Analysts Predict Upward Momentum for iShares S&P Mid-Cap 400 Growth ETF

ETF Channel recently analyzed the underlying holdings of various ETFs, revealing intriguing insights for investors. For the iShares S&P Mid-Cap 400 Growth ETF (Symbol: IJK), the average analyst 12-month target price suggests a promising implied value.

The calculated implied analyst target price for IJK is $107.42 per unit. Given its recent trading price of approximately $96.33 per unit, this indicates an upside potential of 11.51% based on analyst targets. Notably, three underlying stocks within the ETF show significant potential for growth. These are LivaNova PLC (Symbol: LIVN), Visteon Corp (Symbol: VC), and Bruker Corp (Symbol: BRKR).

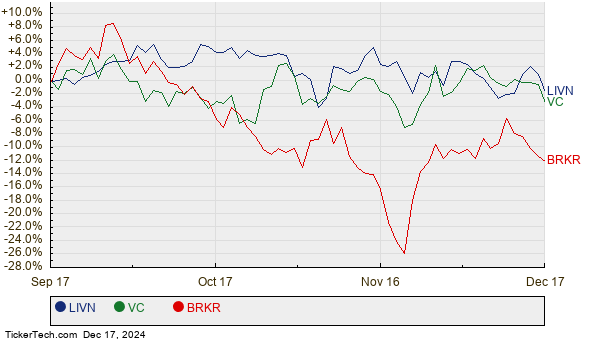

LivaNova PLC currently trades at $50.15 per share, with an average analyst target price of $72.00, reflecting a potential upside of 43.57%. Visteon Corp is priced at $90.46, but analysts predict it could rise to $122.85, representing a 35.80% increase. Similarly, Bruker Corp, trading at $57.18, has a target of $73.91, suggesting a 29.26% upside. The following chart shows the twelve-month price history and performance of LIVN, VC, and BRKR:

Below is a summary table of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares S&P Mid-Cap 400 Growth ETF | IJK | $96.33 | $107.42 | 11.51% |

| LivaNova PLC | LIVN | $50.15 | $72.00 | 43.57% |

| Visteon Corp | VC | $90.46 | $122.85 | 35.80% |

| Bruker Corp | BRKR | $57.18 | $73.91 | 29.26% |

These target prices raise questions about whether analysts are being realistic or overly optimistic. It is crucial for investors to investigate whether these projections have a solid foundation based on recent developments in the companies or the broader industry. A significant price target can signal optimism, but it may also precede potential downgrades if the estimates are detached from current realities. Thorough research is advisable for informed investment decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding Paramount Global

• Ulta Beauty shares outstanding history

• BCG shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.