Coinbase Experiences Surging Stock Growth Amidst Bitcoin’s Volatility

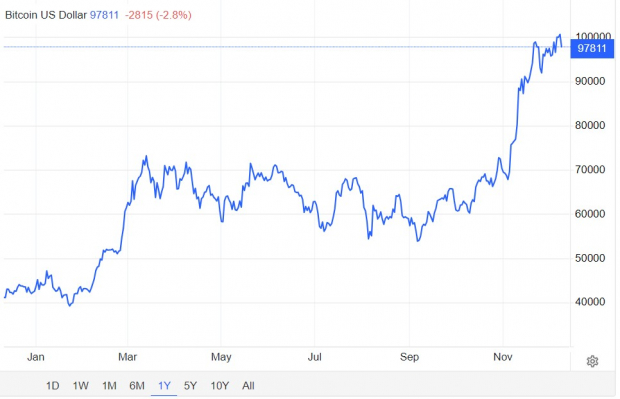

Despite Bitcoin’s price falling below $100,000, it has surged over +120% in 2024. This remarkable gain has fueled a significant increase in the stock of Coinbase Global COIN, which has risen by +80% year to date.

As the largest cryptocurrency exchange in the United States, many investors may see Coinbase’s stock as an attractive buy-the-dip opportunity, particularly with COIN down -9% during Monday’s trading.

Image Source: Trading Economics

Strong Financial Turnaround for Coinbase

Thanks to the Bitcoin surge and growing interest in cryptocurrency, Coinbase’s financial performance has greatly improved. Recently, Coinbase reported Q3 results showing a 100% jump in quarterly sales to $1.2 billion, up from $674.15 million for the same period last year.

Crucially, Coinbase’s Q3 earnings per share (EPS) reached $0.62, translating to a net income of $75 million. This is a significant turnaround from a loss of $2 million or -$0.01 per share a year before, marking the fourth consecutive quarter of positive net income.

Additionally, Coinbase has surpassed the Zacks EPS Consensus for seven consecutive quarters, boasting an impressive average earnings surprise of 341.36% over its last four quarterly reports.

Image Source: Zacks Investment Research

Sales Projections and EPS Outlook

According to co-founder and CEO Brian Armstrong, driving revenue is Coinbase’s primary goal. The company is pivoting away from unpredictable transaction-based revenues to focus on subscription and service revenues.

Total sales for Coinbase are projected to reach $5.61 billion in fiscal 2024, which marks an 80% increase from $3.11 billion in the previous year. Following this growth, FY25 sales are expected to decrease slightly by -2% to $5.48 billion.

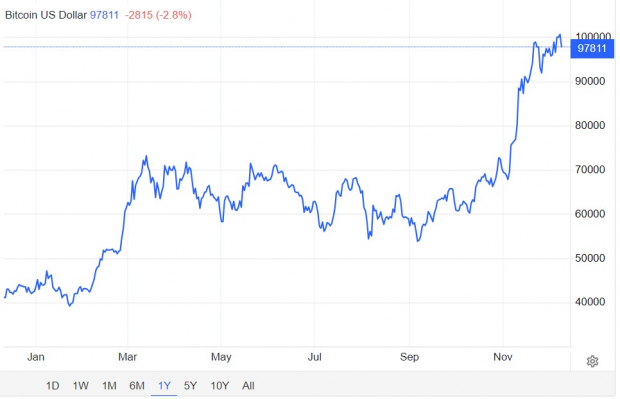

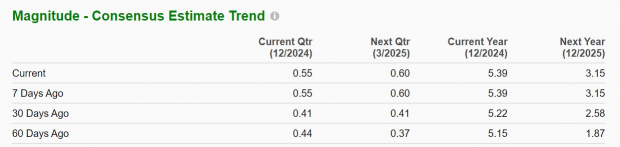

In terms of earnings, analysts expect annual EPS to soar to $5.39 in 2024 compared to $0.37 in 2023. EPS for FY25 is expected to dip to $3.15. Notably, there has been a significant increase in earnings estimate revisions recently, moving from estimates of $1.87 per share just 60 days ago, with FY24 EPS estimates rising by 4% during this time.

Image Source: Zacks Investment Research

Focus on Diversification and Regulatory Environment

Beyond revenue growth, Coinbase is emphasizing improving the utility of cryptocurrencies and fostering regulatory clarity. The company aims to enhance the economic freedom blockchain technology brings to everyday life and innovation in finance.

Key initiatives include developing digital wallets and payment solutions to make cryptocurrency more accessible. The rally in Coinbase’s stock and Bitcoin has been further supported by the belief that President-elect Donald Trump favors cryptocurrencies. Trump has promised to establish a welcoming regulatory environment for cryptocurrencies, which could support Coinbase’s initiatives.

Financial Health and Valuation

With a forward earnings multiple of 67.3X, Coinbase’s stock is trading at a premium compared to the S&P 500, albeit lower than competitor Robinhood Financials’ (HOOD) 54.4X. Positive revisions in earnings estimates are justifying this premium, alongside a stronger balance sheet.

As of Q3 2024, Coinbase’s cash and equivalents grew to $8.62 billion from $5.52 billion in the previous year’s quarter. The total assets of Coinbase currently stand at $290.55 billion, outpacing total liabilities of $281.83 billion.

Image Source: Zacks Investment Research

Final Thoughts

With the growing optimism surrounding Bitcoin and other cryptocurrencies, Coinbase certainly appears poised for further success. As COIN has been added to the Zacks Rank #1 (Strong Buy) list, it may emerge as a compelling investment opportunity for 2024 and beyond.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy’s Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.