Nvidia’s Future: Can It Continue Its Impressive Streak in 2025?

Few stocks have performed as consistently well as Nvidia (NASDAQ: NVDA) over the past two years. The company’s stock has surged about 900% since the start of 2023, hitting new highs in both 2023 and 2024. The pressing question now is whether Nvidia can maintain this winning trend into 2025.

Experts predict 2025 will present more challenges, with Nvidia’s growth expected to slow, even though it remains robust. Is Nvidia still the top artificial intelligence (AI) stock to own as we look ahead?

Nvidia’s GPU Business: Continued Growth on the Horizon

Nvidia stands at the forefront of AI investments thanks to its essential role in building and training AI models. The company’s graphics processing units (GPUs) and CUDA software are recognized for their superiority. In a fast-paced landscape where speed is critical, Nvidia has few competitors.

GPUs excel in parallel processing, allowing for numerous calculations to occur simultaneously. This capability is amplified when thousands of GPUs are grouped in computing clusters. With major AI and cloud computing firms purchasing thousands of GPUs each month, Nvidia’s business has surged, pushing its stock price upward.

Looking ahead, the trend appears set to continue into 2025.

Meta Platforms has indicated that investors can expect a “significant acceleration in infrastructure expense growth” next year. This suggests that Nvidia will likely benefit from increased spending. Similar bullish sentiments have been shared by other major players like Microsoft and Amazon regarding their ongoing investment plans.

This is an encouraging sign for Nvidia as it implies that demand for GPUs is not yet at its peak.

Is Growth Already Reflected in Nvidia’s Stock Price?

Typically, when companies witness significant growth, their stock valuations tend to rise sharply as the market anticipates future performance. However, Nvidia seems to be bucking this trend.

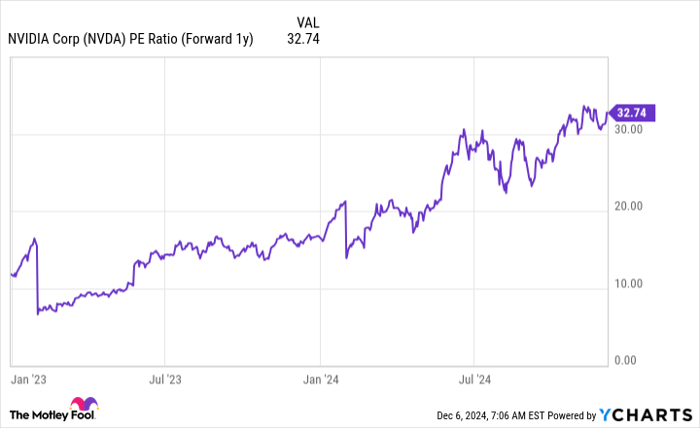

NVDA PE Ratio (Forward 1y) data by YCharts

The accompanying chart displays Nvidia’s one-year forward price-to-earnings ratio, which is based on earnings projections for the upcoming fiscal year. Currently, Nvidia’s stock trades at 33 times its fiscal year 2026 earnings, representing its highest valuation to date. However, the key question is whether this price is justified.

For context, leading companies like Apple and Microsoft trade at 29 times next year’s earnings. The premium on Nvidia’s stock seems reasonable considering its potential for top-tier growth.

Wall Street analysts forecast over 50% revenue growth for Nvidia in fiscal year 2026, largely attributed to the upcoming Blackwell architecture, promising a major performance upgrade over the current Hopper architecture. This could incentivize many to upgrade their computing infrastructure, a trend that likely extends beyond 2025.

Thus, Nvidia continues to have strong factors propelling its growth, making it a worthy stock for 2025. However, investors should be realistic; the stock is unlikely to see the same explosive growth witnessed in 2023 and 2024. Moderate double-digit gains might be more appropriate to expect, potentially allowing it to outperform the market. Consequently, Nvidia remains a leading AI stock for 2025, though with lower return prospects compared to the previous two years.

Don’t Miss Out on This Opportunity

Have you ever felt you missed your chance to invest in successful stocks? If so, pay attention.

Occasionally, our team of analysts issue a “Double Down” stock alert for companies poised for a surge. If you think you’ve missed your window, now could be the ideal time to invest before it’s too late. The returns speak volumes:

- Nvidia: An investment of $1,000 when we first recommended it in 2009 would now be worth $359,936!*

- Apple: A $1,000 investment from our 2008 recommendation would have grown to $46,730!*

- Netflix: A $1,000 investment from 2004 would now stand at $492,745!*

Currently, we’re providing “Double Down” alerts on three exceptional companies, and opportunities like this don’t come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.