I’ve updated my Stock Grader recommendations for 85 major blue-chip stocks.

I hope your Thanksgiving was delightful! As anticipated, the stock market remained relatively calm as many investors took time off for the holiday.

Despite the quiet trading environment, stocks still managed to rally. The Dow experienced a 2% increase, while both the S&P 500 and NASDAQ rose slightly more than 1%. Consequently, the S&P 500 and Dow finished the month at record highs.

The major indices made significant strides throughout November as well. The Dow led with a 7.5% advance, followed by the S&P 500 at 5.7% and the NASDAQ at 6.2%.

Notably, much of the uncertainty that affected the stock market during the first ten months of the year eased following the presidential election.

This brings up an important question: Will December surpass November? The short answer is no.

However, the outlook remains positive. I expect the market’s strength to persist, paving the way for a solid finish to 2024. In today’s Market 360, I will share my reasoning and suggest optimal strategies for December and the New Year.

Can December Deliver More Gains?

Let me clarify that while December may not match November’s performance, it is still traditionally a strong month for the stock market.

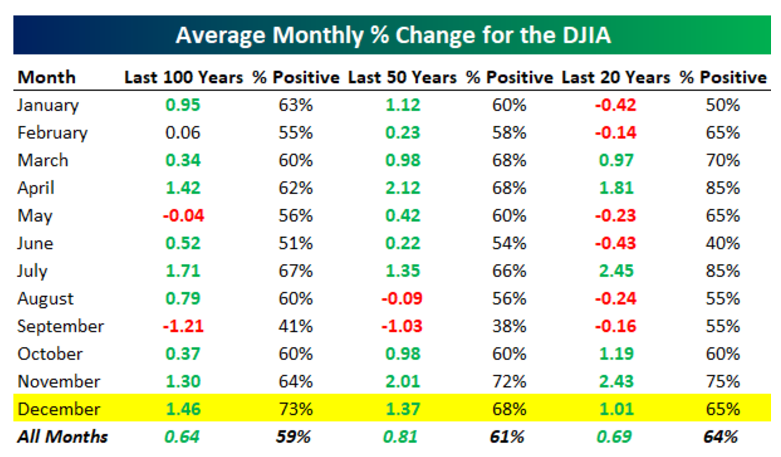

Research from Bespoke Investment Group highlights December as one of the four strongest months annually. Their findings show that the Dow averages gains greater than 1% during these four months (December, April, July, and November) over the last century, fifty years, and twenty years.

To illustrate, the Dow has averaged a gain of 1.46% in December over the past century, 1.37% over the past fifty years, and 1.01% in the past twenty years.

Overall, I remain optimistic about economic performance in December, expecting a year-end rally. However, it’s important to note that stocks are currently at or near all-time highs following November’s surge. Therefore, a consolidation of these gains is necessary. A significant portion of last month’s strength can be traced back to the presidential election, alongside early “January effects” and pension fund activities.

Moreover, December often sees investors selling off losing positions to balance gains for tax purposes. This action tends to lead to tax selling, which can affect market dynamics.

Given these factors, December could exhibit a “washing machine” effect where money fluctuates and gradually trends upward. I remain very positive about the market’s potential, anticipating a strong conclusion to 2024.

This Week’s Rating Updates

This week’s focus will shift to major retailers and the state of the labor market.

Wall Street eagerly awaits insights from key retailers regarding their Black Friday and Cyber Monday sales, which will inform us about consumer strength.

The upcoming ADP employment figures on Wednesday, along with jobless claims on Thursday and the jobs report on Friday, will provide further insight into labor market conditions. With inflation stabilizing near the Federal Reserve’s 2% target, attention turns to unemployment statistics.

By week’s end, we should gain clearer insights into the Fed’s perspective on potential rate cuts before the December Federal Open Market Committee (FOMC) meeting.

Considering these developments could impact market movements, it’s crucial to be prepared. I analyzed the latest institutional buying trends and each company’s financial health, leading to updated recommendations in my Stock Grader for 85 blue-chip stocks. (Subscription required.) Of these stocks…

- Eight stocks were upgraded from a Buy (B-rating) to a Strong Buy (A-rating).

- Eleven stocks were upgraded from a Hold (C-rating) to a Buy (B-rating).

- Nine stocks improved from a Sell (D-rating) to a Hold.

- Two stocks transitioned from a Strong Sell (F-rating) to a Sell.

- Twenty-eight stocks were downgraded from a Buy to a Hold.

- Thirteen stocks dropped from a Hold to a Sell.

- One stock was downgraded from a Sell to a Strong Sell.

I’ve included the first ten stocks rated as Buys below, though a more detailed list—including the fundamental and quantitative grades for all 85 stocks—can be found here. You may find at least one of these stocks in your portfolio, so it’s worth reviewing your holdings accordingly.

| AZN | AstraZeneca PLC Sponsored ADR | B |

Strong Stock Performance Fuels Year-End Optimism

Market Highlights and Investment Opportunities

The market has had an impressive run this year. In the first 11 months, both the S&P 500 and NASDAQ gained over 26%, while the Dow Jones Industrial Average climbed more than 19%.

Our portfolio containing high-quality Growth Investor stocks has performed well in this thriving environment. It’s likely you’ve seen similar benefits from these investments.

Looking to finish the year on a positive trajectory? It’s essential to be invested in top-tier stocks.

Consider that our Growth Investor stocks boast an average annual sales growth of 23.7% alongside a remarkable 506.3% average annual earnings growth. We are well-positioned for a vigorous year-end rally.

If you’re seeking fundamentally sound stocks, our Growth Investor service offers valuable insights to guide your choices.

For more information on my latest research and how Growth Investor can help you achieve profits in 2025 and beyond, click here.

(Current subscribers can click here to access the members-only website.)

Sincerely,

Louis Navellier

Editor, Market 360