“`html

Technology Stocks Shine as S&P 500 Surges, Prospects for AI Heavyweights Look Bright

The S&P 500 (SNPINDEX: ^GSPC) has risen by 28% this year, a remarkable figure that is nearly three times its average annual gain since 1957. This follows a strong performance in 2023, where the index increased by 26%.

As a result of these gains, the S&P 500 is currently trading at a higher valuation, with a price-to-earnings (P/E) ratio of 27.8, significantly above its long-term average of 18.1. This situation complicates the search for value in today’s market.

Stay Informed with Breakfast News! Subscribe to get Breakfast news delivered to your inbox every market day. Sign Up For Free »

Tech Stocks are Steering the Market Forward

Currently, technology stocks are driving the S&P 500’s gains, especially those involved in artificial intelligence (AI). This momentum is expected to persist into 2025, as major tech firms invest heavily in AI infrastructure.

Even though AI stocks are among the priciest in the market, a couple of them still show promise for outperforming the S&P 500 by 2025.

Image source: Getty Images.

Alphabet Stands Out in the AI Race

Last year, a Wall Street analyst coined the phrase “Magnificent Seven” for a group of leading technology stocks. This group consists of Nvidia, Microsoft, Apple, Amazon, Tesla, Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), and Meta Platforms (NASDAQ: META).

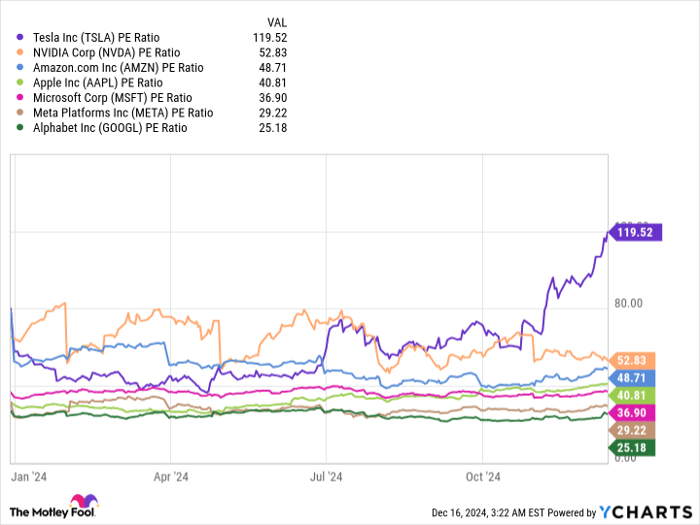

All these companies are participating actively in the AI development race. Notably, Alphabet and Meta Platforms have garnered attention due to their comparatively lower P/E ratios:

PE Ratio data by YCharts

Here’s why Alphabet and Meta could outperform the S&P 500 in 2025.

Why Alphabet Could Outperform

Alphabet is the parent company of Google, YouTube, Waymo (a self-driving car venture), and various other subsidiaries. It has developed its own large language models (LLMs) named Gemini, powering a chatbot and various new features for Google Search.

The majority of Alphabet’s income comes from advertising via Google Search, which maintains a commanding 90% market share. However, this dominance faces challenges from AI chatbots like ChatGPT, which are changing online information access.

In response, Alphabet launched the Gemini chatbot and improved the overall search experience with AI-generated responses called AI Overviews. This feature shows up at the top of Google Search results, providing users with text, images, and useful links. Currently, AI Overviews are being rolled out to 100 countries, aiming to reach around 1 billion users monthly.

Links from AI Overviews are more frequently clicked compared to traditional results, suggesting considerable future revenue potential for Alphabet. Investors are keen to see returns after the substantial investments Alphabet has made in AI development.

However, Alphabet is also dealing with legal pressures. The U.S. Department of Justice (DOJ) won a court case this year, alleging monopolistic practices concerning its dominance in internet search. While a ruling on penalties is pending until mid-2025, potential outcomes may involve selling its Chrome browser or Android operating system, which could hurt Alphabet’s advantages in the market.

Many analysts predict a lengthy legal process. For now, focusing on the AI developments makes more sense for investors. According to Wall Street forecasts from Yahoo, Alphabet’s revenue and earnings are expected to hit record highs in 2025. Although its stock might not align with the high average P/E of 50.4 for the Magnificent Seven, estimates suggest a 38% upside based on the Nasdaq-100’s 34.9 P/E ratio, which would likely surpass the S&P 500’s performance.

Meta Platforms: A Potential Contender

Despite its stock rising almost 80% this year, Meta Platforms remains relatively inexpensive compared to other Magnificent Seven stocks. Many believe it will sustain its growth into 2025, primarily due to its expanding AI initiatives.

The content algorithms for Facebook and Instagram are increasingly being refined by AI. A better understanding of user preferences allows Meta to keep users engaged longer, thus increasing ad impressions and revenue. In the third quarter of 2024, CEO Mark Zuckerberg reported an 8% uptick in Facebook user engagement and a 6% increase for Instagram, attributed to AI-driven recommendations.

Additionally, Meta introduced an AI assistant across its platforms last year. The assistant can answer questions, generate images, suggest activities, and even resolve disputes among users. With over 500 million monthly active users, this tool presents future monetization venues, such as businesses potentially paying to feature product links in AI responses.

Powered by the Llama family of LLMs, which Meta has developed in-house, Meta’s AI initiatives have reached notable popularity. Llama has been downloaded over 600 million times, making it the leading open-source LLM family globally. Next year, Meta plans to launch Llama 4, which Zuckerberg hopes will set new industry standards.

“`

Meta’s Ambitious Investment in AI: A $40 Billion Bet on the Future

Meta is preparing to invest up to $40 billion this year to upgrade its AI data center infrastructure, aiming to enhance its computing capacity for Llama 4. This substantial investment reflects the understanding that larger language models (LLMs) contribute to more intelligent AI software. Through this endeavor, Meta forecasts that its investments could lead to significant revenue opportunities, particularly via the Meta AI platform.

Meta’s Stock Performance and Future Prospects

Despite the impressive gains Meta’s stock has made this year, it still needs to climb another 19.5% for its current P/E ratio of 29.2 to reach the Nasdaq-100’s P/E ratio of 34.9. Analysts believe that Meta’s earnings per share could grow by 12% by 2025, which could create even more potential for stock appreciation. Given these factors, Meta appears to be a solid candidate to outpace the S&P 500 in the upcoming year.

Should You Consider Investing in Alphabet Now?

Before deciding to buy stock in Alphabet, here’s an important consideration:

The Motley Fool Stock Advisor analyst team recently highlighted their view of the 10 best stocks for investors, with Alphabet not making the cut. The stocks chosen have the potential for significant returns in the coming years.

For context, when Nvidia was featured on this list on April 15, 2005, a $1,000 investment made at that time would have grown to an astounding $808,966!*

Stock Advisor offers a straightforward plan for investors, including advice on portfolio building, regular updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

Explore the 10 stocks »

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market and current Amazon subsidiary executive, is a member of The Motley Fool’s board of directors. Additionally, Suzanne Frey, an executive at Alphabet, also serves on the same board. Randi Zuckerberg, who previously worked in market development for Facebook and is the sister of Meta’s CEO Mark Zuckerberg, is a board member as well. Anthony Di Pizio holds no position in any of the stocks discussed. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. Furthermore, The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.