Future Outlook: Analysts Project Gains for iShares Russell Top 200 Value ETF

In our analysis at ETF Channel, we examined the ETFs we track and compared the trading prices of their holdings with the average 12-month target prices set by analysts. The findings for the iShares Russell Top 200 Value ETF (Symbol: IWX) reveal an implied target price of $90.95 per unit based on its underlying assets.

Current Price and Expected Upside for IWX

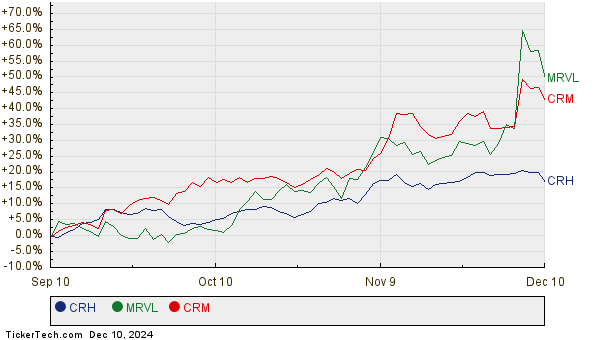

Recently, IWX has been trading at approximately $82.81 per unit. This suggests that analysts anticipate a potential upside of 9.83% when looking at the average target prices of the ETF’s underlying holdings. Noteworthy among these holdings are CRH plc (Symbol: CRH), Marvell Technology Inc (Symbol: MRVL), and Salesforce Inc (Symbol: CRM). CRH, which recently traded at $100.09 per share, has an analyst target of $111.28, indicating an upside potential of 11.18%. Meanwhile, MRVL is expected to rise to a target price of $118.62, signaling a potential gain of 10.83% from its current price of $107.03. Analysts forecast CRM will reach $388.82, representing a 10.60% upside from its recent price of $351.57. The chart below displays the stock performance of CRH, MRVL, and CRM over the past twelve months:

Summary of Analyst Target Prices

Below is a table summarizing the recent trading prices and target projections discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Russell Top 200 Value ETF | IWX | $82.81 | $90.95 | 9.83% |

| CRH plc | CRH | $100.09 | $111.28 | 11.18% |

| Marvell Technology Inc | MRVL | $107.03 | $118.62 | 10.83% |

| Salesforce Inc | CRM | $351.57 | $388.82 | 10.60% |

Analysts’ Perspectives: Justified Optimism or Exaggeration?

The question remains: Are analysts being realistic with these target projections or are they overly optimistic about the paths of these stocks one year from now? Investors must consider whether analysts have solid reasons for their targets or if they are lagging behind significant developments in the companies and their respective industries. While a high target price can indicate confidence in a stock’s future performance, it can also signal potential downgrades if those targets are based on outdated information. Prospective investors should conduct further research before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Largest Discount Preferreds

• SSFN market cap history

• DGX Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.