Analysts Predict Significant Upside for iShares ESG MSCI USA Leaders ETF

Recent analysis reveals a promising forecast for the iShares ESG MSCI USA Leaders ETF (Symbol: SUSL), with strong upside anticipated from its underlying holdings.

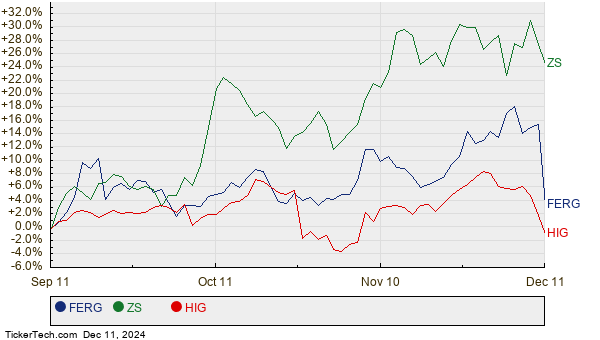

Examining the underlying assets of the SUSL, the average analyst target price for the ETF stands at $118.60 per unit, compared to its recent trading price of $106.57 per unit. This indicates an expected upside of 11.29%. Noteworthy selections among its underlying holdings include Ferguson Enterprises Inc (Symbol: FERG), Zscaler Inc (Symbol: ZS), and Hartford Financial Services Group Inc. (Symbol: HIG). For instance, while FERG is currently at $194.94/share, analysts project a target of $229.93/share, suggesting a potential increase of 17.95%. ZS offers a similar outlook, with a 12.74% upside from $201.39 to $227.05. HIG, trading at $112.98, has a projected target price of $127.20, representing a 12.59% rise. Below is a chart tracking the twelve-month price performance of FERG, ZS, and HIG:

The table below summarizes the currently evaluated analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares ESG MSCI USA Leaders ETF | SUSL | $106.57 | $118.60 | 11.29% |

| Ferguson Enterprises Inc | FERG | $194.94 | $229.93 | 17.95% |

| Zscaler Inc | ZS | $201.39 | $227.05 | 12.74% |

| Hartford Financial Services Group Inc. | HIG | $112.98 | $127.20 | 12.59% |

The upcoming question for investors is whether these targets are realistic or overly optimistic. Are the analysts basing their projections on sound reasoning, or are they out of touch with recent changes in the companies and their sectors? When a stock’s target price suggests significant growth potential, it may reflect optimism or risk becoming outdated if market conditions shift. Investors will need to conduct further research to assess these factors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Further Reading:

• Auto Manufacturers Dividend Stocks

• APCX shares outstanding history

• Phreesia Historical Earnings

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.