Nucor Corporation Boosts Quarterly Dividend Amid Earnings Outlook

Nucor Corporation (NUE) has raised its regular quarterly cash dividend to 55 cents per share, up from 54 cents. This increase is significant as it marks Nucor’s 207th consecutive quarterly cash dividend. The cash dividend will be payable on February 11, 2025, to shareholders recorded as of December 31, 2024. The company has consistently increased its regular dividend for 52 consecutive years since initiating dividends in 1973.

Nucor finished the third quarter with cash and cash equivalents totaling $4,262.8 million. During this quarter, the company repurchased about 2.5 million shares of its common stock at an average price of $156.07 per share.

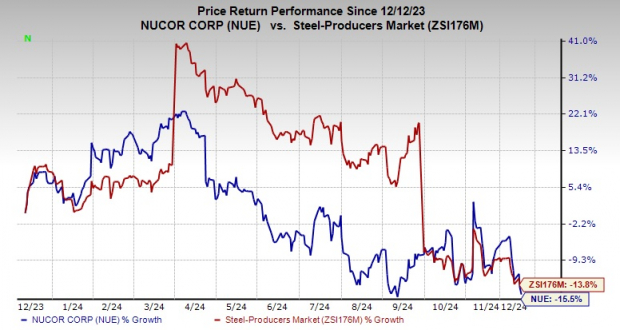

Over the past year, shares of Nucor have declined by 15.5%, while the steel industry as a whole has seen a 13.8% drop.

Image Source: Zacks Investment Research

During its third-quarter earnings call, Nucor expressed that it expects consolidated net earnings for the fourth quarter of 2024 to be lower than those for the third quarter. The anticipated decline is attributed to reduced profitability in the steel mills segment, resulting from lower average selling prices and decreased volumes. Similarly, the steel products division is expected to see a drop in earnings due to the same factors.

On a brighter note, the company predicts sequential improvement in earnings for the raw materials segment, barring any impairment charges similar to those taken during the third quarter of 2024.

Nucor Corporation Price and Consensus

Nucor Corporation price-consensus-chart | Nucor Corporation Quote

NUE’s Rank and Noteworthy Alternatives

Nucor currently holds a Zacks Rank of #5 (Strong Sell).

In contrast, several better-ranked stocks in the basic materials sector include Carpenter Technology Corporation (CRS), DuPont de Nemours, Inc. (DD), and CF Industries Inc. (CF).

Carpenter Technology, rated as Zacks Rank #1 (Strong Buy), has surpassed the Zacks Consensus Estimate in the last four quarters, enjoying an average earnings surprise of 14.1%. Over the past year, its shares have surged by 177.8%.

The Zacks Consensus Estimate for DD’s current-year earnings is forecasted at $3.88 per share, signifying an 11.5% year-over-year uptick. Notably, DD is ranked #2 (Buy) and has consistently exceeded consensus estimates over the last four quarters, achieving an average earnings surprise of 12.9%. Its shares have risen approximately 17.1% in the last year.

Meanwhile, the Zacks Consensus Estimate for CF’s current-year earnings stands at $6.32 per share. CF, also rated #1, has beaten consensus estimates in two of the last four quarters, with a 10.3% average earnings surprise. Its stock has climbed around 16.8% over the past year.

Zacks Reveals Top 10 Stocks for 2025

Interested in getting insights on our top picks for 2025?

Historically, these selections have shown remarkable performance.

Since 2012, when Zacks Director of Research Sheraz Mian took charge of the portfolio through November 2024, the Zacks Top 10 Stocks achieved an impressive +2,112.6%, significantly outperforming the S&P 500, which gained +475.6% during the same period. Sheraz is currently analyzing 4,400 companies to curate the top 10 stocks to buy and hold for 2025. Make sure to catch these stocks when they are announced on January 2.

Be First to New Top 10 Stocks >>

Nucor Corporation (NUE) : Free Stock Analysis Report

DuPont de Nemours, Inc. (DD) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not reflect those of Nasdaq, Inc.