“`html

Current Market Landscape: Bullish Trends and Potential Risks Ahead

Analysts at Citi have indicated that the S&P 500’s positioning is overwhelmingly tilted towards the bulls.

For four consecutive weeks, bullish positioning in the S&P has reached record highs, according to Citi’s analysis.

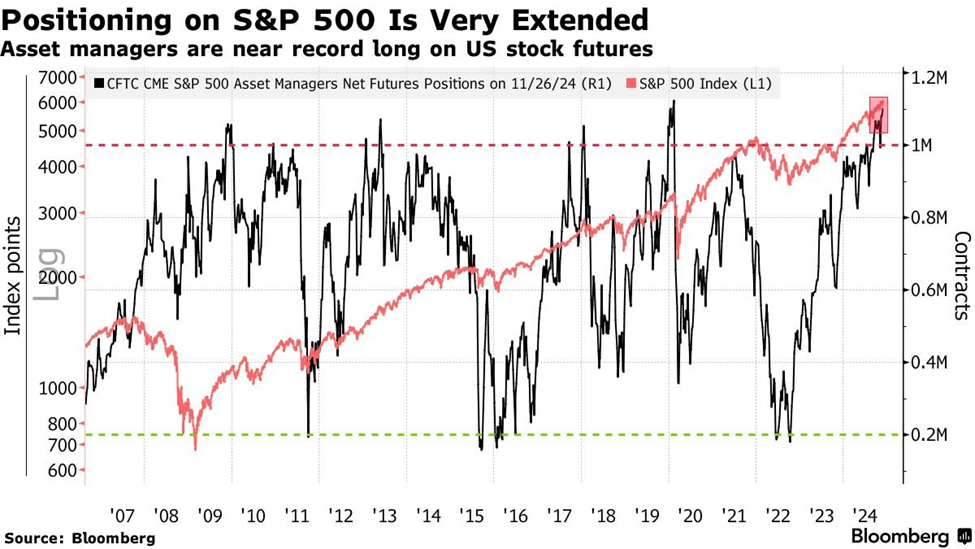

The chart below, sourced from Bloomberg, tracks the data back to 2007. The red line represents the price of the S&P 500, while the black line illustrates the net futures positioning of asset managers. Today’s figures rank among the highest recorded.

Source: Bloomberg

Historically, excluding 2012, such high net long positioning has preceded sharp declines in the S&P shortly after.

Increasing Bullish Sentiment Among Investors

As previously mentioned in prior Digests, U.S. household wealth allocation to stocks is nearing historical highs.

To shed light on the implications of this trend, it’s worth referencing a quote from Stéphane Renevier of Finimize:

A lot of things can influence short-term stock returns: interest rates, economic data, geopolitical issues, investor sentiment – even weather.

However, for long-term returns, one factor stands out: the proportion of assets that investors choose to keep in stocks.

This ratio has proven to be the most reliable predictor of stock returns over the long haul, surpassing even significant factors like valuations.

When investors disproportionately allocate to stocks, it typically leads to below-average long-term returns.

This situation poses a warning sign as we look ahead to 2025.

Market Analysts are Adjusting Their Predictions

In September, JPMorgan released a report suggesting that the market’s forward returns over the next decade could be only half the historical average.

According to MarketWatch:

The argument is primarily based on mathematical analysis.

Current stock-market valuations are high compared to historical norms, driven largely by a few major companies known as the Magnificent Seven.

Extensive historical data indicates that, in the long term, valuations tend to revert to the mean, which may result in diminished stock returns.

Additionally, research firm Ned Davis recently noted the 54 record highs achieved in 2024. While this appears favorable for investors, it has historically signaled lower returns in the subsequent year.

From Business Insider:

Since 1928, in years when the S&P 500 hit more than 35 record highs, the median gain for the index was just 5.8% in the following year, below the historical average of 8%.

In years with at least 50 record highs, the median return was -6% the next year.

A Historical Exception Worth Noting

One notable exception occurred in 1996.

Despite achieving 77 record highs in 1995, the S&P rose 20% in 1996.

Luke Lango, a hypergrowth expert, does not dismiss the possibility of a correction. However, he challenges the idea that it will occur next year:

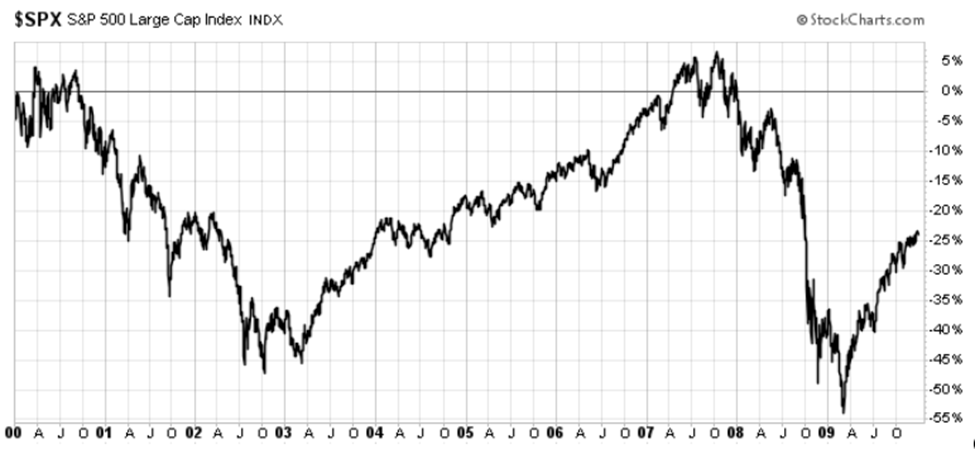

After the bull run of 1995/96, stocks enjoyed three more strong years in 1997, 1998, and 1999, leading up to the dramatic Dot Com Crash where stocks fell nearly 50% from 2000 to 2002.

What does Luke foresee for 2025?

His outlook hinges on several factors. Here’s his optimistic scenario:

If inflation remains low and interest rates continue to decline, S&P 500 valuation multiples may expand, leading to strong stock performance.

After analyzing projections based on Trump’s tax cuts, increased earnings, and investor sentiment, Luke concludes:

If inflation stays low and interest rates decrease, stocks could appreciate more than 30% within the next two years.

Yet, Luke maintains a realistic outlook on the challenges stocks may face in 2025:

If inflation rises and interest rates remain elevated, valuation multiples will likely contract, restricting stock gains… You could see only marginal improvements in stock prices over the next two years.

Navigating Uncertain Choices for Investors

Investors now face a difficult decision.

Should you stay invested to leverage bullish momentum, hoping for a third consecutive year of strong performance? By doing so, you risk facing a sharp market correction that could obstruct or delay your financial plans.

Alternatively, should you sell some of your top-performing stocks, endure capital gains taxes, and shift towards safer investments? This defensive strategy aims to safeguard your profits. However, if the market surges 30% as Luke predicts, missing out on those gains could significantly affect your retirement plans, along with the associated anxiety.

This isn’t an easy choice.

In light of this dilemma, I have encouraged readers to consider a “trading” mindset for today’s market.

Instead of reaching for new stocks at inflated valuations for your buy-and-hold portfolio (or further investing in high-valued blue chips), focus on short-term trades. This approach allows you to capitalize on upward momentum while minimizing potential losses.

“`

Discover Auspex: A Smart Tool to Tackle Stock Market Challenges

Investing wisely can help you avoid sudden market downturns, but how can you put theory into practice?

Introducing the Revolutionary Stock Screening Tool

When you think about “buying low and selling high,” what aspects should you focus on?

Is it the strength of a company’s fundamentals, such as growing profit margins and sales? Maybe it’s the technical indicators that signal increasing momentum?

Or could it be market sentiment? As regular readers know, I often say “price is truth,” implying that rising prices reflect positive investor sentiment.

Each of these elements is crucial for a successful market strategy. That’s why Luke has developed Auspex, a groundbreaking stock screening system that integrates all three approaches.

Auspex evaluates over 10,000 stocks, identifying those that meet strict criteria for fundamental, technical, and sentiment performance. Next Wednesday at 1 PM ET, Luke will host a special event to share insights on how Auspex was created, its impressive performance since summer, and how it can help investors stay engaged in upward market movements.

Understanding Auspex’s Precise Screening Method

This detailed screening process generates only 5-20 “buy” signals each month. Luke’s approach is simple: buy them all and leave them untouched for the month.

By doing this, you avoid frequent trading and the stress of daily buy/sell alerts. Instead, you make your purchases at the start of the month and revisit them about 30 days later.

The following month, Auspex will deliver a new set of recommendations based on its criteria. Some stocks may reappear, or you may be suggested to invest in new opportunities.

The key takeaway is to keep your portfolio aligned with the top-performing stocks based on fundamental, technical, and sentimental strength every month.

This method enhances your chances of holding on to strong stocks while minimizing the risk of significant losses. A one-month holding period ensures that strength doesn’t diminish too quickly.

Luke has utilized the Auspex system with his Inner Circle readers and consistently outperformed the market for the past five months. Notably, in November, while the S&P 500 increased by 5.73% and the Dow rose by 7.54%, the Auspex Equal Weight portfolio achieved over an 8% gain. This period marked the strongest monthly performance of 2024.

We’ll continue to share insights in the upcoming days. To secure your spot for next Wednesday’s event at 1 PM ET, click here. We expect high attendance!

Looking Ahead: What Can We Expect for the Market Next Year?

Histories indicate we might see modest returns going forward. Yet, the current market trends suggest potential for significant gains.

We believe that focusing on the strongest stocks and holding them for shorter periods is a smart tactic to navigate market fluctuations. This approach mirrors the idea of “renting” the market instead of permanently buying into it.

Whatever strategy resonates with you, be ready for a 2025 that could swing by 20% in either direction.

Have a great evening,

Jeff Remsburg