Analysts See Promising Upside for Vanguard Real Estate ETF

In our analysis at ETF Channel, we evaluated the trading price of various ETF holdings against the anticipated 12-month target prices set by analysts. For the Vanguard Real Estate ETF (Symbol: VNQ), the projected average target price based on its holdings is $103.20 per unit.

Current Performance and Future Expectations

With VNQ currently trading around $93.07 per unit, analysts expect a potential upside of 10.88%. Certain holdings within VNQ stand out for their promising target price increases. For instance, RMR Group Inc (Symbol: RMR) is priced at $21.58 per share but has an average target of $27.50, suggesting a notable 27.43% upside. Similarly, Piedmont Office Realty Trust Inc (Symbol: PDM) has a current trading price of $9.43 with an anticipated target of $11.00, reflecting a 16.65% potential gain. Community Healthcare Trust Inc (Symbol: CHCT) is also noteworthy, with a recent price of $18.85 and a target of $21.50, indicating a 14.06% upside.

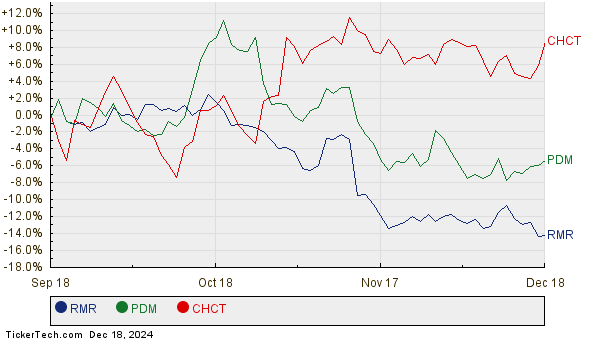

Below is a twelve-month price history chart showing the performance patterns of RMR, PDM, and CHCT:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Real Estate ETF | VNQ | $93.07 | $103.20 | 10.88% |

| RMR Group Inc | RMR | $21.58 | $27.50 | 27.43% |

| Piedmont Office Realty Trust Inc | PDM | $9.43 | $11.00 | 16.65% |

| Community Healthcare Trust Inc | CHCT | $18.85 | $21.50 | 14.06% |

These analyst targets raise questions about their validity. Are analysts overly optimistic in their forecasts for the coming year? Have they accounted for recent industry changes adequately? A target price significantly higher than a stock’s current trading price could indicate optimism but may also suggest a need for potential adjustments if market conditions shift.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• The DividendRank Top 25

• Institutional Holders of WS

• Top Ten Hedge Funds Holding SPNE

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.