Investing in Top Retail Stocks: A Closer Look at Target and Walmart

Target (NYSE: TGT) and Walmart (NYSE: WMT) stand out as leading retail stocks, offering opportunities for investors to tap into long-term economic growth. While Walmart has outperformed this year with stock returns of about 75%, Target has seen a decline of 9%. However, for those focused on dividend income, the comparison takes a different turn.

Target’s Superior Dividend Yield

Walmart’s remarkable stock performance has led to reduced dividend yield; currently, its yield sits around 1%, lower than the S&P 500 average of 1.2%. If Walmart were still at its early year share price, the yield would have been approximately 1.6%. In contrast, Target boasts a dividend yield of 3.4%.

To earn a $1,000 dividend from Walmart, investors would need to stake about $100,000 due to the low yield. Conversely, with Target’s higher dividend, an investment of under $30,000 would suffice to achieve the same dividend income.

Dividend Growth from Both Retail Giants

For anyone investing for dividends, growth potential is crucial. Both companies have a strong track record of increasing dividends, vital for keeping pace with inflation over time.

This year, Target raised its dividend by nearly 2%, marking its 53rd consecutive year of increases—a significant achievement for any company. Known as a Dividend King, Target consistently showcases its reliability for dividend investors. Walmart, similarly impressive, raised its quarterly dividend by 9% in February, achieving its own remarkable milestone of 51 consecutive years of increases.

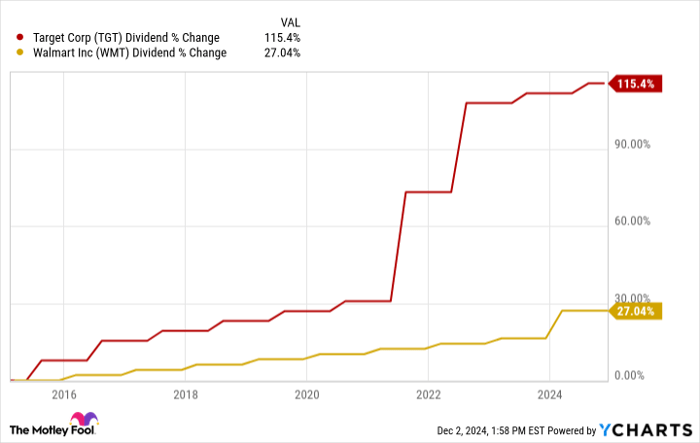

Though Walmart had a higher recent increase, Target has demonstrated larger overall growth in dividends over the past decade by doubling its payout during this period.

TGT Dividend data by YCharts

Assessing Dividend Safety and Sustainability

The payout ratio, which indicates the portion of earnings distributed as dividends, is another important factor. Both Walmart and Target maintain payout ratios under 50%, with Walmart enjoying a slight advantage in cushion.

TGT Payout Ratio data by YCharts

A lower payout ratio does not inherently mean Walmart will have larger future increases than Target. Keeping its payout ratio low allows Walmart to allocate cash towards growth strategies, especially as competition with Amazon continues.

Investors can be reassured that both Target and Walmart’s dividends are currently safe, presenting room for future increases.

Should Dividend Investors Favor Target?

This year, Target faced challenges due to lower demand for discretionary items. However, as economic conditions improve, the company may regain momentum. Walmart’s relatively high valuation—34 times next year’s expected earnings compared to Target’s 13—could also leave it vulnerable to market corrections, potentially making Target a more appealing option for value-oriented investors.

If long-term investing with a focus on dividend income is your goal, Target might be the more advantageous choice compared to quickly jumping onto Walmart’s rising stock.

Is Now a Good Time to Invest in Target?

Before purchasing Target stock, consider this:

The Motley Fool Stock Advisor analyst team has pinpointed their selection of the 10 best stocks to invest in right now, and Target is not included. Those chosen stocks could yield significant returns in the coming years.

Reflecting on a past recommendation, when Nvidia was picked on April 15, 2005, a $1,000 investment then would now be worth over $859,528!

Stock Advisor offers investors a straightforward guide to success, emphasizing portfolio building, ongoing analyst updates, and two new stock picks every month. Since 2002, Stock Advisor has significantly outperformed the S&P 500 by over four times.

See the 10 stocks »

*Stock Advisor returns as of December 2, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Target, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.