Deluxe Corp Offers Attractive Options for Income-Seeking Investors

Exploring Covered Calls and Dividend Yields for DLX Shares

Shareholders of Deluxe Corp (Symbol: DLX) looking to enhance their earnings beyond the stock’s 5.2% annualized dividend yield may consider selling the July 2025 covered call at the $25 strike. By doing this, they can collect a premium based on a $2.00 bid, translating to an additional 13.8% return based on the current stock price. This potential annualized return comes to a total of 18.9% if the stock is not called away. However, if the stock rises above $25, shareholders forfeit any gains above that price. Currently, DLX shares would need to increase by 6.9% for the stock to be called. In that case, shareholders would enjoy a 15.5% return, which includes any dividends accrued before the shares were called.

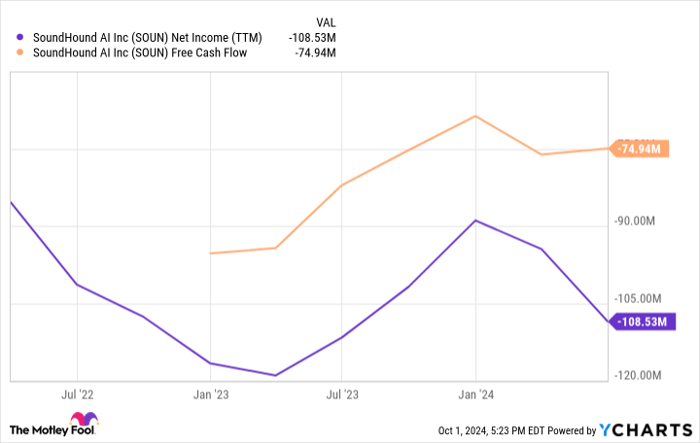

Dividend payments typically fluctuate according to a company’s profitability. To assess whether the recent dividend is likely to persist, examining the dividend history chart for DLX can provide useful insights that inform expectations surrounding the 5.2% annualized dividend yield.

Below is a chart depicting DLX’s trailing twelve-month trading history, with the $25 strike highlighted in red:

The charts above, along with the stock’s historical volatility, can guide investors when considering the trade-off of selling the covered call at the $25 strike, which entails relinquishing potential upside beyond that amount. To assist in this analysis, we calculate the trailing twelve-month volatility for Deluxe Corp. Based on the last 251 trading day closing values and today’s price of $23.17, the volatility stands at 36%. For additional call option strategies spanning various expiration dates, you can visit the DLX Stock Options page on StockOptionsChannel.com.

On Tuesday, during mid-afternoon trading, the S&P 500 recorded a put volume of 841,155 contracts against a call volume of 1.76 million, resulting in a put:call ratio of 0.48 for the day. This figure significantly contrasts with the long-term median put:call ratio of 0.65, indicating that traders are leaning heavily towards call options in today’s trading environment.

Find out which 15 call and put options traders are discussing today.

![]() Top YieldBoost Calls of Stocks with Insider Buying »

Top YieldBoost Calls of Stocks with Insider Buying »

Also see:

• Manufacturing Dividend Stocks

• Institutional Holders of PMFG

• Institutional Holders of HI

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.