investors… and BigBear.ai didn’t make the cut. These chosen stocks could yield substantial returns in the coming years.

For perspective, consider when Nvidia was chosen for the list on April 15, 2005… a $1,000 investment at that time would be worth $847,211!*

Stock Advisor offers an easy investment strategy, including portfolio guidance, analyst updates, and two new stock recommendations each month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 2, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.