Airlines Soar: Positive Forecasts Fuel Investment Potential

The air travel sector is regaining momentum after the pandemic, with stronger demand facilitating growth within the Zacks Transportation – Airline industry. Notably, leisure travel is thriving, but business travel is also showing a significant resurgence.

Passenger numbers have increased notably during both the summer season and the Thanksgiving holiday this year. The International Air Transport Association (IATA) recently provided a positive outlook for the airline industry, forecasting that passenger counts will exceed 5 billion globally in 2025, marking a historic milestone. Given this optimistic outlook, investing in airline stocks such as United Airlines (UAL), SkyWest (SKYW), and Ryanair Holdings (RYAAY) appears to be a sound strategy.

Details on IATA’s Positive 2025 Forecast

Boosted by flourishing air travel demand, IATA projects the airline industry will reach a net profit of $36.6 billion in 2025, a rise from the estimated $31.5 billion in 2024. Operating profits are expected to hit $67.5 billion, enhancing the net operating margin to 6.7%, up from 6.4% in 2024. Additionally, the industry’s total revenue is expected to exceed $1 trillion for the first time, reaching $1.007 trillion, which indicates a 4.4% increase from the previous year.

Passenger revenues will be the primary contributor to this optimistic forecast, with expectations of $705 billion in 2025, making up 70% of total revenues. Ancillary revenues are projected at $145 billion, and IATA predicts a record 5.2 billion people will fly in 2025.

Cargo revenues should also reach $157 billion in 2025, which, while lower than the $138 billion reported in 2023, surpasses pre-pandemic levels. Additionally, cargo volumes are predicted to grow to 72.5 million tons, signifying a 5.8% rise from 2024 projections.

Total costs for airlines in 2025 are expected to be $940 billion—4% higher than 2024 estimates. This increase is largely due to projected labor costs, forecasted to rise by 7.6%. IATA anticipates an average jet fuel price of $87 per barrel in 2025, down from $99 in 2024, leading to a total fuel bill of $248 billion, which constitutes 26.4% of operating costs.

Regionally, North American carriers are expected to drive profit growth, with an anticipated net profit of $13.8 billion, translating to $11.8 per passenger. Passenger demand is expected to grow by 3% year-over-year. European airlines are projected to generate net profits of $11.9 billion, while airlines in Latin America, the Middle East, and Asia Pacific are also forecasted to recover substantially due to increasing passenger volumes.

Top Airline Stocks to Consider

Given the optimistic climate in the airline industry, it may be wise to consider investing in airline stocks to potentially enjoy solid returns. Here are three stocks with a Zacks Rank of #1 (Strong Buy) or #2 (Buy), which have experienced positive earnings estimate revisions.

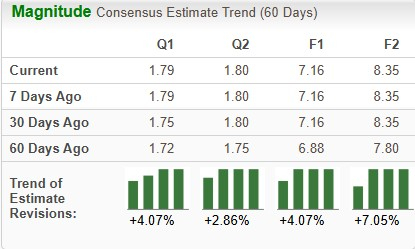

SkyWest boasts a Zacks Rank of #1. The company is experiencing substantial revenue growth from its flying agreements and modernization of its fleet. Its earnings have consistently exceeded the Zacks Consensus Estimate over the past four quarters, averaging a remarkable surprise of 79.12%. In the last 60 days, earnings estimates for this year and the next have been revised upward by 4.1% and 7.1%, respectively.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

United Airlines, headquartered in Chicago, holds a Zacks Rank of #2. The company has also seen upward revisions in earnings estimates of 3.5% for the current year and 3.6% for next year. Strong air travel demand and the introduction of new routes are key growth drivers for UAL.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Ryanair, an Irish carrier, also carries a Zacks Rank of #2. The airline is benefiting from high passenger volumes, as indicated by impressive traffic figures in recent months. Ryanair has outperformed the Zacks Consensus Estimate in three of its last four quarters, with a recent revision of next year’s earnings estimates increased by 1.04%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Insight into Zacks’ Top 10 Stocks for 2025

Are you interested in early insights on our 10 top stock picks for 2025?

History shows these selections have performed remarkably well.

From 2012, when our Director of Research, Sheraz Mian, began managing this portfolio, the Zacks Top 10 Stocks achieved a +2,112.6% return, significantly outperforming the S&P 500’s +475.6%. Currently, Sheraz is evaluating 4,400 companies to identify the best 10 stocks to buy and hold for 2025. Be sure to take advantage of this opportunity when the stocks are announced on January 2.

Be First to New Top 10 Stocks >>

Ryanair Holdings PLC (RYAAY): Free Stock Analysis Report

United Airlines Holdings Inc (UAL): Free Stock Analysis Report

SkyWest, Inc. (SKYW): Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.