Skyrocketing Sentiment in Semiconductor Stocks

Recent discussions reveal strong optimism among executives in the semiconductor sector, especially regarding growth in artificial intelligence (AI). In the past few weeks, stocks focused on AI, such as Marvell (MRVL), Broadcom (AVGO), and Astera Labs (ALAB) have surged after exceeding Wall Street forecasts. Read the full analysis here.

While this overall positive sentiment may indicate a good opportunity for investors, it’s crucial to remember that company insiders often profit from rising stock prices. This post aims to analyze current trends and provide reasons for investors to consider the semiconductor sector leading into 2025. Here are five compelling factors to explore:

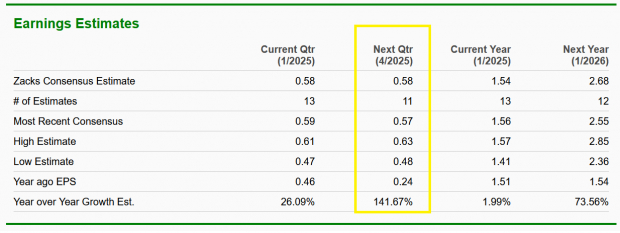

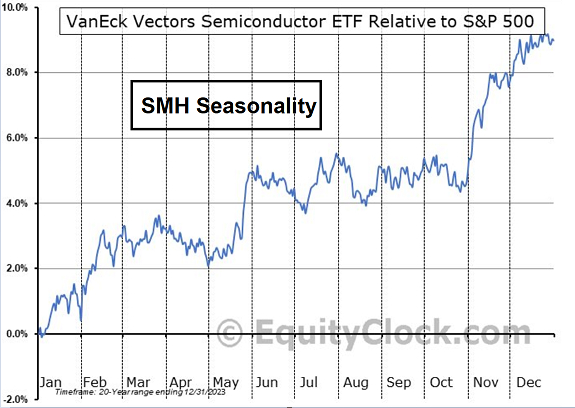

1. Strong Earnings Projections: A key indicator for investors is Zacks Consensus Estimates, summarizing forecasts from Wall Street analysts. Marvell, rated as a top Zacks Rank #1 (Strong Buy), anticipates impressive earnings growth in the upcoming quarter.

Image Source: Zacks Investment Research

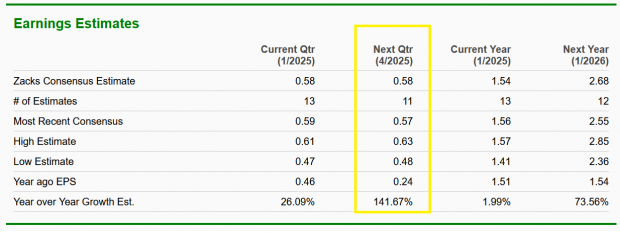

2. High Profit Margins: The semiconductor industry consistently enjoys higher profit margins compared to many other sectors. For instance, Nvidia’s (NVDA) gross margins have increased from about 50% in 2023 to over 75% today.

Image Source: Zacks Investment Research

3. Notable Investments: Recent SEC filings show that billionaire investor David Tepper possesses over two million shares of Advanced Micro Devices (AMD). Tepper is not alone; other prominent investors have also made significant purchases in chip stocks, including Broadcom (AVGO).

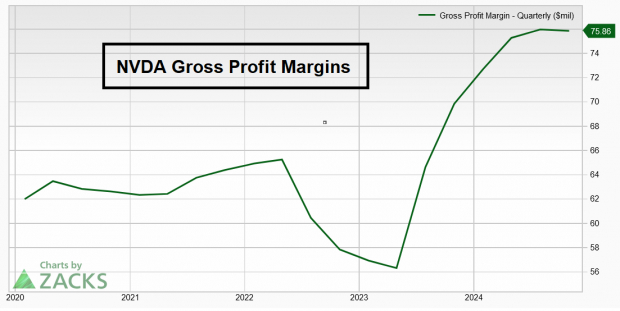

4. Seasonal Trends: Patterns from previous years suggest that the beginning of the new year is ideal for investing in the Semiconductor ETF (SMH). There is also notable interest from option traders applying bullish strategies to this sector.

Image Source: Equity Clock

5. Breakout Stocks: Price movements are crucial for assessing success in the market. Several semiconductor stocks, such as AVGO, ALAB, and MRVL, have recently achieved significant price breakouts, indicating the potential for new upward trends.

Image Source: TradingView

Conclusion

With strong earnings prospects, healthy profit margins, and noteworthy investor interest, semiconductor stocks appear to be well-positioned for future growth. Investors may find favorable opportunities within this thriving industry.

Explore 5 Clean Energy Stocks with High Potential

Energy plays a vital role in our economy, underpinning a multi-trillion dollar industry filled with some of the largest companies globally.

Innovative technologies are now revolutionizing clean energy, making it possible for sustainable sources to surpass traditional fossil fuels. Substantial investments are directed towards solar and hydrogen fuel technologies.

Emerging leaders in this sector might just become standout performers in your investment portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to access Zacks’ prime selections at no cost today.

Interested in the latest investment suggestions from Zacks Investment Research? Download 5 Stocks Set to Double and get this free report.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Marvell Technology, Inc. (MRVL): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

VanEck Semiconductor ETF (SMH): ETF Research Reports

Astera Labs, Inc. (ALAB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.