Agnico Eagle Mines Plans to Acquire O3 Mining for $204 Million

Agnico Eagle Mines Limited (AEM) and O3 Mining Inc. have entered into a definitive support agreement. AEM will make an offer to acquire all of O3 Mining’s outstanding common shares for cash at $1.67 each through a takeover bid. This offer totals approximately $204 million on a fully diluted in-the-money basis.

A Significant Premium in the Offer Price

The offer price of $1.67 per common share indicates a substantial 57% premium over the volume-weighted average price of O3 Mining’s shares on the TSX Venture Exchange for the 20-day period ending December 11, 2024.

Valuable Assets: The Marban Alliance Property

O3 Mining’s key asset is the Marban Alliance property, which it fully owns. This property features the Marban deposit, an advanced exploration project with potential for an open-pit mining operation similar to Agnico Eagle’s Barnat open pit at the Canadian Malartic complex.

Synergies with Agnico Eagle’s Operations

Integrating the Marban Alliance property into the Canadian Malartic land package could create significant synergies. This is due to Agnico Eagle’s established operational expertise and existing infrastructure, including the Canadian Malartic mill, workforce, and equipment fleet.

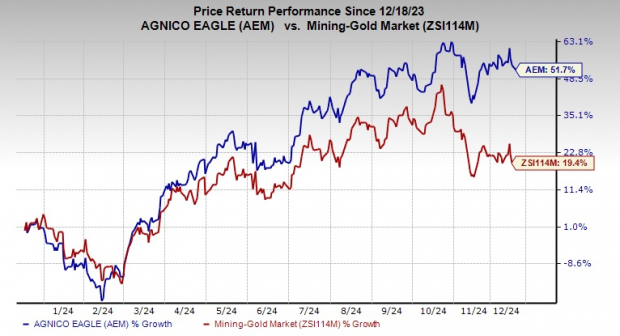

Agnico Eagle’s Stock Performance

Over the past year, Agnico Eagle’s shares have increased by 51.7%, outpacing the industry’s growth of 19.4%.

2024 Production and Cost Projections

Looking ahead, AEM expects its gold production for 2024 to be between 3.35 and 3.55 million ounces. The company is likely to achieve its mid-range target. It forecasts total cash costs per ounce to fall between $875 and $925, with an All-In Sustaining Cost (AISC) range of $1,200 to $1,250. Total capital expenditures for 2024 are expected to be between $1.6 million and $1.7 million, excluding capitalized exploration.

Agnico Eagle’s Price and Consensus Insights

Agnico Eagle Mines Limited price-consensus-chart | Agnico Eagle Mines Limited Quote

AEM’s Current Rank and Notable Picks

Agnico Eagle holds a Zacks Rank #3 (Hold).

Prominent stocks in the basic materials sector include Carpenter Technology Corporation (CRS), Ingevity Corporation (NGVT), and CF Industries Inc. (CF).

Carpenter Technology is rated Zacks Rank #1 (Strong Buy) and has consistently exceeded the Zacks Consensus Estimate in the last four quarters, achieving an average earnings surprise of 14.1%. Its shares have surged by 161.6% in the past year.

Meanwhile, Ingevity, rated Zacks Rank #2 (Buy), has met or surpassed expectations in three of the past four quarters, delivering an average earnings surprise of 95.4%. Its earnings consensus for the current year has grown by 15.9% in the last 60 days.

The consensus estimate for CF’s current year earnings stands at $6.32 per share. CF, also a Zacks Rank #1 stock, beat consensus estimates twice in the past four quarters, leading to an average earnings surprise of 10.3%. Its shares have appreciated approximately 18.2% over the last year.

Zacks Names Top 10 Stocks for 2025

Are you ready to discover the top 10 stock picks for 2025?

Previous performance suggests their potential could be remarkable.

Since 2012, when our Director of Research Sheraz Mian took charge of the Zacks Top 10 Stocks, this portfolio has gained an impressive +2,112.6%, significantly outpacing the S&P 500’s +475.6%. Sheraz is currently analyzing 4,400 companies to identify the best 10 stocks to invest in for 2025. Don’t miss the March 2 release of these picks.

Be First to New Top 10 Stocks >>

Get the latest recommendations from Zacks Investment Research. Download “5 Stocks Set to Double” today at no cost.

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Carpenter Technology Corporation (CRS): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

Ingevity Corporation (NGVT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.